The Hidden Mechanics of CD Growth Calculation

Calculating CD growth involves understanding several key factors. It's more than just simple interest; it's about maximizing your returns. This means understanding how term length, interest rates, and compounding frequency all work together. For instance, longer-term CDs generally offer higher interest rates. However, they also tie up your funds for a longer period.

Understanding Compounding Frequency

Compounding frequency plays a major role in how your CD grows. This refers to how often the interest you earn is added back to your principal. More frequent compounding (daily, monthly, quarterly) results in faster growth. This happens because the earned interest becomes part of the principal. Future interest calculations are then based on this larger sum, creating a snowball effect that leads to higher overall returns.

The Impact of CD Structures

Different CD structures, like traditional, bump-up, and no-penalty CDs, each have their own growth patterns. Traditional CDs have a fixed interest rate for the entire term. Bump-up CDs allow a one-time rate increase if market rates rise. No-penalty CDs offer penalty-free withdrawals, but typically have lower rates. The best structure depends on your financial goals and risk tolerance. While considering CDs, it's also helpful to understand the potential of other investment avenues. For example, if you’re interested in growing digital assets, this article offers insights into selling digital products: selling digital products.

The Role of Early Withdrawal Penalties

Early withdrawal penalties can significantly affect your CD returns. These penalties, often equal to several months' interest, are meant to deter early withdrawals. If you might need your money before the CD matures, consider these penalties when projecting your potential return. This reinforces the importance of carefully selecting a term length.

It’s crucial to consider historical trends. Between 1980 and 2025, CD interest rates have varied significantly due to economic conditions and federal monetary policy. In 1984, average CD rates were over 11% APY, while in 2009, they dropped below 1%. This volatility highlights the impact of economic factors on CD returns. For a deeper dive into historical CD rates, check out this resource: Learn more about historical CD rates. Understanding these trends can help you make informed choices about your CD investments.

Mastering the Formula to Calculate CD Growth

Calculating CD growth may seem complicated, but it's a straightforward process. This section will guide you through calculating your CD returns so you know exactly how your money will grow.

Understanding the Key Factors

Several factors influence CD growth: principal, interest rate, term length, and compounding frequency. Your principal is your initial investment. The interest rate, expressed as the Annual Percentage Yield (APY), reflects the total interest earned over a year, including compounding. The term length, or duration of the CD, is crucial. Finally, the compounding frequency (daily, monthly, quarterly, annually) indicates how often earned interest is added back to the principal. Check out this helpful resource: How to master CD calculations.

The Power of Compounding

Compounding is the key to CD growth. It's earning interest not just on your initial deposit, but also on the accumulated interest. The more frequent the compounding, the faster your CD grows. For instance, a CD with daily compounding will earn slightly more than one with monthly compounding, even with the same APY.

Visualizing Growth: The Impact of Interest Rates

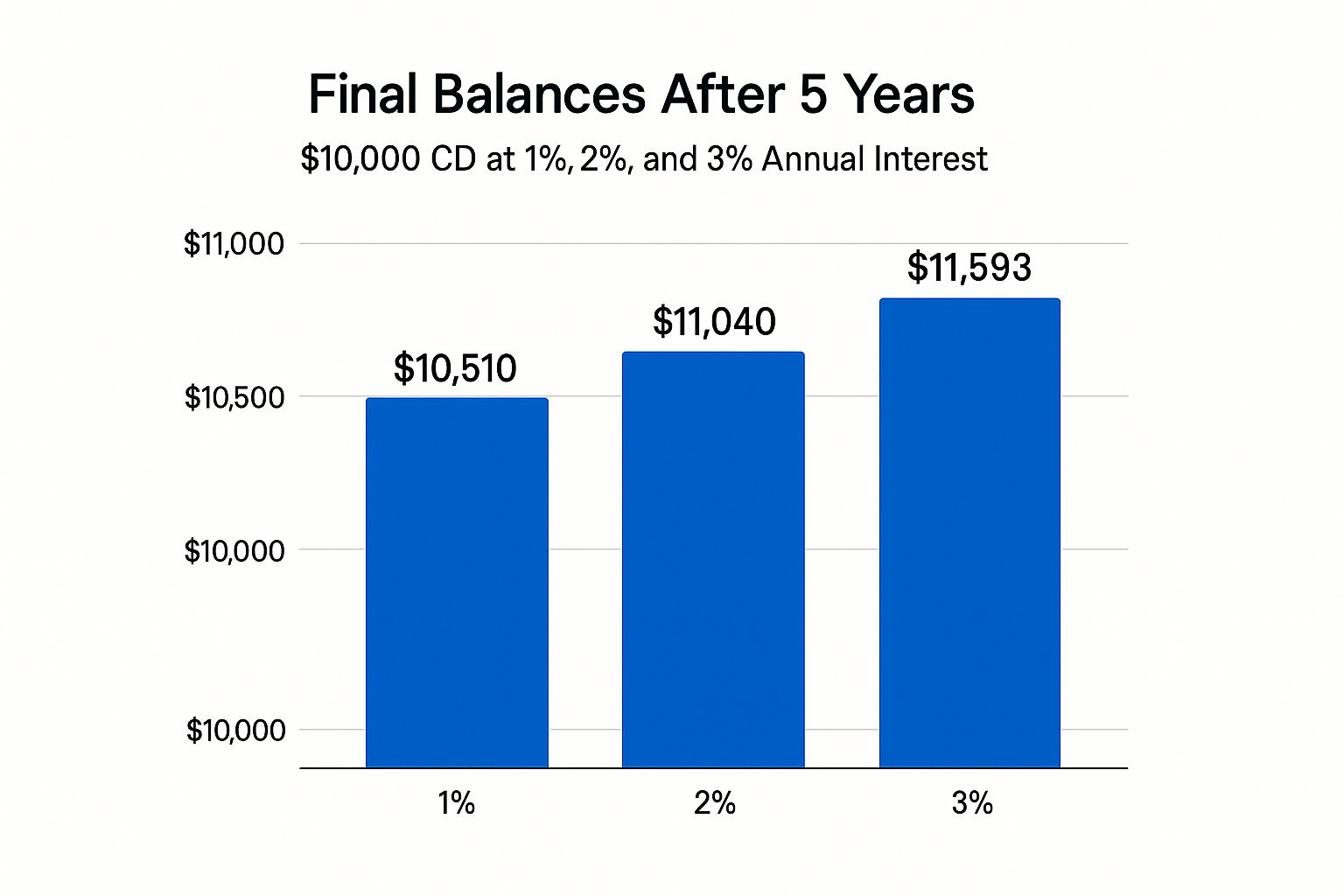

The infographic below visually represents how varying interest rates affect CD growth. It compares the final balances of a $10,000 CD after 5 years at 1%, 2%, and 3% APY.

As you can see, even a small interest rate difference can significantly change your final return. A higher interest rate leads to more earned interest and a larger final balance.

Compounding Frequency Impact on CD Growth

To illustrate the impact of compounding frequency, let's examine a $10,000 CD with a 5% interest rate over a 5-year term. The table below shows how different compounding frequencies affect the final value.

| Compounding Frequency | Final Value | Effective APY | Additional Earnings vs. Simple Interest |

|---|---|---|---|

| Annual | $12,624.77 | 5.00% | $0.00 |

| Quarterly | $12,762.82 | 5.09% | $138.05 |

| Monthly | $12,800.85 | 5.12% | $176.08 |

| Daily | $12,820.37 | 5.13% | $195.60 |

As the table reveals, more frequent compounding results in higher returns, though the differences become less pronounced as the frequency increases. Daily compounding earns the most compared to annual compounding, highlighting the power of compounding.

The Importance of APY vs. APR

Understanding the difference between Annual Percentage Rate (APR) and APY is crucial. APR is the simple annual interest rate, while APY includes the effects of compounding. APY provides a more accurate representation of your true return. Always use the APY when calculating CD growth. Calculating CD growth over time also depends on the prevailing interest rates and the compounding frequency the issuing bank applies. CD rates historically fluctuate, influenced by the Federal Reserve policy and market conditions. You can learn more about historical CD rates.

Putting It All Together

By understanding these concepts, you can accurately calculate CD growth and make smart investment decisions. Knowing how principal, interest rate, term length, and compounding frequency interact will help you choose the best CD for your financial goals.

Beyond Basic Math: Advanced CD Growth Strategies

Calculating CD growth involves more than just basic math. Savvy investors use advanced strategies to maximize their returns. This section explores these techniques, providing you with the tools to optimize your CD investments.

CD Laddering: Optimizing for Different Interest Rate Environments

CD laddering is a powerful strategy that involves splitting your investment across multiple CDs with varying maturity dates. This balances liquidity and yield. In a rising interest rate environment, shorter-term CDs in your ladder mature faster, allowing you to reinvest at higher rates. How to master interest calculations offers a deeper dive into these mechanics. Conversely, if rates are falling, the longer-term CDs in your ladder lock in the previously higher rates.

Digital Tools for Precise Projections

Financial professionals utilize specialized tools for accurate CD return projections.

- Specialized CD Calculators: These calculators often include advanced features, such as APY comparisons and early withdrawal penalty assessments.

- Spreadsheet Formulas: Spreadsheet software like Microsoft Excel or Google Sheets provides formulas for calculating compound interest, enabling precise growth projections.

Using these tools can significantly improve your CD investment decisions.

To illustrate the different tools available, let's take a look at the following comparison:

CD Growth Calculator Comparison: Comparison of popular online CD calculators showing their features, accuracy, and additional functionalities.

| Calculator Name | Basic Features | Advanced Features | Mobile Accessibility | Cost | Unique Benefits |

|---|---|---|---|---|---|

| Calculator 1 (Example) | Term, deposit, interest rate calculation | APY comparison, early withdrawal penalties | Yes | Free | User-friendly interface |

| Calculator 2 (Example) | Term, deposit, interest rate calculation | Inflation adjustment, tax implications | Yes | Free | Detailed graphs and charts |

| Calculator 3 (Example) | Term, deposit, interest rate calculation | CD laddering strategies | No | Paid | Advanced scenario planning |

This table provides a glimpse into the varied features offered by different CD calculators. Choosing the right tool depends on your specific needs and preferences. Consider factors like mobile accessibility, advanced functionalities, and cost when making your selection.

Factoring in Inflation and Taxes: The Real Return

Many investors don't fully consider the effects of inflation and taxes on their real returns. Inflation erodes the purchasing power of earnings, while taxes reduce net profit. Accounting for these is vital for accurate CD growth calculations. For instance, a 5% CD return with 3% inflation results in a real return closer to 2%. Taxes further reduce your final earnings.

Case Studies: Strategic Decision-Making

Accurate CD growth predictions inform strategic decisions:

- Early Withdrawals: Knowing the precise penalty helps determine if an early withdrawal is financially sound.

- Reinvestment Timing: Projecting future returns helps you decide when to reinvest matured CDs.

- Portfolio Allocation: Assessing CD growth potential helps optimize your overall investment portfolio.

Understanding inflation, taxes, and potential penalties empowers informed decisions.

Advanced Laddering Techniques and Rate Negotiation

Beyond basic laddering, consider these advanced techniques:

- Mathematically Optimized Rung Spacing: Customizing CD maturity dates can further improve returns based on your financial goals.

- Rate Negotiation: Many institutions allow for rate negotiation, potentially securing better-than-advertised rates.

Exploring these options could potentially increase your earnings.

Historical Rate Patterns: Calculate CD Growth Accurately

Understanding past CD rate patterns is essential for projecting realistic future growth. Analyzing historical CD performance helps identify economic indicators that influence rate movements, leading to more informed investment decisions. This historical perspective is crucial for accurately calculating CD growth in the current market.

The Influence of Economic Cycles

CD growth rates are not fixed; they fluctuate with economic conditions. During periods of high inflation, CD rates tend to rise as financial institutions compete for deposits. Conversely, during economic downturns, rates often fall as the Federal Reserve lowers interest rates to stimulate lending. This interconnectedness underscores the importance of understanding economic cycles when calculating CD growth.

A Look Back: CD Growth Through the Decades

Comparing identical CD investments across different economic periods reveals how significantly returns can vary. The early 1980s offer a striking example. Double-digit CD growth was common due to exceptionally high interest rates, a response to rampant inflation. An investment of $10,000 in a 5-year CD at 12% would have yielded substantially more than a similar investment during the low-rate environment of the 2010s. This stark contrast highlights the impact of historical context on CD growth.

The Federal Reserve's Role in Shaping CD Rates

The Federal Reserve's monetary policy plays a major role in determining CD rates. When the Fed raises interest rates, banks typically follow suit, increasing CD yields to attract depositors. The opposite happens when the Fed cuts rates. Recognizing these patterns is crucial for strategically timing your CD investments. Globally and in major markets like the United States, CD growth has closely mirrored central bank policies and economic cycles. Periods of high inflation, like the 1980s, led to CD rates over 10% APY. The post-2008 recession saw rates below 1%. More recently, aggressive rate hikes in 2022 and 2023 pushed CD yields above 6% APY, before easing to around 4% in early 2025. This historical data illustrates how macroeconomic factors influence CD growth potential. To delve deeper into the history of CD interest rates, explore this resource: Find more detailed statistics here.

Recognizing Early Warning Signs of Rate Shifts

Understanding historical rate patterns allows you to anticipate potential future shifts. By monitoring key economic indicators like inflation, GDP growth, and the Federal Reserve's announcements, you can gain valuable insights into likely rate movements. This foresight can help you position your CD investments to capitalize on favorable rate changes.

Applying Historical Context to Modern CD Calculations

While past performance doesn't guarantee future results, it provides essential context for calculating realistic CD growth in today's environment. By considering historical trends, you can avoid overly optimistic or pessimistic projections. This develops a more accurate understanding of potential returns, essential for making informed CD investment decisions.

Capitalizing on Future Rate Movements

Studying historical rate patterns not only allows for more accurate calculation of current CD growth, but it also helps you position yourself to take advantage of future rate changes. This forward-thinking approach is key to maximizing your CD returns over the long term.

Strategic CD Growth Hacking: Insider Techniques

Beyond basic calculations, maximizing CD growth involves strategic techniques. This goes beyond simply looking at the advertised rates. It requires understanding how to structure your investments for the best possible returns. Let's explore some insider tips to make your CDs work harder.

Mastering the Art of CD Laddering

CD Laddering is a popular strategy for balancing liquidity and return. It involves splitting your investment across multiple CDs with staggered maturity dates. This allows you to access some of your funds regularly.

How to master CD laddering provides a more in-depth look at this strategy. For instance, you could structure a ladder with CDs maturing every 6 months, 1 year, 18 months, and so on. This provides regular access to a portion of your invested capital.

Calculating the optimal "rung spacing"—the time between each CD's maturity—is crucial. This involves considering your financial goals and anticipated interest rate changes. If rates are projected to rise, shorter rungs allow for quicker reinvestment at the higher rates.

Negotiation: Securing Above-Advertised Rates

Many people don't realize that CD rates are often negotiable, especially for larger deposits. Don't hesitate to contact banks directly and inquire about potential rate increases.

Even a small increase can significantly impact your overall return, especially over longer terms. This simple act of negotiating can add substantial value to your CD holdings.

Long-Term CDs vs. Laddering: Weighing the Options

While laddering offers liquidity, longer-term CDs generally provide higher interest rates. Choosing the best strategy depends on the current interest rate environment and your individual financial needs.

If rates are high and expected to decline, locking in a longer-term CD might be beneficial. If rates are low and expected to increase, laddering lets you capture those increases as your CDs mature.

Monitoring Economic Indicators: Capturing Rate Peaks

Understanding the relationship between economic indicators and CD rates is vital. Factors like inflation, Federal Reserve policy, and overall economic growth influence interest rate trends.

By monitoring these indicators, you can better anticipate rate hikes. This allows you to position your CD investments accordingly. For example, rapidly rising inflation often precedes rising interest rates, making it a good time to invest in CDs.

Hybrid Strategies: Combining Promotional and Standard CDs

Some banks offer promotional CDs with higher-than-usual rates for specific terms or deposit amounts. Combining these with standard CDs can create a hybrid strategy.

This could mean placing some of your funds in a promotional CD to benefit from the higher rate, while also maintaining a balanced portfolio with standard CDs. This approach helps you take advantage of short-term gains while maintaining long-term stability.

The Growth Showdown: CDs vs. Alternative Investments

Effective resource allocation is crucial for smart investing. Explore this helpful resource on resource allocation for more information. This section compares CD growth with other investment options, providing a data-driven analysis to help you make informed decisions.

High-Yield Savings Accounts: A Close Comparison

High-yield savings accounts offer attractive interest rates and easy access to your money. However, CD rates tend to be higher, particularly for longer terms. This difference in return becomes more pronounced over time thanks to the benefits of compounding. For instance, a 5-year CD might offer a 1% higher interest rate than a high-yield savings account, resulting in substantially greater earnings on your initial deposit.

Treasury Securities: Safety and Stable Returns

Treasury securities are backed by the U.S. government, making them a very safe investment. While they offer stable returns, their growth potential is sometimes lower than CDs, especially when interest rates are rising. This is because CD rates often adjust more rapidly to market shifts, providing better potential gains.

Bond Funds: Diversification and Market Risk

Bond funds offer diversification across a collection of bonds, which can help reduce risk. However, their returns can fluctuate with market conditions, unlike the fixed returns of CDs. Bond funds might offer greater growth in some markets, but CDs provide predictable, guaranteed returns, making them a more secure option for risk-averse investors.

Dividend Stocks: Income and Growth with Higher Risk

Dividend stocks can provide income through dividend payments and the potential for price appreciation. However, they carry considerably more risk than CDs. Stock prices can change dramatically, while CD returns remain fixed. For long-term growth, stocks might outperform CDs, but this potential comes with increased uncertainty. CDs offer stability and predictable growth, suitable for conservative investors.

Analyzing Risk-Adjusted Returns

When comparing investment options, it's essential to consider risk-adjusted returns. This involves evaluating the risk associated with each investment compared to its potential return. Some investments may offer higher potential returns but also carry a greater risk of loss. CDs, with their fixed returns, often perform better than riskier investments on a risk-adjusted basis, particularly during times of economic uncertainty.

The Impact of Liquidity and Taxes

Liquidity, or how easily you can access your money, is another important factor. High-yield savings accounts allow immediate access, while CDs lock up your money for a specific term. Early withdrawal penalties can significantly reduce CD returns. Taxes also affect your net return. Interest earned on CDs and dividends from stocks are typically taxable, impacting your overall profit.

Determining the Right Fit for Your Portfolio

The best investment strategy depends on your financial objectives and how much risk you're comfortable with. CDs are a good choice for those seeking safe, predictable returns and who are comfortable locking up their funds for a set time. They're a valuable tool for protecting capital and achieving consistent, though possibly slower, growth. Use our Certificate-of-Deposit Calculator here to estimate your CD growth and make informed investment decisions. The calculator can help you compare different CD offers and choose the best one for your financial goals.