Deciding between a Money Market Account (MMA) and a Certificate of Deposit (CD) really comes down to one core trade-off: liquidity versus guaranteed returns.

Think of it this way: MMAs give you fast, penalty-free access to your cash, but their interest rates can fluctuate. This makes them perfect for an emergency fund. CDs, on the other hand, reward you with higher, fixed interest rates for locking your money away for a set period, which is ideal for specific, time-bound financial goals.

Money Market Vs. CD: A Head-to-Head Comparison

Choosing the right home for your savings is a critical step in managing your money well. While both Money Market Accounts and Certificates of Deposit are federally insured, low-risk places to grow your cash, they’re built for fundamentally different jobs. Getting a handle on their core distinctions is the key to matching your savings strategy to your actual financial needs.

An MMA acts like a hybrid savings-and-checking account, often giving you a debit card and the ability to write checks. That makes it a fantastic spot for money you might need on short notice. A CD, however, is a time deposit. You agree to leave your funds untouched for a specific term—anywhere from a few months to several years—and in exchange, the bank gives you a predictable, and usually higher, interest rate.

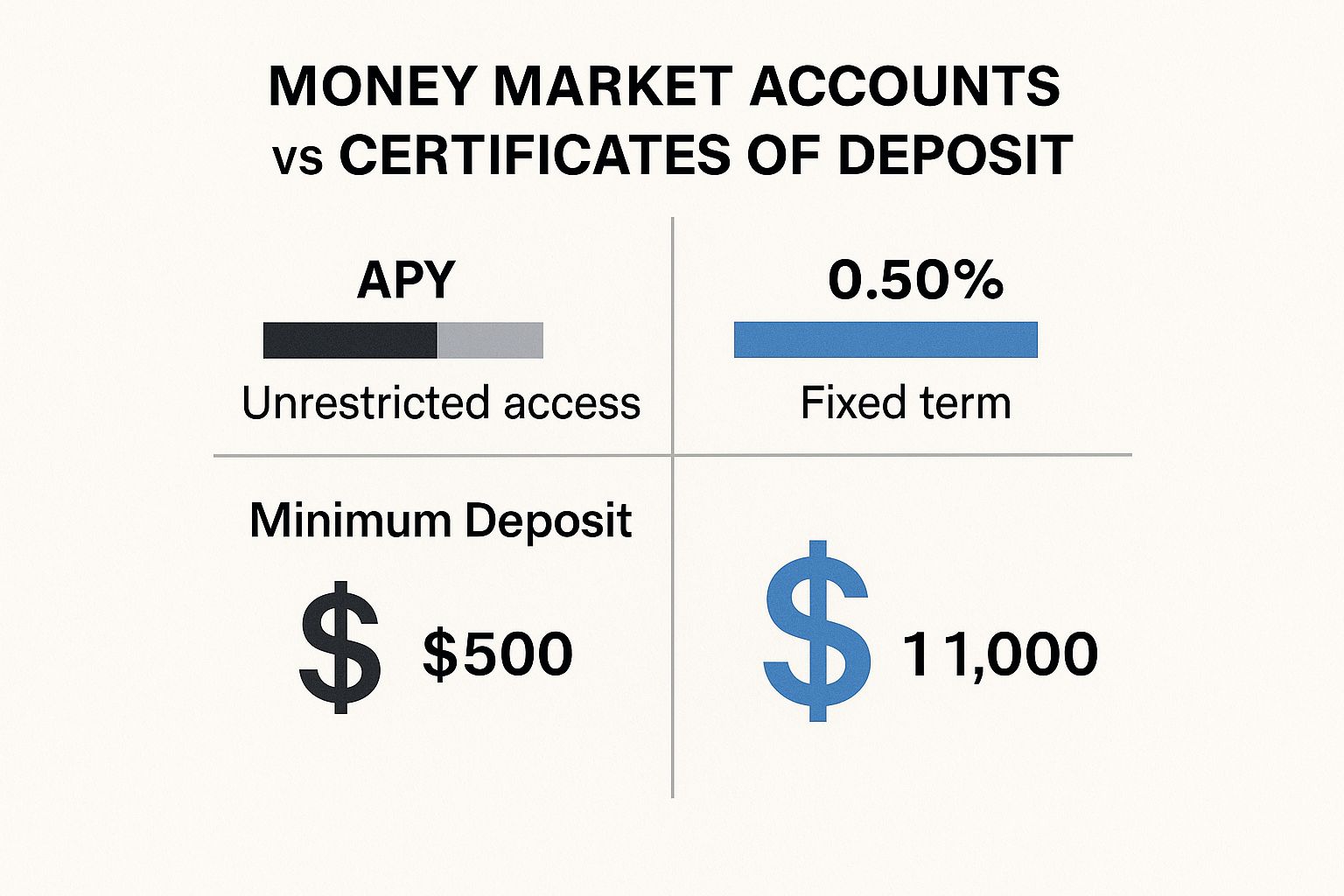

The visual below breaks down the key differences in APY, liquidity, and typical deposit requirements for both account types.

As the infographic highlights, CDs generally come with a better APY but require you to commit a larger initial deposit and lock up your funds.

To make the comparison even clearer, here’s a quick summary table. For a deeper dive with more specific scenarios, check out our full guide at https://www.bankdepositguide.com/articles/cd-vs-money-market.

Key Differences at a Glance: Money Market Account vs. CD

This table offers a side-by-side look at what truly separates these two popular savings tools.

| Feature | Money Market Account (MMA) | Certificate of Deposit (CD) |

|---|---|---|

| Interest Rate | Variable; moves with market conditions | Fixed; locked in for the entire term |

| Access to Funds | Highly liquid; check-writing & debit card access | Illiquid; early withdrawal triggers penalties |

| Best For | Emergency funds, short-term savings goals | Time-bound goals (e.g., a down payment) |

| Typical Term | No term; ongoing, open-ended account | Fixed terms (e.g., 6 mo, 1 yr, 5 yr) |

This comparison gives you the foundation for deciding which account aligns with your financial situation. If you're looking for more perspectives on savings and investment strategies, the articles on the Yieldseeker Blog offer some excellent insights.

Analyzing Interest Rates and Your Earning Potential

For most savers, the core question in the money market vs. CD debate boils down to one thing: which one will grow my money faster? The answer lies in the Annual Percentage Yield (APY), and this is where the two accounts take completely different paths.

A money market account comes with a variable APY, meaning the rate can—and will—change over time. This isn’t necessarily a bad thing. When the Federal Reserve hikes interest rates to cool the economy, your MMA's yield will likely climb right along with them, padding your returns automatically. Of course, the reverse is also true; when rates are cut, your earnings will probably dip.

A Certificate of Deposit, on the other hand, offers a fixed APY. The rate you lock in on day one is the exact rate you're guaranteed for the entire term. This delivers predictability, shielding you from falling rates and making it a fantastic tool for hitting specific savings goals.

How Economic Cycles Impact Your Choice

The fixed-versus-variable rate structure isn't just a technical detail; it's a strategic one. Your choice should be heavily influenced by the current economic environment and where you think rates are headed next.

Key Insight: When interest rates are rising, a money market account is your best friend, letting you ride the wave up without any effort. But when rates are high and expected to fall, locking in a top-tier CD rate can protect your earning power for months or even years.

Getting this timing right is how you truly maximize your returns. If you lock up your cash in a 5-year CD right before a major rate-hiking cycle, you’ll be stuck watching from the sidelines. Likewise, leaving a pile of cash in an MMA while rates are cratering means you’re accepting a much lower return than a CD could have secured. To help you decide, check out our guide on whether CDs are a good investment right now.

A Look at Historical Rate Performance

History shows just how much this matters. Nearly 40 years ago, CDs were all the rage, with average one-year yields soaring above 11%. But after the 2009 recession and through the pandemic, those same rates sank below 1%, making MMAs and high-yield savings accounts far more appealing.

Then came the aggressive Fed rate hikes of 2022, and CD yields came roaring back to life. By mid-2025, some banks were offering CDs with an APY as high as 4.40%. It’s a perfect illustration of how locking in a great CD rate can be a brilliant move when you catch the market at its peak.

Understanding Liquidity and Access to Your Funds

When you’re weighing a money market account against a CD, the single biggest day-to-day difference comes down to liquidity. It’s a simple concept: how fast can you get your hands on your cash without paying a penalty? Your answer to that question will steer you toward the right account for your goals.

Think of a money market account as your financial toolkit—ready for anything. MMAs are built for easy access, blending the high-yield potential of a savings account with the convenience of a checking account. Most come with debit cards and check-writing privileges, making them perfect for an emergency fund. It’s no surprise that U.S. money market fund assets hit a record $6.6 trillion in mid-2024 as people looked for safe, liquid places to park their cash.

CDs are a completely different animal. When you open a Certificate of Deposit, you’re striking a deal with the bank: you agree to leave your money untouched for a specific term, and in exchange, they give you a guaranteed—and usually higher—interest rate. That lack of access is the price you pay for the better return.

The Real Cost of Breaking a CD Term

Pulling your money out of a CD before its maturity date almost always comes with an early withdrawal penalty. And it’s not just a minor slap on the wrist. The penalty is usually calculated based on the interest you've earned or would have earned.

Key Takeaway: The CD penalty is meant to be a serious deterrent. If you break a CD term, you could lose months of interest—and in some cases, even eat into your original principal if you withdraw very early in the term.

The exact penalty depends on the bank and the CD's term length, but a common structure looks like this:

- For CDs with a term of one year or less: The penalty is often three months' simple interest.

- For CDs with a term longer than one year: You might forfeit six to twelve months' worth of simple interest.

Let's make that real. Say you have a $10,000, 24-month CD earning 4.00% APY. If a major expense forces you to cash out after just one year and the penalty is six months of interest, you'd give up about $200. This potential loss is why CDs are a poor fit for money you might need on short notice.

This trade-off between access and return is a core idea in personal finance. For a deeper look into how this plays out across different assets, you might find this article on understanding liquidity in various investments helpful.

Comparing Minimum Deposits and Account Safety

Beyond the headline rates and access rules, the practical side of opening and protecting your account is a huge factor in the money market vs. CD decision. How much you need to start with and how safe your money really is are two areas where these accounts look similar at first glance but have some key differences.

For anyone just starting to build their savings, a money market account (MMA) is often the path of least resistance. Many online banks and credit unions offer MMAs with no minimum deposit at all. Others might ask for a token amount, maybe $100, making them a fantastic, low-friction tool for getting an emergency fund off the ground.

The Higher Bar for High-Yield CDs

Certificates of Deposit, on the other hand, can be a bit more demanding—especially the ones waving the most attractive rates. While you can find some CDs with no minimum, it's very common for the best high-yield deals to require an upfront deposit of $500, $1,000, or even $2,500 or more. This is a critical detail. A CD’s rate might look better, but you have to bring the capital to the table first. For a closer look at these requirements, you can check out our guide on the typical CD minimum deposit.

To get a feel for how this plays out, we can look at a simple growth scenario. This highlights the trade-off between the low entry point of an MMA and the higher earning power of a CD.

Deposit Requirements and Potential Growth Example

Here’s a table illustrating typical minimums and a hypothetical 5-year growth comparison for both accounts.

| Attribute | Money Market Account (MMA) | Certificate of Deposit (CD) |

|---|---|---|

| Typical Minimum Deposit | $0 – $100 | $500 – $2,500+ for high-yield |

| 5-Year Growth on $5,000 | $5,012.51 (at 0.05% APY) | $5,525.82 (at 2.02% APY) |

As you can see, the difference in returns is stark. While the MMA is easier to start, the CD's locked-in rate delivers significantly more growth over time if you can meet the initial deposit requirement. For more on these types of comparisons, check out the analysis at SCCU.com.

The Ultimate Peace of Mind: Regardless of minimums, both accounts are among the safest places you can park your cash. This is a crucial point that shouldn't get lost in the rate debate.

Both MMAs and CDs come with a powerful safety net in the form of federal insurance. This backing is a cornerstone of their appeal as low-risk savings vehicles.

Here’s how that protection works:

- For Banks: Accounts are insured by the Federal Deposit Insurance Corporation (FDIC).

- For Credit Unions: Accounts are insured by the National Credit Union Administration (NCUA).

In both cases, your deposits are protected up to $250,000 per depositor, per insured institution, for each account ownership category. This government guarantee means you won't lose your principal investment, even in the unlikely event your bank or credit union fails. So, when you’re choosing between an MMA and a CD, you can rest assured that the fundamental safety of your money is a given with either option.

Matching the Right Account to Your Financial Goals

Choosing between a money market account and a CD isn't just about comparing features. It’s about matching the right financial tool to a specific life goal. The best account for you is the one whose structure supports exactly what you're trying to achieve, whether that's building a safety net or saving for a big purchase.

This simple shift in perspective turns the "money market vs. CD" debate from a technical exercise into a strategic decision. By mapping an account’s benefits directly to your savings timeline and how quickly you need access, you can put your money to work in the most effective way.

The Ideal Tool for Your Emergency Fund

When your main objective is building a financial safety net, a money market account (MMA) is almost always the best tool for the job. The entire point of an emergency fund is to be there when you need it—for a sudden medical bill, an urgent car repair, or a leaky roof.

An MMA is built for this. With easy liquidity, debit card access, and check-writing privileges, your cash is always ready. You earn a competitive, variable interest rate without locking your money away. It’s a combination of solid returns and complete accessibility that a CD simply can't match.

For anyone focused on financial security, learning how to start an emergency fund is the critical first step.

Key Takeaway: The penalty-free liquidity of a money market account makes it the undisputed champion for emergency funds. You never have to worry about paying a fee just to get to your own money during a crisis.

Securing a Down Payment or a Major Purchase

If your savings goal has a fixed deadline and a specific dollar amount, a Certificate of Deposit (CD) often makes more sense. Think about saving for a down payment on a house in three years or buying a new car in 18 months. In these scenarios, predictability and maximizing your return are what matter most.

A CD gives you a locked-in, fixed interest rate, protecting your earnings from the ups and downs of the market. This security means you can calculate exactly how much your savings will grow by your target date—a crucial element for confident financial planning.

The trade-off, of course, is that your money is illiquid. But since you have a set timeline, that restriction is a feature, not a bug. It helps you stay disciplined.

Today's interest rate environment makes this choice even more relevant. While MMAs offer flexible rates that can top 4% APY in some markets, CDs provide the stability of locking in high yields for a set term. This shields you from potential rate drops down the road.

Ultimately, the best choice in the money market vs. CD comparison boils down to one simple question: Do you need flexibility or a guaranteed outcome? Your answer will point you directly to the right account for your financial journey.

Frequently Asked Questions About MMAs and CDs

Even with a side-by-side comparison, some practical questions always pop up just before you pull the trigger. The small details are what matter most, especially when you're thinking about real-world scenarios like inflation, what to do when an account matures, or how to build a smart, balanced savings plan. This section tackles those common sticking points with direct answers.

My goal here is to clear up any final confusion you might have in the money market vs. CD debate. Once these questions are answered, you can build your financial strategy with total confidence.

Which Is Better During High Inflation: a CD or Money Market?

When inflation is running hot, the right choice really hinges on where you think interest rates are headed next. Inflation eats away at your money's buying power, so getting the best possible yield is non-negotiable.

A money market account is your best bet if you believe interest rates are still climbing. Because its APY is variable, it will rise almost in lockstep with the Federal Reserve as it hikes rates to fight inflation. This keeps your returns from falling too far behind rising costs and prevents you from getting stuck in a low-rate product while better deals appear.

On the other hand, a high-yield CD is the smarter play if you think rates have peaked or are about to drop. By locking in a high fixed rate, you guarantee that return for the entire term. This protects your earnings even if market rates start to tumble later on.

Strategic Insight: It's all about matching your account to the interest rate cycle. Use an MMA to ride rates up, and use a CD to lock in a great rate before it disappears.

What Happens When a CD Matures?

When your Certificate of Deposit hits its maturity date, your bank gives you a small window of time to act. This is called a grace period, and it usually lasts between seven and ten days. Always check with your bank for their specific timeline.

You have a few choices during this grace period:

- Renew the CD: You can simply roll the entire balance—principal plus interest—into a new CD for the same term. The interest rate will be whatever the bank is offering that day, which could be higher or lower than your old rate.

- Withdraw the Funds: Cash it all out. You can take the full balance, including every cent of interest you earned, with zero early withdrawal penalties.

- Change the Term: You might decide to roll the money into a CD with a different term. Maybe a shorter one to stay flexible or a longer one to chase a higher rate, depending on your goals and the current rate environment.

If you don't do anything, watch out. Most banks will automatically renew your CD for the same term at whatever rate is current. This is why it’s critical to track your maturity dates so you don't get locked into a new term you didn't want.

Is It a Good Idea to Have Both a CD and a Money Market Account?

Absolutely. For most people, having both a CD and a money market account isn't just a good idea—it's an excellent strategy. Using them together lets you build a balanced approach that plays to the strengths of each, neatly separating your funds based on what you need them for.

Think of it as creating a two-part savings system for different jobs:

- Money Market Account for Liquidity: This is your go-to emergency fund. It gives you instant, penalty-free access to cash when something unexpected happens.

- CD for Specific Goals: This is for money earmarked for a future event with a deadline. Use it for a house down payment or that big vacation you're planning, where you want a guaranteed return and know you won't need the cash early.

By running both, you get the best of both worlds. You keep the flexibility you need for life's curveballs with the MMA, while your CD quietly works in the background, earning a higher, predictable return on money you can afford to set aside. This dual-account strategy is a cornerstone of smart, goal-based saving.

Ready to see how a CD can work for your specific goals? Use the Certificate-of-Deposit Calculator to project your earnings with precision. Model different deposit amounts, rates, and compounding frequencies to find the perfect fit for your financial plan. Plan your savings confidently with our free tool at https://www.bankdepositguide.com/cd-calculator.