Staring at your retirement savings can feel like looking at a pile of parts with no assembly manual. For many, the biggest fear isn't just about having enough—it's about making sure that money lasts for the rest of their lives. This is where creating guaranteed income in retirement comes in. It’s the strategy of turning that lump sum of savings into a steady, reliable paycheck you can count on, month after month.

Why Guaranteed Income Is Your Retirement Paycheck

Think of guaranteed income as the foundation of your financial house in retirement. It’s not just about having a pile of money; it's about having a predictable cash flow to cover your non-negotiable expenses—things like your mortgage, healthcare, and groceries—without lying awake at night worrying about the stock market.

This security is what gives you permission to shift from a lifetime of "saving" to confidently "spending" what you've worked so hard for.

The goal is essentially to build your own personal pension. With traditional pensions becoming a relic of the past for many, you can use a few key financial tools to replicate their single best feature: a dependable check that shows up like clockwork.

The Modern Retirement Reality

The need for a reliable income stream in retirement has never been more critical. People are living longer, and the old safety nets aren't as common. This has created a significant retirement income gap.

In fact, research shows that nearly 50% of households nearing retirement are at risk of not being able to maintain their standard of living. Annuities have emerged as one solution, but many people admit they don't fully understand them, highlighting a clear need for better education around these tools. For more context, you can explore more about these retirement trends and the state of protected income.

Building Your Income Foundation

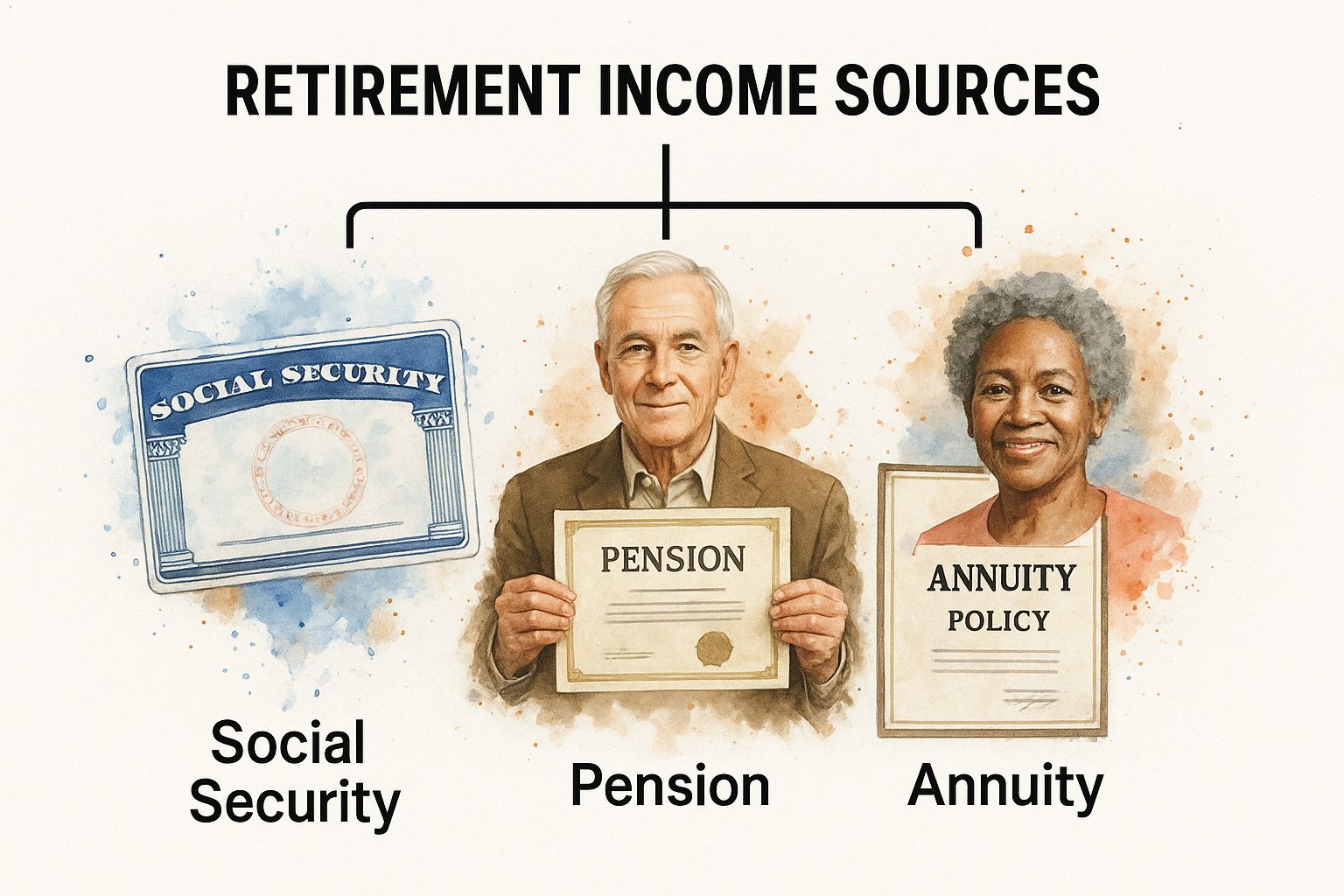

Creating this personal paycheck involves layering different sources of income to build a sturdy financial base. The primary building blocks usually include:

- Social Security: This is the bedrock for most American retirees, a foundational government benefit.

- Pensions: If you're lucky enough to have one, this employer-sponsored plan offers a defined monthly payout for life.

- Annuities: These are contracts with an insurance company designed specifically to provide a guaranteed stream of payments, either for a set number of years or for the rest of your life.

By combining these elements, you shift your focus from simply having a "nest egg" to engineering a true "retirement paycheck." It’s a move from asset accumulation to durable income distribution—which, at the end of the day, is the whole point of retirement planning.

The Core Pillars of Retirement Income

When you think about building a reliable income for retirement, it helps to picture a sturdy, three-legged stool. Each leg is a different source of support. If one leg is a bit wobbly or missing entirely, the stool might tip. But with all three in place, you’ve got a stable foundation you can count on for the long haul.

Getting to know these three sources—Social Security, pensions, and annuities—is the first step toward building that dependable, lifelong paycheck.

This visual gives you a good sense of how these income streams layer together. Social Security is the broad base for nearly everyone, pensions are a less common but powerful layer, and annuities offer a flexible way for anyone to add another layer of security. Let’s break down each one.

Pillar 1: Social Security

For most Americans, Social Security is the bedrock of retirement. It’s the reward for a lifetime of contributing through your payroll taxes. You pay in while you work, and the government sends you a monthly check when you retire. Before Social Security was created back in 1935, nearly half of all seniors lived in poverty. Today, that number is down to around 10%—a testament to its incredible impact.

But here’s the thing: Social Security was never meant to cover all your bills. It’s a safety net, designed to replace just a portion of your working income. If you try to live on it alone, you’ll likely find yourself facing a major income gap and some tough financial choices. Think of it as the concrete foundation of your retirement house—it's absolutely essential, but you still need to build the walls and the roof on top of it.

Pillar 2: Traditional Pensions

The second pillar is the traditional pension, often called a defined benefit plan. For decades, this was the gold standard. You worked for a company, they funded a pension plan for you, and when you retired, you received a fixed monthly check for the rest of your life. Simple and secure.

Unfortunately, that gold standard has become a rarity, especially in the private sector. Most companies have shifted the retirement savings burden onto their employees through 401(k)s and similar plans. If you’re one of the lucky few who still has a pension, you’ve got a fantastic source of predictable income. For everyone else, the job is to figure out how to build your own private pension.

The modern retirement landscape requires a proactive approach. Since traditional pensions are no longer a given, individuals must assemble their own guaranteed income streams using the tools available today.

And that’s exactly where the third pillar comes in. It’s the key to completing the picture.

Pillar 3: The Modern Annuity

The third—and most widely available—pillar for creating your own guaranteed paycheck is the annuity. At its heart, an annuity is a simple contract you make with an insurance company. You give them a chunk of money (either all at once or over time), and in exchange, they promise to send you a regular, guaranteed check.

Annuities effectively fill the gap that pensions left behind. They are the main tool available today that lets you turn a piece of your nest egg—say, from a 401(k) or an IRA—into a personal pension that you control and can't outlive. This structure offers incredible peace of mind, ensuring that no matter what the stock market does, your most essential bills are covered. They are one of several excellent choices among the top low-risk retirement investments available to secure your financial future.

By combining these three pillars—the foundation of Social Security, the good fortune of a pension if you have one, and the personal power of an annuity—you can construct a multi-layered income strategy. This approach creates the durable, worry-free retirement paycheck you deserve.

How Annuities Create Your Private Pension

With traditional pensions all but vanishing, many of us are left figuring out how to create our own reliable, lifelong income. This is exactly where the modern annuity comes in. It’s the main tool available today that lets you turn a chunk of your retirement savings into a private pension that you control.

Think of buying an annuity like purchasing a rental property that’s guaranteed to send you a monthly check—but without the headaches of leaky faucets or late-night tenant calls. You give a sum of money to an insurance company, and in return, they contractually agree to pay you a steady stream of income for a set number of years or even for the rest of your life. It’s a direct way to lock in a piece of your financial future.

This idea is gaining traction across generations. Recent research shows a major shift in how different age groups think about retirement funding. While 84% of baby boomers expect to lean on Social Security, that figure drops to 69% for Gen X and plummets to just 44% for millennials. This trend highlights a growing need for other sources of guaranteed income, with a striking 88% of millennials showing interest in products like annuities to create a dependable paycheck. You can read the full study from Allianz for more generational insights.

Finding the Right Annuity Type for You

Annuities aren't a one-size-fits-all solution. They come in several flavors, each built for different financial goals and comfort levels with risk. Getting to know the three main types is the first step in seeing how one might fit into your strategy for guaranteed income in retirement.

Here’s a quick rundown of the most common options:

- Fixed Annuities: The most straightforward and predictable choice.

- Variable Annuities: Geared toward growth, with exposure to market ups and downs.

- Fixed Indexed Annuities: A hybrid approach balancing safety with growth potential.

Let’s dig into how each one actually works.

Fixed Annuities: The Supercharged CD

A fixed annuity is the simplest of the bunch, operating a lot like a Certificate of Deposit (CD) but with a few key advantages for retirement planning. You deposit a lump sum, and the insurance company pays you a fixed, guaranteed interest rate for a specific term.

The biggest benefit here is predictability. You know exactly how much your money will grow and what your future income payments will be. This makes it a great tool for conservative folks who prioritize safety and want to take the guesswork out of at least a portion of their retirement income. It provides a solid, reliable income stream you can absolutely count on.

Variable Annuities: Fueling Growth Potential

For those who are comfortable taking on more risk for the chance at higher returns, a variable annuity is an option. With this type, your premium is invested in a portfolio of sub-accounts, which are very similar to mutual funds. Your returns—and by extension, your future income checks—are tied directly to how those investments perform.

Key Takeaway: Variable annuities offer the highest growth potential, but they also come with market risk. If the underlying investments do well, your income can grow substantially. If they perform poorly, your account value and income could drop. This type is usually best for people with a longer time horizon who want to supplement their guaranteed income with a growth-focused strategy.

Fixed Indexed Annuities: The Middle Ground

A fixed indexed annuity (FIA) offers a unique blend of safety and growth, which has made it an increasingly popular choice. It carves out a middle ground between the certainty of a fixed annuity and the market exposure of a variable one.

Here’s the basic idea: your returns are linked to the performance of a market index, like the S&P 500. Critically, however, your principal is protected from market downturns.

- How it works: When the index goes up, you get credited interest based on a portion of that gain. This is usually subject to a "cap" (a maximum interest rate you can earn) or a "participation rate" (the percentage of the index's gain you actually receive).

- The safety net: If the index goes down, you don’t lose any money. Your account value just stays the same for that period. You typically get a guaranteed minimum return, often 0%, ensuring your principal is safe.

This structure lets you participate in market gains without that gut-wrenching feeling of watching your retirement savings evaporate during a downturn. It’s designed for people who want better-than-CD returns but aren't willing to risk their principal, making it a powerful tool for building a secure yet growing income stream.

Balancing Guarantees with Growth and Liquidity

A solid retirement plan isn't built on guarantees alone. While a secure income floor is essential for covering your non-negotiable expenses, a truly resilient strategy also has to fight off inflation and handle life’s curveballs. This means striking a careful balance between the safety of guaranteed income in retirement, the need for growth, and having access to your money—what the pros call liquidity.

Think of it like building a house. Your guaranteed income is the solid foundation—it has to be there, unshakable. But you also need walls and a roof to protect you from the elements (growth to beat inflation) and doors and windows so you can get in and out (liquidity). A durable plan needs all three.

Using CDs for Predictable, Short-Term Income

One of the most straightforward ways to add a layer of predictable income and liquidity is with Certificates of Deposit (CDs). A CD is a simple savings product from a bank or credit union. You agree to leave your money on deposit for a fixed term—anything from a few months to several years—and in return, you get a fixed interest rate.

CDs aren't meant for lifelong income like an annuity; they're perfect for short- to medium-term goals. Because they come with government-backed insurance (up to FDIC/NCUA limits), they are one of the safest places to park cash.

A popular and highly effective way to use them is through a strategy called CD laddering.

Imagine a staircase where each step is a different CD. Instead of dumping all your cash into one five-year CD, you split it up across several CDs with staggered maturity dates—for instance, one-year, two-year, three-year, four-year, and five-year terms.

This approach creates a predictable, rolling stream of cash. Each year, as one "rung" of your ladder matures, you have a decision to make. You can spend the money, or you can reinvest it into a new, long-term CD at the top of the ladder, which usually lets you lock in a better interest rate. This keeps a portion of your money available every year and helps you adapt as interest rates change.

Modeling Your CD Income with a Calculator

Sketching out a CD ladder is a lot less intimidating when you have the right tool. By using a Certificate-of-Deposit Calculator, you can model exactly how the strategy will play out. You can plug in different deposit amounts, term lengths, and interest rates to get a crystal-clear picture of your future income stream.

Here’s a quick walkthrough:

- Enter Your Initial Investment: Start with the total amount you plan to put into your ladder.

- Divide and Conquer: Split that total across several CDs. For a five-year ladder with $50,000, you'd model five separate $10,000 CDs.

- Input Terms and Rates: For each CD, enter its term (12 months, 24 months, etc.) and the corresponding interest rate (APY).

- Analyze the Outcome: The calculator will immediately show you the maturity value for each CD and the total interest you'll earn.

This simple process turns an abstract idea into a concrete, actionable part of your retirement income plan.

Comparing Retirement Income Sources

To see where CDs fit in the bigger picture, it helps to compare them against other common retirement income products. Each has its own trade-offs between safety, growth potential, and ease of use.

| Income Source | Income Guarantee Level | Growth Potential | Complexity | Best For |

|---|---|---|---|---|

| CDs | Very High (FDIC/NCUA insured) | Low | Low | Short-term, predictable income and liquidity. |

| Fixed Annuities | High (Insurer-backed) | Low to Moderate | Moderate | Long-term, guaranteed income for life. |

| Pension Plans | High (PBGC-backed) | None (Fixed benefit) | Low (Managed by employer) | Retirees with employer-sponsored plans. |

| Dividend Stocks | None (Dividends can be cut) | High | High | Long-term growth and potentially rising income. |

| Bonds | Moderate to High (Issuer-dependent) | Low to Moderate | Moderate | Stable, predictable interest payments (coupons). |

This table highlights that there's no single "best" option—the right choice depends on your personal need for security versus your goals for growth.

Adding Growth to Your Income Strategy

While CDs and annuities deliver on security, their growth is often modest. To make sure your spending power doesn't get eroded by inflation over a 20- or 30-year retirement, you have to add assets with higher growth potential to the mix.

This is where sources like dividend-paying stocks and bonds come in.

- Dividend Stocks: These are shares in well-established companies that distribute a slice of their profits to shareholders. This can provide a regular income stream that has the potential to grow if the company continues to do well.

- Bonds: When you buy a bond, you're lending money to a company or a government. They promise to pay you back with regular interest payments over the life of the bond.

These assets carry more market risk than guaranteed products, but they are vital for long-term growth. For those looking to layer more sophisticated income streams on top of their core plan, there are various options strategies for generating investment income that can complement a traditional portfolio.

Ultimately, by building a foundation of guarantees and then thoughtfully adding growth-oriented assets, you create a balanced, durable portfolio designed to see you through retirement.

Crafting Your Personal Retirement Income Plan

Turning retirement ideas into a real-world strategy is where the rubber meets the road. Building a plan for guaranteed income in retirement isn't some form of financial voodoo; it’s a straightforward process of figuring out your needs, looking at what you have, and then making smart choices to create a paycheck for life.

Think of it like drawing up blueprints before building a house. You wouldn't just start hammering without knowing how many rooms you need or what supplies are on hand. Your income plan works the same way—it has to start with a crystal-clear picture of your financial life.

To make sure you don't miss anything important, it's often helpful to follow a comprehensive retirement planning checklist while you put your strategy together.

Step 1: Define Your Income Floor

Your first, and most critical, task is to calculate your "income floor." This is the bare-minimum, non-negotiable amount of money you need every month to cover your essential living costs. These are the bills that show up like clockwork, no matter what the stock market is doing.

- Housing: Mortgage or rent, property taxes, and insurance.

- Utilities: Electricity, water, gas, and internet.

- Healthcare: Insurance premiums, co-pays, and predictable prescription costs.

- Food: Your basic monthly grocery budget.

- Transportation: Car payments, insurance, fuel, and routine maintenance.

Once you’ve tallied these up, you have your target. This is the amount of monthly income that absolutely, positively must be guaranteed. Your Social Security benefits will cover part of this, so the real goal is to use other tools—like annuities or a pension—to fill any gap that’s left over.

Step 2: Assess Your Current Assets

With your income target set, it’s time to take inventory of what you already have. Look at all your retirement accounts, like your 401(k), IRA, and other savings. This isn't just about the total balance; it's about figuring out how those assets can be turned into the reliable income you need.

A chunk of this capital will be used to "buy" your guaranteed income streams. For instance, you might decide to use 30% of your 401(k) balance to purchase a fixed annuity that, when combined with Social Security, covers your entire income floor. The rest of your assets can then stay invested for growth, covering discretionary spending and future wants.

You can even use our tools to model how different assets can generate that income. For example, you can check out our guide on the CD calculator to see how a portfolio of CDs could create a predictable stream of interest payments.

Step 3: Align with Your Financial Advisor

Getting on the same page with a financial professional is key. The problem is, sometimes there's a big disconnect between what retirees actually want and what some advisors focus on.

Recent survey data shows a surprising gap: while 88% of investors say their top priority is a steady income stream, only 66% of advisors share that as a primary goal. Even more telling, 83% of investors believe guaranteed income beyond Social Security is important, yet fewer than half of advisors (46%) really emphasize it. You can read the full Global Atlantic survey findings to see the data for yourself.

When you meet with an advisor, be direct. Start the conversation by saying, "My primary goal is to establish a guaranteed income floor of $X per month to cover my essential needs. Can you show me how we can achieve that?"

This one sentence changes the entire conversation. It frames the discussion around your core objective—security. It forces the strategies and products being recommended to directly serve your goal of creating a durable, reliable retirement paycheck, not just chasing the highest market returns. This way, you’re not just a client; you’re an informed partner in building your financial future.

Clearing Up Common Retirement Income Myths

The road to a secure retirement is littered with old myths and misunderstandings. It’s easy to get spooked by these half-truths, which can cause you to freeze up right when you should be making confident moves.

Let's clear the air and bust three of the biggest myths about guaranteed income in retirement. Once you see the facts, you can swap that anxiety for the confidence you need to build a financial plan that lasts.

Myth 1: Annuities Are Too Complex and Expensive

You hear it all the time: annuities are confusing, high-fee products that mostly benefit the person selling them. While it’s true that some annuities are complex and carry higher costs, that’s not the whole story. Far from it. Simple, low-cost annuities are very much a real thing.

It's like buying a car. You can get a basic, reliable sedan that gets you from A to B, or you can splurge on a luxury sports car with a dozen high-tech gadgets. The same goes for annuities. A simple fixed annuity, for example, works a lot like a CD but gives you the option to create an income stream for life. The costs are usually minimal and already baked into the guaranteed rate you're quoted.

The Key Takeaway: Don't let the complexity of some annuities scare you away from all of them. The trick is to focus on the simple, transparent products that are easy to understand and solve your specific goal: creating a reliable paycheck.

Myth 2: I Will Lose Control of My Money

This is a big one—the fear of handing over a lump sum of your hard-earned money and losing access to it forever. It's a completely valid concern, but today’s annuities are built with a lot more flexibility than their predecessors. You have plenty of options to make sure you, and your family, stay in the driver's seat.

For instance, many annuities have liquidity options that let you withdraw a certain percentage of your account value each year without a penalty. Even better, survivor benefits are a standard feature. You can set up the contract so that if you pass away before the funds run out, the remaining money goes directly to your spouse or other beneficiaries. You aren't just "giving the money away"; you're directing it to protect your family's future.

Myth 3: My 401(k) Is Enough

Finally, there’s the common belief that a big 401(k) balance is a golden ticket to a worry-free retirement. While having a healthy nest egg is a fantastic starting point, it's still just a pot of money. And that pot is subject to the whims of the market. It’s not a paycheck.

The real difference between a pot of money and a guaranteed income stream is security. One can run out; the other is designed not to.

The whole point of a guaranteed income strategy is to turn a portion of that nest egg into a reliable check that you can't outlive. This protects the money you need for essential bills from the ups and downs of the stock market. Understanding this distinction is crucial, and it helps you see how different tools fit into your plan. To that end, it's worth exploring if products like CDs are a good investment for this purpose. You can learn more in our guide to CD investments.

Frequently Asked Questions About Guaranteed Income

When you start digging into the world of guaranteed income in retirement, a lot of practical questions pop up. That's a good thing. Getting clear answers is how you build a financial plan you can actually trust.

Let's tackle some of the most common ones I hear from clients.

How Much Should I Put Into an Annuity?

This is the big one, and the honest answer is: it depends. There’s no magic percentage. A really solid rule of thumb is to secure enough guaranteed income to cover your non-negotiable monthly expenses—what I call your "income floor."

First, add up your essential bills (mortgage, utilities, food, healthcare). Then, subtract what you'll get from Social Security or a pension. The gap is what you need to fill.

For example, if your essential bills are $4,000 a month and Social Security covers $2,500, you’d look for an annuity or other product that can generate that missing $1,500. This approach locks in your basic needs, which frees up your other investments for growth, travel, or just having fun.

What Happens to My Annuity if I Die Early?

This is a common and completely valid fear—that if you pass away shortly after buying an annuity, the insurance company just pockets your life savings. Fortunately, that’s a myth.

Modern annuities come with plenty of options to protect your money for your family.

You can build a death benefit right into the contract. This ensures that if you die before receiving the full value of your principal, the remainder goes directly to your spouse, kids, or whoever you name as a beneficiary. You can also choose a payout structure, like a "period certain," that guarantees payments for a minimum number of years, even if you're not around.

Will My Payments Keep Up with Inflation?

A guaranteed check every month is great, but what's that check going to be worth in 20 or 30 years? Protecting your purchasing power is absolutely critical.

To solve this, you can add an inflation-protection rider to your annuity. Think of it as a built-in raise. These riders, often called Cost of Living Adjustments (COLAs), will increase your payment each year.

The increase can be a fixed rate, like 3%, or it can be tied to a formal inflation measure like the Consumer Price Index (CPI). It’s a powerful feature that helps ensure your retirement paycheck doesn't shrink over time.

Ready to see how different savings strategies can create a predictable income stream? The Certificate-of-Deposit Calculator helps you model and compare CD returns, empowering you to make informed decisions for a secure retirement. Try our free CD Calculator today!