Beyond The Headlines: What Really Matters When You Compare CD Rates

Don't let the allure of a high advertised CD rate be your sole guide. Experienced investors know the highest number isn't always the best deal. Instead of chasing flashy rates, financial professionals advise a deeper analysis when comparing CDs. This involves a five-factor framework that distinguishes informed CD selection from simple rate shopping.

The Five-Factor Framework for CD Comparisons

Comparing CD rates requires considering these key elements:

Annual Percentage Yield (APY): APY represents the actual annual return, incorporating the impact of compounding. It's a more accurate measure than the basic interest rate.

Compounding Frequency: How often interest compounds (daily, monthly, quarterly, annually) affects your overall return. Frequent compounding boosts yields.

Early Withdrawal Penalties: Life throws curveballs. Understanding potential penalties is crucial if you might need access to your money before the CD matures. Some penalties can severely diminish your returns.

CD Term Length: Aligning the CD term with your financial goals and timeline is essential. Longer terms usually offer higher rates, but less liquidity.

Institutional Stability and Reputation: Choosing a reputable financial institution offers peace of mind, a factor not easily quantifiable but still important.

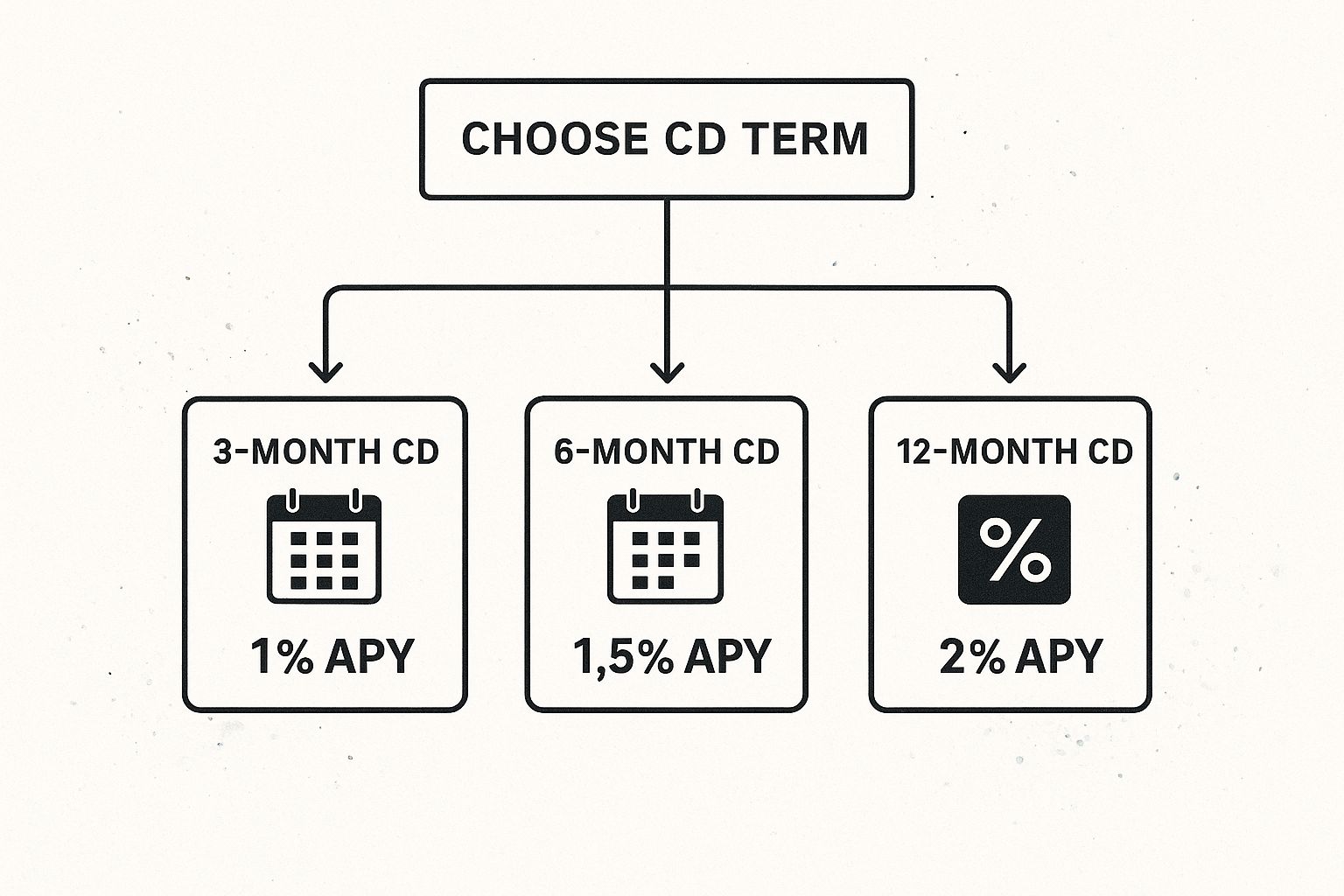

To illustrate the relationship between CD term length and APY, consider the following:

As the infographic shows, a 12-month CD at 2% APY outperforms a 3-month CD at 1% or a 6-month CD at 1.5% APY. However, the longer term also means less access to your funds. For broader investment strategies, explore these smart investing tips.

Beyond Simple Rate Comparisons

While a 5.2% APY might catch your eye, a 4.8% APY with daily compounding and lower early withdrawal penalties could be more beneficial. Imagine needing access to some of your funds during the CD term. A smaller penalty could save you significant money, potentially exceeding the returns of the higher-rate CD.

This is why fixating on the highest advertised rate can be deceptive. Analyzing all five factors together is key for informed decisions aligned with your financial goals.

To help you evaluate CDs effectively, consider the following framework:

Introducing the "Professional CD Evaluation Framework," a five-factor system experienced investors use to compare CD opportunities:

| Evaluation Factor | Weight Priority | Assessment Method | Warning Signs |

|---|---|---|---|

| APY | High | Compare APYs across different institutions and term lengths. | Significantly lower APY than competitors for similar terms. |

| Compounding Frequency | Medium | Calculate the effective APY based on compounding frequency. | Infrequent compounding (e.g., annual) with no corresponding APY advantage. |

| Early Withdrawal Penalties | High | Review the penalty structure carefully, considering your potential need for early access. | Excessively high penalties (e.g., more than 1 year's interest) or complex penalty calculations. |

| CD Term Length | High | Align the term with your investment timeframe and financial goals. | Mismatched term length to your financial needs. |

| Institutional Stability and Reputation | Medium | Research the financial institution’s ratings and reviews. | Negative reviews or concerns about the institution's financial health. |

This framework helps investors prioritize factors based on individual needs. For example, someone prioritizing liquidity would give "Early Withdrawal Penalties" a higher weight than someone focused on maximizing long-term returns.

Understanding the interplay of these factors, rather than viewing them in isolation, separates informed investors from those simply chasing headlines. This comprehensive approach helps you choose the CD that maximizes returns while aligning with your needs and risk tolerance. Remember, it’s not about the "best" rate alone, but the best CD for your situation.

Decoding Rate Structures: Why Some Banks Pay More Than Others

Shopping for Certificates of Deposit (CDs) can be a surprising experience. One bank might offer a 4.2% Annual Percentage Yield (APY), while another offers a seemingly much better 5.5% APY. This isn't a matter of luck; it's the result of several factors that influence how banks set their CD rates. Understanding these factors is key to making a well-informed investment decision, much like understanding the nuances of finding the best exchange rates South Africa.

Promotional Rates and Minimum Deposits

Banks frequently use promotional rates to attract new customers or increase their deposits. These offers can present real opportunities, but always read the fine print. Some promotional CDs require significant minimum deposits, tying up more of your money than you may have planned. Furthermore, these attractive rates often expire after an initial period, leaving you with a potentially much lower rate afterward.

Often, promotional rates mask increased stringency with early withdrawal penalties to offset the marketing costs. Therefore, consider if you truly need to access the money and if so, what penalty you would face.

Rate Tiers and CD Pricing

Many banks structure their CD rates using tiers based on the deposit amount. Larger deposits frequently qualify for higher APYs. This tiered approach reflects the bank's cost of funds and profit targets. If a bank consistently offers high rates across all deposit levels, they might be aggressively seeking liquidity. This could indicate underlying financial pressures. While not necessarily a cause for alarm, it's a factor to consider when assessing the bank's overall stability.

Think of it like bulk discounts; banks can offer higher rates on larger sums because they have more capital to work with. Understanding this dynamic allows you to make more informed choices and possibly negotiate for a better rate if your deposit is substantial.

The Hidden Catches

Sometimes, the highest CD rates come with hidden drawbacks that can erode your returns. For example, some institutions impose steep early withdrawal penalties, effectively locking your money in. Others use complicated compounding formulas that might appear beneficial initially but ultimately yield less than simpler, more frequent compounding. A thorough understanding of the complete rate structure is crucial when comparing CDs.

This doesn't mean you must avoid the higher-paying CD, but understand the ramifications of withdrawing your money early. Is the potentially higher yield worthwhile? Evaluate your risk tolerance and potential liquidity needs.

Rate Fluctuations and Historical Context

CD rates have seen significant fluctuations in recent years. Before January 2022, CD rates averaged around 1% APY. However, as the Federal Reserve combated inflation, rates climbed dramatically. By December 2022, rates were above 4% APY, and by March 2023, some short-term CDs offered rates as high as 5% APY. The highest national CD rate even exceeded 6% APY in late 2023. You can research historical CD rates for a deeper understanding. This volatility underscores the importance of understanding rate fluctuations and how they might impact your investment.

Credit Unions and Online Banks

Credit unions often offer competitive CD rates, sometimes outpacing traditional banks. This is because credit unions are member-owned and can pass some cost savings onto their depositors. Online banks, with lower overhead than brick-and-mortar institutions, also tend to offer leading rates. However, regulatory factors like reserve requirements and interest rate caps can influence rates across all institutions.

By understanding the factors driving CD pricing, you can move beyond simply comparing rates and identify real value. This allows you to make informed decisions aligned with your financial goals and risk tolerance.

Mastering CD Calculators: Get Accurate Return Projections

Basic CD calculators offer a starting point, but for truly effective CD rate comparisons, a deeper dive is essential. Let's explore the advanced calculations that unlock the real potential of various CD strategies.

Beyond Simple Interest: The Power of Compounding

Compounding is key to maximizing CD returns. Whether interest compounds daily, monthly, or quarterly significantly affects your final payout. Simple interest calculations just won't cut it for accurate long-term projections. For instance, a 5% APY compounded monthly yields slightly more than 5% compounded annually. This seemingly small difference can add up to a substantial amount over a typical CD term. A CD calculator with adjustable compounding frequency provides a much more precise estimate. Check out our CD Calculator for a hands-on demonstration.

Taxes and Inflation: The Real-World Impact

Sophisticated CD calculations go beyond projected interest. They factor in real-world elements like taxes and inflation. Taxes can significantly erode your final return. A calculator that incorporates your tax bracket offers a realistic view of net earnings. Inflation also diminishes your returns' purchasing power. By factoring in inflation, you can assess the real growth of your investment—what your money will actually buy down the line.

Stress Testing and Economic Scenarios

Advanced CD calculators let you model various economic conditions. By adjusting interest rates and inflation projections, you can “stress test” your CD choices. This reveals how different economic climates might affect your returns, leading to more robust investment decisions. For example, what if interest rates suddenly drop? This type of analysis prepares you for market fluctuations and keeps your CD portfolio aligned with your financial goals.

CD Laddering and Opportunity Cost

Advanced calculators are also crucial for evaluating CD laddering. Laddering involves staggering CD purchases with different maturity dates, balancing access to funds with higher returns. A CD calculator helps you project the overall return of a laddered portfolio and assess the opportunity cost of locking money into longer-term CDs versus maintaining liquidity with shorter-term options. This helps determine the best term lengths and renewal timing for your laddering strategy.

From Calculations to Actionable Insights

These calculations aren't just theoretical. They are practical tools for better investment outcomes. By mastering advanced CD calculator techniques, you make informed choices about term length, compounding, and portfolio strategy. This empowers you to maximize returns while managing risk and liquidity needs.

Introducing a table to further clarify the nuances of advanced CD calculations:

"Advanced CD Calculator Variables and Their Impact" summarizes key inputs that differentiate basic calculations from professional return projections. This information is vital for making informed CD investment decisions.

| Calculator Variable | Return Impact | Calculation Approach | Common Oversights |

|---|---|---|---|

| Compounding Frequency | Significantly impacts overall return; more frequent compounding leads to higher yields. | Use the calculator's compounding setting (daily, monthly, quarterly, annually). | Assuming annual compounding when it's actually more frequent. |

| Tax Bracket | Reduces the net return after taxes. | Input your tax bracket into the calculator for a more realistic projection. | Ignoring the impact of taxes on overall returns. |

| Inflation Rate | Erodes the purchasing power of returns over time. | Adjust for inflation within the calculator to determine the real return. | Not considering the long-term effects of inflation. |

| Interest Rate Projections | Allows for scenario planning and stress testing. | Adjust interest rate inputs to model different economic conditions. | Failing to account for potential interest rate fluctuations. |

| Laddering Strategy Inputs (Maturity Dates, Amounts) | Helps optimize laddered portfolio returns and liquidity. | Input individual CD details for a comprehensive ladder analysis. | Not using a calculator to model the combined returns of a ladder. |

This table highlights the crucial variables within a CD calculator that can significantly impact your return projections. Understanding and utilizing these variables effectively helps you make more informed decisions, ultimately leading to better investment outcomes.

The Penalty Reality: How Early Withdrawal Rules Change Everything

When comparing Certificate of Deposit (CD) rates, the advertised Annual Percentage Yield (APY) often grabs your attention. But don't let it steal the show entirely. Overlooking the early withdrawal penalty can quickly turn your “safe” investment into a source of frustration. A Mortgage Calculator can offer a glimpse into the kind of calculations involved in projecting CD returns.

This section explores how these penalties truly affect your returns and what to consider when evaluating different CDs. For a deeper dive into early withdrawal penalties, check out our dedicated article: Read also: CD Early Withdrawal Penalty.

Penalties: More Than Just Lost Interest

Many people mistakenly think of early withdrawal penalties as simply forfeiting a few months of interest. A more accurate way to look at it is to calculate the penalty as a percentage of your total investment.

For instance, a six-month interest penalty on a 5-year CD with a 4% APY is roughly 1% of your principal. This perspective reveals the true cost of an early withdrawal.

Imagine an unexpected job loss forces you to access funds tied up in a CD with a stiff penalty. That seemingly small percentage can equate to a significant loss, impacting your financial security.

The Trap of High Rates and Steep Penalties

Some banks dangle high rates to attract depositors, then slap on heavy penalties to discourage early withdrawals. This tactic can essentially trap your money, restricting your financial maneuverability.

What if a medical emergency requires immediate access to your savings? A hefty penalty could worsen an already difficult situation. So, when comparing CD rates, scrutinize the penalty structure, keeping in mind your personal situation and the potential need for early access.

Penalty Structures and Institutional Stability

CD rates have historically mirrored economic conditions. In the early 1980s, they climbed above 15% APY reflecting high inflation. By the 2010s, rates hovered near zero following the Great Recession. Learn more about historical CD rates here.

Different penalty structures can offer clues about a financial institution's stability. Excessively high penalties might suggest a bank is struggling to attract deposits, potentially hinting at underlying financial weakness. More reasonable penalties often indicate sounder financial practices.

Don’t just look at the penalty in isolation; consider it within the larger context of the institution’s financial health and reputation.

Strategies for Mitigating Penalty Risk

While understanding penalties is vital, there are ways to lessen their potential impact.

CD Laddering: This involves staggering your CD maturity dates, allowing access to portions of your savings without penalty.

Diversification: Strategically allocate funds across CDs with different terms and penalties to balance your desire for higher returns with the need for liquidity.

Negotiation: Consider negotiating a lower penalty with your bank, especially if you have a substantial deposit.

These techniques, combined with a solid understanding of penalty implications, empower you to make well-informed CD choices.

Strategic CD Selection: Matching Terms to Your Life Situation

The "best" CD isn't one-size-fits-all. It's about finding the right fit for your financial life, goals, and comfort with risk. This section explores how to tailor your CD choices to your specific circumstances. You might be interested in: Highest CD Rates Available.

Short-Term vs. Long-Term: Looking Beyond the Surface

Longer-term CDs typically offer higher rates. However, this isn't the whole story. Short-term CDs can sometimes be more profitable in dynamic market conditions.

Imagine locking into a 5-year CD at a seemingly attractive rate, only to see rates jump a year later. You're stuck. A series of shorter-term CDs allows you to reinvest at the new, higher rate as each CD matures.

Life Stages and CD Strategies

Your life stage greatly influences your ideal CD approach. A young professional saving for a down payment might prioritize short-term CDs for their liquidity, accepting lower rates for flexibility. A retiree seeking stable income might choose longer-term CDs for predictable returns, even with potential penalties.

Each life stage comes with unique financial priorities. Align your CD choices accordingly.

Retirement Planning and CD Term Selection

Retirement planning presents its own challenges. Long-term CDs offer predictable income, but they also tie up your money. Balancing stability with access to funds for unexpected expenses is key.

A CD ladder with staggered maturity dates can be a valuable tool. This strategy provides regular access to a portion of your funds while still taking advantage of the typically higher rates of longer-term CDs.

Emergency Funds and Return Optimization

Emergency funds require immediate access to cash. While higher-yielding, long-term CDs are attractive, they don't fit this need.

For emergency funds, liquidity trumps return optimization. Short-term CDs or high-yield savings accounts provide better access to your money when you need it most, even with slightly lower returns.

Tax Implications and CD Choices

Taxes significantly impact your overall CD returns. Different CD types and holding periods have varying tax consequences. Retirement accounts, for example, may offer tax advantages for CD holdings.

Understanding these tax implications is crucial. Factor in your tax bracket to calculate your true after-tax returns.

Avoiding the "Highest Rate" Trap

Don't blindly chase the highest advertised rate. Ignoring factors like penalties, compounding frequency, and your own financial needs can lead to disappointing results.

A slightly lower rate with better terms and conditions might be a smarter choice than the highest rate with restrictive penalties and limited flexibility.

Adapting to Change

Financial situations change. Job changes, market fluctuations, and unexpected expenses can shift your needs quickly. Build a CD strategy that can adapt.

Regularly review your CD portfolio and adjust your choices to align with your evolving financial goals and risk tolerance.

Advanced Strategies: Professional Techniques for Maximum Returns

Beyond comparing basic CD rates lies a world of sophisticated techniques for earning more. This section explores strategies used by seasoned investors and institutions to boost CD returns.

Rate Arbitrage: Finding the Best Deals

Rate arbitrage involves spotting and exploiting rate differences between financial institutions. It requires actively monitoring CD rates offered by various banks and credit unions. You might find, for instance, that a smaller institution offers a noticeably higher rate on a 1-year CD. Shifting funds to seize these opportunities can increase your overall return without taking on more risk.

This approach, however, requires staying on top of market fluctuations. You need to be ready to move your money quickly when favorable rates appear.

Timing the Market: Anticipating Rate Changes

Savvy investors time their CD purchases based on the Federal Reserve's policy cycles. Understanding the Fed's influence on interest rates can help you anticipate changes and adjust your CD strategy. If the Fed hints at a coming rate hike, delaying your CD purchase might let you lock in a higher rate later. Conversely, if rates are poised to drop, securing a CD beforehand secures the current, higher yield.

Tax Efficiency: Sheltering Your Returns

Building a tax-efficient CD portfolio involves understanding the tax implications of different CD types and holding periods. Consider holding CDs within a tax-advantaged retirement account like an IRA. This can defer or eliminate taxes on the interest earned. This strategy necessitates careful planning and coordination with your overall financial goals. Remember to compare after-tax returns to ensure the tax benefits outweigh any potential rate differences.

Advanced Laddering: Fine-Tuning Your Approach

Advanced CD laddering goes beyond the simple, evenly distributed approach. A barbell strategy, for example, concentrates investments in short-term and long-term CDs. This maximizes liquidity while capturing potentially higher long-term yields. A bullet strategy targets a specific maturity date, ideal for a future purchase or expense. Dynamic rebalancing involves adjusting the ladder as rates shift, taking advantage of better yields while maintaining desired liquidity.

Leveraging Promotions and Bonuses: Extra Returns

Many institutions offer limited-time promotions with increased rates or bonus payments for new deposits. Actively looking for and using these offers can boost your CD returns. However, it's critical to look beyond the initial bonus and evaluate the CD's long-term value, especially the standard rate after the promotional period.

Identifying Market Inefficiencies: Spotting Consistent Value

Sometimes, institutions consistently offer above-market rates on CDs. This might be due to a strategy of rapidly growing their deposit base. Analyzing historical rate data can help you identify these opportunities. While appealing, always balance potentially higher returns with the institution's financial stability and FDIC insurance limits.

CDs and Broader Fixed-Income Portfolios

CDs provide stability and predictable income within a diversified fixed-income portfolio. They can balance higher-risk, potentially higher-return investments like bonds. This approach requires understanding your investment goals and risk tolerance and aligning your CD strategy with your overall portfolio objectives.

These advanced techniques require more analysis and attention, but they offer substantial benefits for dedicated investors. Always balance maximizing returns with managing risk and maintaining adequate liquidity. The Certificate-of-Deposit Calculator helps project returns, incorporating these advanced strategies.

Your CD Selection Action Plan: From Analysis to Investment

Turning CD rate research into a smart investment takes a structured approach. This plan helps you combine comparison factors with your needs and risk tolerance.

Building Your Personalized CD Scoring System

Choosing the highest CD rate isn't always the best strategy. Instead, create a scoring system that weighs different CD features based on what matters most to you.

For example:

- High Liquidity Needs: Prioritize low early withdrawal penalties.

- Long-Term Growth Focus: Focus on APY and how often interest compounds.

- Risk Aversion: Look for strong institutions with FDIC insurance.

This personalized method helps you choose CDs that fit your financial goals.

Monitoring Rates and Renewal Opportunities

CD rates fluctuate constantly. Track rates and renewal options by setting up rate alerts from financial websites like Bankrate. Alternatively, create a spreadsheet to compare offers from different banks. Staying informed helps you get better rates when your CDs mature.

This Bankrate screenshot shows current CD rates. Notice how APYs vary even for the same terms at different banks. This shows why comparing offers is crucial.

Setting Clear Decision Criteria

Set specific rules for switching banks or changing your CD strategy. For instance:

- A minimum rate difference for switching (e.g., a 0.5% higher APY).

- Changes in your finances (e.g., choosing shorter-term CDs if you might need the money).

- Problems with your current bank's financial health.

These rules help you make objective choices, not emotional ones.

Due Diligence and Implementation Timeline

Before investing, create a checklist:

- Confirm the bank's FDIC insurance.

- Review the terms, especially early withdrawal penalties.

- Understand the application and transfer process.

This prevents surprises. Account for processing and transfer times to avoid gaps in interest and keep your money growing.

Ongoing Management and Strategy Adjustments

Your CD strategy should adapt as your finances change. Review your portfolio and adjust based on your goals and risk tolerance.

Consider automating some of the comparison and monitoring process using online tools or financial software. This saves time and ensures consistent oversight. Developing relationships with banks that offer competitive rates can also be advantageous.

Secure Your Financial Future With the Right CD Strategy

This action plan transforms CD rate comparisons into informed investment decisions, maximizing returns while aligning with your financial goals and risk tolerance. Success depends on smart choices and consistent action.

Ready to project your CD returns? Use our Certificate-of-Deposit Calculator to make informed decisions and maximize your investment potential.