When you're shopping for a Certificate of Deposit, one of the first things you'll notice is the minimum deposit. This can be anywhere from $0 to over $2,500, and it really depends on the bank or credit union you're looking at.

Online banks and credit unions are often your best bet for the lowest entry points, making it incredibly easy to get started. On the other hand, traditional brick-and-mortar banks tend to ask for a bit more, usually starting at $500 or $1,000.

What Is the Typical Minimum Deposit for a CD

Think of a CD's minimum deposit as the price of admission for a guaranteed interest rate. It's the cover charge to get into the club. Just like concert tickets have different prices for different venues, these minimums change based on a bank's business model. Some institutions roll out the red carpet for everyone, while others set a higher bar, aiming for savers with more to invest.

There isn't a single industry-wide standard, but you'll quickly see patterns emerge once you start comparing different types of institutions. Knowing these trends is the first step to finding a CD that fits your budget and savings goals perfectly.

Common Deposit Thresholds

When you start looking around, you'll see that most CD minimums fall into a few common buckets. This makes it easier to figure out which banks are a good match for the cash you have on hand.

- $0 to $100: This is the most welcoming tier, almost entirely dominated by online banks and some forward-thinking credit unions. They use these no-minimum or low-minimum CDs as a great way to attract new customers.

- $500 to $1,000: For a long time, this was the classic range. You'll still find it at many traditional banks and credit unions. It's a standard, tried-and-true entry point for savers.

- $2,500 and Up: You'll see higher minimums like this for special offers. Banks often reserve their best promotional rates or unique term lengths for CDs with a bigger buy-in, targeting more established savers.

The whole idea of a "minimum deposit" has changed dramatically over the years. Back in the 1980s and '90s, you'd be hard-pressed to find a CD that didn't require $500 or $1,000 to open. The rise of online banking completely blew that up, introducing $0 minimums and making CDs accessible to pretty much everyone. It's a perfect example of how innovation in banking directly benefits us as savers.

Of course, the minimum deposit is just the starting line. The real magic happens with the amount you actually put in, since that's what determines your final interest earnings. It's always a good idea to deposit as much as you're comfortable locking away for the CD's term. You can use a good CD Calculator to see how different deposit amounts will play out.

Why Do CD Minimums Vary So Much?

Have you ever wondered why one bank demands a $1,000 deposit to open a CD, while another lets you get started with just a few dollars? This isn't just a random choice. The huge range in minimums boils down to one thing: the bank's business model.

Think of it like this. A traditional, brick-and-mortar bank is like a big department store. It has rent to pay, lights to keep on, and tellers to staff. These high overhead costs mean every single account needs to pull its weight. For them, the administrative work of setting up and managing a tiny CD just isn't worth the hassle.

That’s why you’ll often see these established institutions set their entry points at $500, $1,000, or sometimes much more. They are looking for customers who bring in enough capital to make the relationship profitable from day one.

The Online Bank Advantage

Online-only banks play a completely different game. With no expensive branches to maintain, their operating costs are dramatically lower. This lean, digital-first structure gives them the freedom to be much more flexible.

For these banks, a $0 minimum deposit CD is a fantastic marketing tool. By dropping the barrier to entry, they can attract a much broader audience, from seasoned savers to someone opening their very first account. It’s all about customer acquisition—get you in the door with an easy-to-open CD, and you might stick around for a checking account or a loan later on. It’s a classic case of a business passing its operational savings on to you.

And Then There Are Jumbo CDs

On the complete opposite end of the spectrum, you have jumbo CDs. These accounts are built specifically for individuals or businesses with a lot of cash to park, typically requiring a minimum deposit of $100,000 or more.

The "jumbo" label isn't just for show. It signals a different kind of relationship with the bank.

A deposit of $100,000 is a magic number for banks. It gives them a large, stable chunk of capital they can use for lending and other activities. In exchange for you providing this sizable deposit, they often reward you with a premium interest rate you simply can't get on a standard CD.

So, here’s how the different strategies break down:

- Traditional Banks: They focus on the profitability of each customer. This leads to higher minimums to offset their high overhead costs.

- Online Banks: They focus on attracting a high volume of customers. They use low or zero minimums as a powerful incentive to grow their customer base quickly.

- Jumbo CDs: They target a niche market of wealthy depositors, offering top-tier rates to secure large, reliable blocks of capital.

At the end of the day, a CD's minimum deposit is a reflection of the bank’s strategy. Once you understand whether they're chasing big-ticket deposits or broad customer growth, you can see why their offers look the way they do—and find the one that’s a perfect match for your own financial goals.

Does a Higher Minimum Deposit Get You a Better Rate?

It’s the question on every saver’s mind: will putting more cash down unlock a better interest rate? It feels logical. If you put more skin in the game, you should get a bigger reward. But in the world of Certificates of Deposit, that gut feeling is usually wrong.

With the major exception of jumbo CDs—those massive accounts requiring $100,000 or more—the minimum deposit for a CD almost never dictates the interest rate you’ll earn. For standard CDs, that minimum is just the price of admission. It’s a gate you pass through, not a lever you pull for better returns.

This means you need to shift your thinking. Forget hunting for a high minimum deposit, thinking it signals a premium product. Your real mission is to find the highest APY, regardless of the entry fee.

Why a Bigger Deposit Doesn't Mean a Better Rate

Let’s bust this myth wide open with a real-world example.

Imagine you're comparing two 12-month CDs. A big, traditional bank offers one with a $1,000 minimum deposit for a CD that pays 4.50% APY. At the same time, an online bank has a CD with a $0 minimum deposit paying 5.00% APY.

Which one is the better deal? It's a no-brainer. The account with no entry barrier actually delivers a much higher return. On the exact same principal, the saver who chose the online bank comes out ahead. It's clear proof that a higher minimum deposit doesn't automatically mean a better rate.

So, what does drive the rate? It's all about what's happening behind the scenes at the bank.

- A Bank's Need for Cash: If a bank needs to raise money fast to fund its loans, it will offer higher, more tempting APYs to pull in deposits. This need for capital has nothing to do with its minimum deposit rules.

- The CD's Term Length: This is a big one. Longer terms almost always get you higher rates because you’re promising to leave your money untouched for a greater period. A 5-year CD will nearly always beat a 6-month CD from the same bank.

- Market Competition: Online banks are locked in a fierce battle for your business. Their weapon of choice? High-yield, low-minimum CDs designed to lure you away from the competition.

The bottom line is simple: Focus on the APY, first and foremost. The minimum deposit is just a hurdle to clear, not a reliable sign of quality. A high APY is a high APY, whether it costs $1 or $1,000 to get in the door.

Making a Smarter Choice

Once you get this, you can start building a much smarter savings strategy.

To see how different deposit amounts and rates play out over time, a good investment calculator can be your best friend. It lets you run the numbers and see for yourself how a higher APY—even on a smaller initial deposit—can easily outperform a lower APY that required more cash upfront.

Your goal is to get the best possible return on your hard-earned money. By looking past the minimum deposit for a CD and zooming in on the APY, you can make more profitable choices. To see how this fits into the bigger picture, it helps to understand if CDs are a good investment right now and what role they should play in your portfolio.

Alright, you know what a CD minimum deposit is. Now, let's put that knowledge to work.

Finding the right CD isn't about chasing the absolute lowest entry fee. It's a balancing act. You're looking for that sweet spot: a great APY, a term length that fits your life, and fair penalties—all without having to tie up a fortune just to get started.

Think of it like shopping for a car. The minimum deposit for a CD is just the price tag. But you wouldn't buy a car based on price alone, right? You'd check the engine, the mileage, the features. A CD with a $0 minimum but a terrible interest rate is like a cheap car that guzzles gas. It's a bad deal. The goal is to find the total package where accessibility meets real earning power.

Start with Online Comparison Tools

Your first stop should be a good financial comparison website. These sites are incredibly useful because they pull in CD rates from dozens of banks and credit unions—especially the online-only players—and lay them all out in a simple, easy-to-scan table.

This saves you the headache of hopping from one bank's website to another. You can usually filter the results by what matters most to you, whether that's the term length or the minimum deposit, to quickly zero in on the best contenders.

Here’s a quick look at what you'll typically find on a comparison site.

A table like this lets you spot top-tier APYs and their minimums in seconds, instantly flagging the most competitive offers out there.

The Four Pillars of a Great CD

As you sift through the options, measure each CD against these four key factors. Don't get so focused on one that you forget the others. The best deals nail the combination.

- High Annual Percentage Yield (APY): This is non-negotiable. It's the engine of your earnings. A higher APY means more money in your pocket, period.

- Low Minimum Deposit: This is what gets you in the door. It makes the CD accessible so you can start saving without needing a huge lump sum.

- Suitable Term Length: Your money will be locked up, so pick a term that matches your financial timeline. Don't commit funds you might need for an emergency or a near-term goal.

- Fair Early Withdrawal Penalties: Life happens. Know the penalty before you commit. A fair penalty is typically three to six months of interest, not an arm and a leg.

The perfect CD is a blend of all four. A low minimum gets you in the game, but a high APY is how you win. Don't be dazzled by one great feature—always look at the whole package.

To see how these different factors actually play out with your money, it helps to run the numbers. Learning how to use a CD Calculator is the single best way to visualize your potential returns and see how a few tenths of a percentage point can really add up.

And while you're exploring CDs, it's smart to keep an eye on other secure options that might fit into your broader financial plan. For example, learning about the top annuities for retirement income can give you another tool for building long-term security. The key to a strong portfolio is finding the right mix of products that work for you.

Exploring Your No-Minimum and Low-Minimum Options

For savers just getting started, that minimum deposit can feel like a roadblock. But a growing number of banks and credit unions are clearing the path, offering accessible CDs designed to get everyone in the savings game. These no-minimum and low-minimum options are a huge help for anyone ready to earn real interest without needing a pile of cash upfront.

The easiest entry point of all is the $0 minimum deposit CD. Think of it as an open invitation to start saving, pioneered mostly by online banks. These CDs remove the initial funding hurdle completely. You can open one with whatever you have on hand—$20, $200, it doesn't matter—and start earning a competitive rate right away.

This approach lets you build your savings at your own pace. You could even open several of these no-minimum CDs over time as you set more money aside. If that sounds interesting, our guide to the CD ladder strategy explains exactly how to build a flexible, high-earning portfolio this way.

The Rise of Low-Minimum Tiers

While a zero-dollar minimum is fantastic, it isn't your only choice. Many financial institutions offer very approachable low-minimum tiers that are still easy for most people to hit. The most common thresholds you'll see are $100 and $500.

These tiers often hit a sweet spot, offering solid APYs without requiring a major commitment. A $500 minimum, for example, is a popular level for promotional CDs that might feature a unique term or a special rate. It’s a small enough amount for many savers to manage, but it also signals a level of commitment that banks like to see.

The key takeaway here is that you have more choices than ever. Whether you can start with a little or a lot, there's a CD out there with your name on it. The decision to invest $500 or $2,500 is entirely up to you, and today's market caters to both.

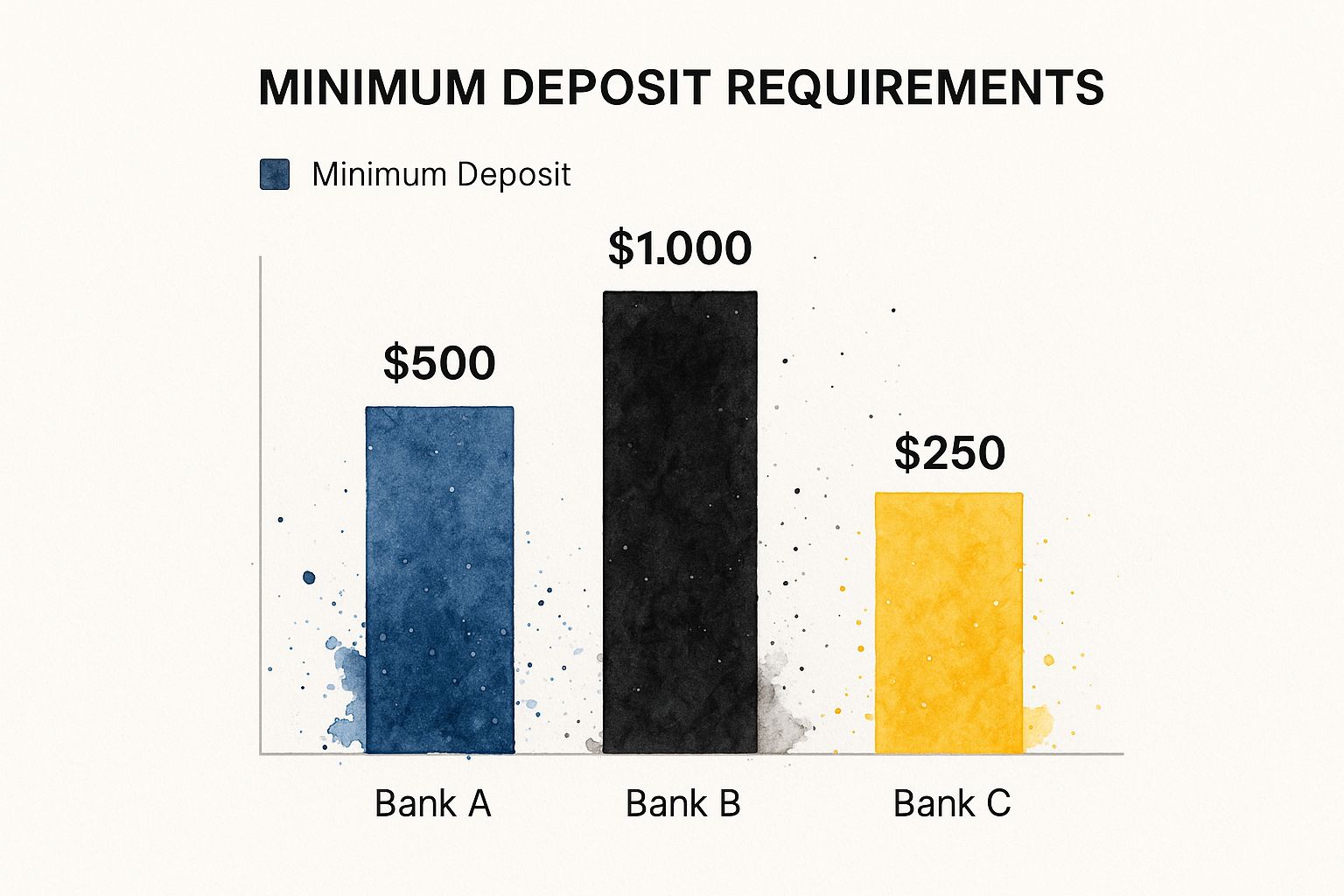

This infographic shows just how much minimum deposit requirements can vary from one bank to the next.

As you can see, the entry points differ quite a bit. That's exactly why it pays to shop around for a minimum that actually fits your budget.

Comparing Your Accessible CD Options

To make the right call, it helps to see these options side-by-side. Each type of accessible CD comes with its own trade-offs, from total flexibility on one end to potentially higher promotional rates on the other. This table breaks down what you can generally expect.

Comparison of Low and No-Minimum CD Features

| CD Type | Typical Minimum Deposit | Common APY Range | Key Feature |

|---|---|---|---|

| No-Minimum CD | $0 | Competitive, but may lag top promotional rates | Ultimate Accessibility: Lets you start saving with any amount, no matter how small. |

| Low-Minimum CD | $100 - $500 | Often aligns with standard or promotional rates | The Sweet Spot: Low barrier to entry with access to great, often promotional, APYs. |

| Standard CD | $1,000+ | Broad range, sometimes tiered for higher rates | Wide Availability: Offered by nearly every bank, including traditional brick-and-mortar institutions. |

Ultimately, finding the right minimum deposit for a CD is all about matching a bank's offer to your personal financial situation. By exploring these accessible options, you put yourself in control and can start growing your money on your own terms.

Answering Your Top Questions About CD Deposits

Even after you’ve got the basics down, a few “what-if” questions always seem to pop up. This is your quick-fire guide to clear, simple answers for the most common sticking points savers have about the minimum deposit for a CD. We’ll run through a few practical scenarios to help you clear up any last-minute confusion.

Think of it as a final checklist before you lock in a rate and start earning. Getting these details straight will help you round out your knowledge and feel totally confident in your savings plan.

Let’s dive in.

What Happens If I Don't Meet the Minimum Deposit?

This is a really common worry, but the answer is straightforward. If you try to open a CD without meeting the minimum deposit, the bank or credit union simply won't let you open the account. It’s a hard stop.

This isn't like a checking account where you might open it and then get hit with a fee for dropping below a certain balance. For a CD, the minimum deposit is a strict entry requirement. Your application will either be rejected on the spot or you'll be prompted to add more funds before you can proceed. You have to fund it with the required amount to lock in that advertised rate and term.

Should I Deposit More Than the Minimum Required?

Absolutely, as long as you can comfortably part with the money for the full term. The minimum deposit is just the ticket that gets you in the door. The real earning power comes from the principal—the actual amount you invest—since that's what your interest is calculated on.

A quick example makes this crystal clear:

- Scenario: You find a great 12-month CD offering a 5.00% APY with a $500 minimum deposit.

- Depositing the Minimum: If you put in just the required $500, you’ll earn about $25 in interest over the year.

- Depositing More: But if you put $5,000 into that exact same CD, you'll walk away with around $250 in interest.

The lesson is simple: to maximize your return, you should deposit as much as you're comfortable locking away. Just always keep an eye on FDIC (or NCUA for credit unions) insurance limits, which protect your money up to $250,000 per depositor, per institution.

Are There Benefits to Choosing a CD with a Higher Minimum?

Sometimes, but it’s definitely not a golden rule. The main reason to even consider a CD with a high minimum is the chance to snag a better interest rate. This is most common with "jumbo CDs," which demand deposits of $100,000 or more and almost always pay a premium rate.

Some banks might also tier their rates. For instance, they could offer a slightly higher APY for deposits over $10,000 compared to what they give for the base $1,000 minimum.

But this is far from universal. In fact, many online banks that have $0 or very low minimums offer some of the most competitive rates you can find. It's crucial to compare the APY directly instead of just assuming a higher minimum deposit for a CD automatically means a better deal.

Do No-Penalty CDs Also Have Minimum Deposits?

Yes, they do. No-penalty CDs—which have the fantastic perk of letting you withdraw your money early without getting dinged—still come with minimum deposit rules set by the bank.

These minimums usually follow the same patterns as traditional CDs. You can easily find no-penalty CDs from online banks with $0 or $500 minimums, while some brick-and-mortar banks might ask for $1,000 or more. The "no-penalty" feature is all about the withdrawal rules, not the initial deposit required to get started.

Knowing these details is a big part of smart money management. To improve your overall financial health, it’s always a good idea to explore different areas of personal finance.

Ready to see how your own deposit could grow? The Certificate-of-Deposit Calculator makes it easy to project your earnings and compare different CD options. Find the perfect fit for your savings goals today at https://www.bankdepositguide.com/cd-calculator.