Decoding CDs: The Hidden Potential in Secure Investments

Certificates of Deposit (CDs) offer a compelling blend of security and predictable returns, making them a valuable option for specific investment strategies. But are they the right fit for your financial goals? Let's explore what a CD is and how it could potentially benefit you. At its core, a CD is a fixed-term agreement with a financial institution. You deposit a sum of money for a pre-determined period, called the term, and the institution pays you a fixed interest rate.

This term can range from a few months to several years, offering flexibility based on your individual needs.

Understanding the Mechanics of CDs

The main appeal of a CD lies in its predictable nature. Unlike investments tied to market fluctuations, CDs offer a guaranteed return. This allows you to know exactly how much your investment will be worth on the maturity date. This stability can be especially valuable during periods of market uncertainty.

In addition, the interest earned on a CD typically compounds. This means you earn interest not just on your initial deposit but also on the accumulated interest. Over time, this compounding effect can significantly enhance your overall returns.

The Safety Net of FDIC Insurance

A key advantage of CDs is the protection provided by FDIC insurance. This insurance safeguards your principal up to $250,000 per depositor, per insured bank. This offers considerable peace of mind, knowing your investment is secure even if the financial institution experiences difficulties.

This security feature is a major consideration when evaluating CDs, particularly for those with a lower risk tolerance.

Historical CD Performance and Current Rates

Historically, CD returns have fluctuated. In the 1980s, one-year CDs saw Annual Percentage Yields (APYs) reach over 11% due to high inflation and the Federal Reserve's response. By contrast, in June 2013, the average yield was just 0.24% APY, reflecting different economic circumstances.

This illustrates how CD returns are influenced by the prevailing economic climate. You can delve deeper into the history of CD rates here.

Balancing Security and Opportunity Cost

While CDs offer security and predictable returns, it’s crucial to also consider their limitations. One potential downside is the opportunity cost. By locking your money into a CD, you might forgo potentially higher returns from other investments, especially during periods of robust market growth.

Another important factor is the early withdrawal penalty. If you need to access your funds before the CD matures, you'll likely face a penalty, which can diminish your overall returns. For alternative strategies to safeguard your finances, consider exploring various asset protection strategies.

Ultimately, the decision of whether a CD is the right investment for you depends on a careful assessment of your individual financial goals, risk tolerance, and investment timeline.

CD Rates Through Time: Learning From The Past

Understanding if a CD is a good investment today requires looking back at historical CD rate performance. Examining these trends offers valuable insights into economic cycles and their effect on investment returns. From the high yields of the 1980s to the near-zero rates after the 2008 financial crisis, and now the current market, CD rate history provides a compelling lesson for investors.

The Rollercoaster Ride of CD Yields

CD rates haven't stayed constant. They've fluctuated significantly over the past few decades. In the mid-1990s and early 2000s, CD rates sometimes reached around 5% APY, making them competitive for savers. However, the Great Recession caused a dramatic drop, pushing rates near zero for nearly a decade.

This trend continued through the COVID-19 pandemic until the Federal Reserve intervened with aggressive interest rate hikes in 2022 and 2023. As a result, CD rates resurged, with some exceeding 6% APY by late 2023. Subsequent Fed rate cuts in late 2024 then led to a slight decline. This volatility emphasizes the importance of understanding the historical context when considering CDs as investments. Learn more about historical CD rates.

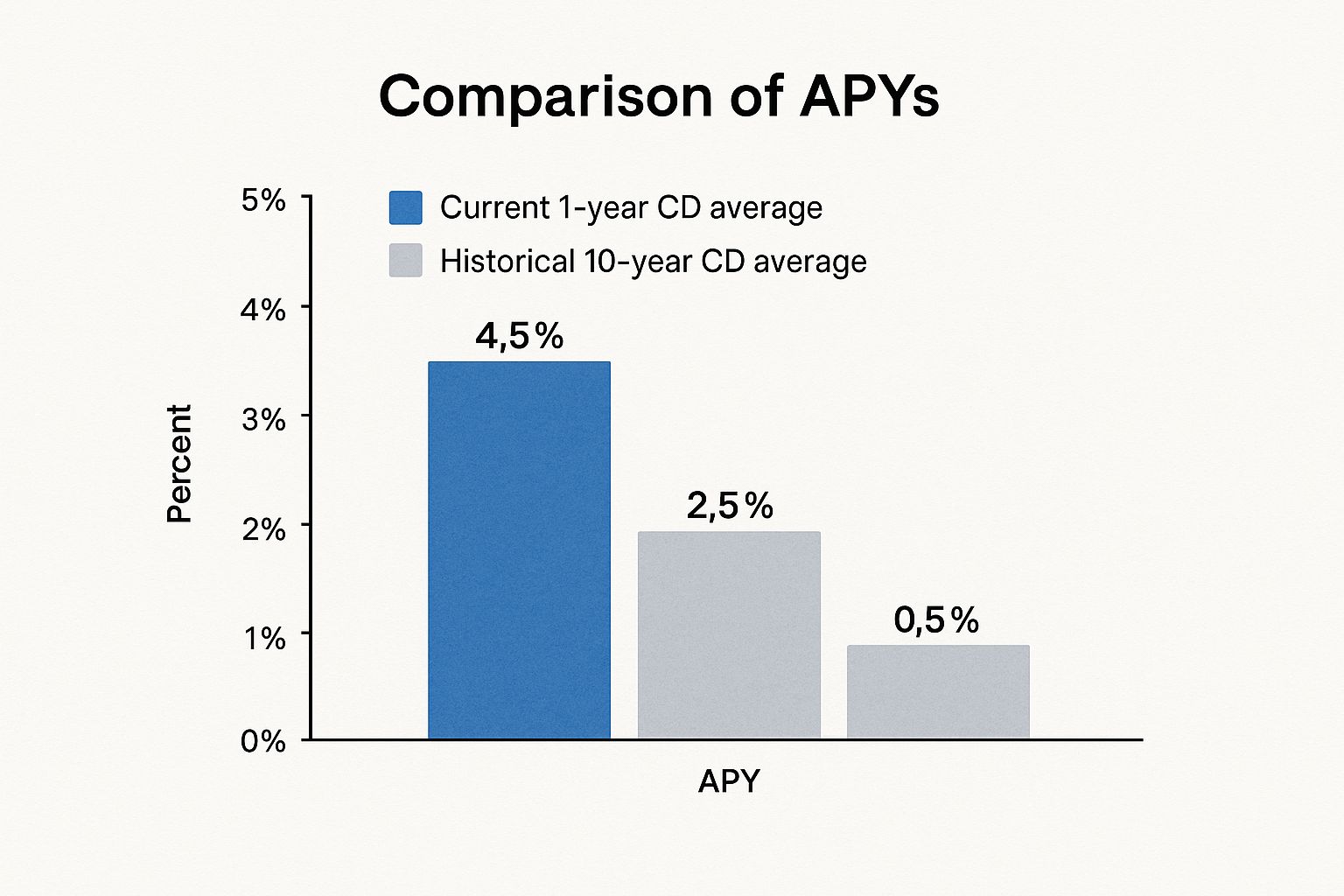

The following infographic compares the current average 1-year CD APY, the 10-year historical average, and the current average savings account APY.

As the infographic shows, current 1-year CD rates are significantly higher than both historical averages and current savings account rates. This highlights the potential for CDs to outperform other conservative savings options in the present market.

To further illustrate the historical fluctuations of CD rates, let's examine the following table:

Historical CD Rate Comparison by Decade

This table shows the average CD rates across different time periods to illustrate how rates have fluctuated historically.

| Time Period | Average 1-Year CD Rate | Economic Context | Investment Appeal |

|---|---|---|---|

| 1980s | High (often double-digit) | High inflation, economic instability | Attractive yields, but with higher risk |

| 1990s - Early 2000s | Moderate (around 5%) | Relatively stable economic growth | Competitive returns for savers |

| Late 2000s - Mid 2010s | Very low (near zero) | Post-recession, low interest rate environment | Low appeal, returns barely outpacing inflation |

| Late 2010s - 2020s | Fluctuating (near zero to over 6%) | Pandemic recovery, Fed intervention, subsequent rate cuts | Highly dependent on market timing and Fed policy |

The table above demonstrates how significantly CD rates can change based on economic conditions. It highlights periods of both high and low returns, reinforcing the importance of understanding these cycles.

Lessons From High-Yield Periods

High CD yield periods, like the 1980s, offer important lessons. These periods often correlate with economic instability or rapid growth. For example, the double-digit CD rates of the 1980s reflected the high inflation of that time. This tells us that while high CD rates can be tempting, they often occur during times of greater economic uncertainty.

The Impact of Low-Rate Environments

The extended period of near-zero CD rates following the 2008 crisis illustrates another key point: low-rate environments reduce the attractiveness of CDs. During these times, CD returns may barely keep up with inflation, making them less appealing compared to other investment choices. This reinforces the importance of considering the broader economic climate and alternative investments.

Timing Is Everything

The cyclical nature of CD rates highlights a vital takeaway: timing is crucial. A CD bought during rising rates can offer much higher returns than one purchased during declining rates. Understanding these cycles allows investors to strategically position their investments for better returns. Therefore, researching current market conditions and interest rate trends is essential when evaluating CDs.

Is a CD a Good Investment For You? The Honest Analysis

Deciding if a Certificate of Deposit (CD) is right for your portfolio requires careful thought. It's essential to weigh the advantages and disadvantages against your personal financial goals. Let's take a balanced look at both the strengths and weaknesses of CDs.

The Upsides of CD Investing

CDs offer several attractive features. The most prominent is the guaranteed return. You know exactly how much your investment will grow over the CD's term. This predictability simplifies financial planning.

Additionally, CDs are FDIC-insured, protecting your principal up to $250,000 per depositor, per insured bank. This makes CDs a low-risk choice, perfect for those who prioritize safety.

Finally, CDs offer a range of term lengths. This flexibility allows you to select a timeframe that aligns with your specific financial objectives, whether short-term or long-term.

The Potential Downsides of CDs

While CDs offer security and predictability, they also have potential drawbacks. A key consideration is inflation risk. If the rate of inflation surpasses your CD's interest rate, your purchasing power can decrease over time.

Another factor is opportunity cost. The money invested in a CD could potentially earn higher returns in other investments, particularly in a robust market.

Lastly, early withdrawal penalties can be substantial. Withdrawing your money before the CD matures can significantly reduce your overall return. This makes CDs less suitable if you anticipate needing quick access to your funds.

Weighing the Pros and Cons

To help you decide if a CD is a good fit, the following table summarizes the key advantages and disadvantages:

To help you make an informed decision, let's compare the pros and cons of CD investments in a detailed table.

CD Investment: Pros vs. Cons Comparison

This table compares the advantages and disadvantages of CD investments to help readers make informed decisions.

| Aspect | Advantages | Disadvantages | Best For |

|---|---|---|---|

| Returns | Guaranteed, predictable | Potentially lower than other investments | Risk-averse investors |

| Security | FDIC-insured up to $250,000 | Limited growth potential | Preserving capital |

| Liquidity | Fixed term options | Early withdrawal penalties | Planned expenses |

| Inflation | Protection against nominal losses | Can lose purchasing power if inflation outpaces interest | Low inflation environments |

As the table illustrates, CDs involve trade-offs. Carefully consider these trade-offs in light of your individual financial situation.

Who Benefits Most From CDs?

CDs are especially well-suited for certain investors. They're a good choice for those who prioritize preserving capital over aggressive growth, such as retirees or individuals saving for a down payment.

CDs can also play a valuable role in a diversified portfolio. They offer stability and can help reduce overall portfolio risk. However, investors looking for substantial growth may find CDs too restrictive.

For further information comparing savings accounts and CDs, check out this helpful resource: Savings Account vs. CD. Ultimately, the decision of whether a CD is a good investment for you depends on your individual risk tolerance, financial goals, and time horizon. Think carefully about your specific circumstances. Used strategically, a CD can be a valuable part of a well-rounded financial plan.

Today's CD Landscape: Navigating Current Opportunities

The current economic climate plays a significant role in how attractive Certificates of Deposit (CDs) are as investments. Understanding this landscape is key to answering the question, "Is a CD a good investment?" We'll examine how recent Federal Reserve decisions and inflation trends influence CD yields and explore where the most competitive rates can be found.

Current Rate Environment and Its Impact on CDs

The Federal Reserve's recent interest rate decisions are a major factor influencing CD yields. Rate hikes generally push CD rates upward, while rate cuts can cause them to decline. This connection highlights the importance of keeping up with current monetary policy when considering CDs. Inflation also significantly impacts the real return on CD investments. If inflation outpaces CD interest rates, the purchasing power of your investment can decrease over time.

Finding the Best CD Rates

Competitive CD rates can be found at a variety of financial institutions. Traditional banks offer CDs, but online banks and credit unions often provide more attractive yields. Comparing rates from several sources before committing to a CD is essential. Researching and comparing helps investors find the institutions offering the best returns. You might be interested in: Certificate of deposit rate trends.

Comparing CDs to Other Investment Options

To fully evaluate the value of CDs, it's important to compare them to other investment options. How do CDs measure up against high-yield savings accounts, Treasury securities, and money market funds? High-yield savings accounts offer more liquidity but may have lower interest rates. Treasury securities are backed by the U.S. government and offer different levels of risk and return. Money market funds typically provide relatively stable returns but may not keep up with rising interest rates. Understanding these comparisons helps investors decide if a CD aligns with their financial goals.

Expert Insights and Projections

Financial experts provide valuable perspectives on the factors currently driving CD rates. Their insights often include projections about short-term trends, which can help investors anticipate future rate movements. This information allows investors to make more informed decisions. For example, looking at CD rate trends over the past four decades highlights how they react to economic conditions and monetary policy. During the 1980s, rates were high due to high inflation. The 1990s and early 2000s saw rates moderate.

CD Rates Over Time

Following the 2008 financial crisis, CD rates stayed low, with short-term CDs offering better yields than long-term CDs. The six-month CD rate averaged between 0.42% and 0.44% from 2010 to 2012, before falling below 0.15% in 2013. Recent Federal Reserve rate hikes have pushed CD rates to historic highs, making them an attractive savings option again. However, their appeal can decrease if rates fall, as seen in late 2024, emphasizing the importance of timing in CD investments. Find more detailed statistics here.

Making Informed Investment Decisions

By considering current market conditions, comparing CD rates across different financial institutions, and understanding the broader investment landscape, you can determine if CDs are a suitable choice for your portfolio right now. CDs offer stability and predictable returns, but assessing their potential alongside other investment options is crucial for maximizing your investment returns.

Winning CD Strategies That Actually Work

Knowing if a CD is a good investment is the first step. Maximizing your returns requires a well-defined strategy. It's more than just depositing your money and hoping for the best. Let's look at some proven CD strategies to potentially boost your returns.

The Power of CD Laddering

CD laddering is a popular and effective strategy. It involves splitting your investment across several CDs with different maturity dates. For example, with $10,000, you could create five $2,000 CDs maturing in 1, 2, 3, 4, and 5 years.

This staggered approach offers two main advantages: increased liquidity and a potentially higher yield. As each CD matures, you can reinvest at the current (and possibly higher) rate or withdraw your money without penalty. This strategy lets you benefit from rising interest rates while still having access to some of your funds. Learn more about calculating CD returns: How to master CD calculations.

Exploring Specialty CDs

Beyond traditional CDs, specialty options can further enhance returns. Bump-up CDs let you increase your interest rate once during the term if market rates rise. This allows you to capitalize on favorable rate changes. No-penalty CDs often have slightly lower initial rates but allow penalty-free withdrawals, providing a balance between liquidity and return.

Timing the Interest Rate Cycle

Smart CD investors understand the importance of timing. A CD isn't always a good investment. Aligning your CD purchases with rising interest rate cycles can significantly improve your returns. By researching and anticipating rate movements, you can lock in higher yields as rates increase. This active approach can make a significant difference compared to passive investing.

Strategic CD Portfolio Integration

CDs offer a secure place for funds designated for specific goals, such as a down payment or education expenses. They can be a valuable part of a diversified investment portfolio. Allocating a portion of your portfolio to CDs reduces overall risk and guarantees access to funds at specific times. This allows you to pursue higher-growth investments while protecting essential capital.

Measuring CD Strategy Success

Evaluating your CD strategy involves several factors. Overall return, alignment with financial goals, and liquidity are key indicators. Calculate your total return, assess your access to funds, and consider how your CD investments support your overall financial plan. By regularly monitoring and adjusting your strategy, you can optimize your CD portfolio for the best possible results. These strategies help you move beyond simply asking, "Is a CD a good investment?" and focus on making CDs a strategic part of your financial success.

Beyond CDs: Smart Alternatives Worth Considering

When considering CD alternatives, it's essential to choose an investment strategy aligned with your financial goals. Is a CD truly the best fit? Exploring alternatives across the risk-reward spectrum helps pinpoint the perfect match. Let's compare CDs to other options, examining their strengths and weaknesses.

Inflation Protection and Tax Advantages

For protection against inflation, consider Treasury Inflation-Protected Securities (TIPS) and I-bonds. These securities adjust their principal based on inflation, a safeguard CDs lack. Both TIPS and I-bonds offer certain tax advantages, especially for long-term investors. However, CDs might be preferable for short-term goals where a fixed rate is more important than inflation protection.

High-Yield Savings and Money Market Funds

High-yield savings accounts offer greater flexibility than CDs. While their rates might not always match the highest CD rates, they provide easy access to your funds without penalties. Money market funds offer competitive rates and check-writing capabilities, making them suitable for short-term savings with liquidity needs. If accessible funds are your priority, these options outperform CDs, despite potentially lower returns.

Higher-Return Alternatives: Bonds, Stocks, and ETFs

Investors seeking potentially higher returns might consider bonds, dividend stocks, and ETFs (Exchange Traded Funds). Bonds offer fixed income payments and are generally less risky than stocks. Dividend stocks provide regular income through dividend payouts, while ETFs offer diversification across various asset classes.

However, these options come with increased risk compared to CDs. Financial advisors recommend realistic risk assessments, especially for bonds and stocks, as their values fluctuate with market conditions. For investors with a longer time horizon and higher risk tolerance, these options could outpace CD returns.

Choosing the Right Investment

The right investment depends on your individual circumstances. A retiree prioritizing capital preservation might favor CDs or I-bonds. A young professional with a longer time horizon might lean towards stocks or ETFs for higher growth potential. Someone saving for a down payment might opt for a high-yield savings account. Even with high CD rates, like the recent surge to over 6% APY, other options may better align with individual goals.

This comparison equips you to make informed decisions based on your risk tolerance, time horizon, and financial aspirations. Ready to calculate potential CD returns? Use our Certificate-of-Deposit Calculator to project investment growth and explore different CD scenarios.