Navigating your financial strategy often involves a critical decision: what to do with cash you need in the near future. Whether you're saving for a down payment, building an emergency fund, or simply looking to earn a better return than a standard checking account offers, finding the right home for your money is crucial. The goal isn't just to store it, but to make it work for you without exposing it to unnecessary market volatility. This is where understanding the best short term investments becomes a powerful tool in your financial toolkit.

This guide is designed to cut through the noise and provide a clear, actionable roadmap. We will explore a curated list of the top ten options for short-term financial goals, typically those within a one-to-three-year timeframe. Forget generic advice; we are diving deep into the specifics. For each investment vehicle, you'll find a detailed breakdown covering its mechanics, potential returns, associated risks, and ideal investor profile. We'll compare options like High-Yield Savings Accounts against Treasury Bills and explain when a Certificate of Deposit (CD) might be more suitable than a Money Market Fund.

Our focus is on practical application. You will learn not just what these investments are, but how to use them effectively to meet your specific needs. By the end of this article, you will have the confidence and knowledge to select the right instrument to park your cash, balancing safety, liquidity, and return to optimize your financial position for 2025 and beyond. Let's explore where your money can achieve its highest potential over the short haul.

1. High-Yield Savings Accounts

When searching for the best short term investments, a High-Yield Savings Account (HYSA) is often the foundational starting point. Unlike traditional savings accounts that offer negligible interest, HYSAs provide significantly higher annual percentage yields (APYs), often ranging from 4% to over 5% as of 2024. This makes them an ideal vehicle for capital that needs to remain liquid and secure while still generating a meaningful return.

HYSAs are primarily offered by online banks and credit unions, which pass on their lower overhead costs to customers in the form of better rates. This structure allows your money to grow much faster than it would in a standard account, making it perfect for goals like building an emergency fund, saving for a down payment on a home, or setting aside funds for a major upcoming purchase.

Why It's a Top Short-Term Investment

The primary appeal of an HYSA lies in its unique combination of safety, accessibility, and competitive returns. These accounts are federally insured by the FDIC (or NCUA for credit unions) up to $250,000 per depositor, per institution. This government backing effectively eliminates the risk of losing your principal investment, a crucial feature for short-term goals where capital preservation is paramount.

Key Insight: The power of an HYSA is its ability to outperform inflation without exposing your funds to market volatility. It's not just a place to park cash; it's a tool for actively protecting and growing its purchasing power over a 6 to 24-month horizon.

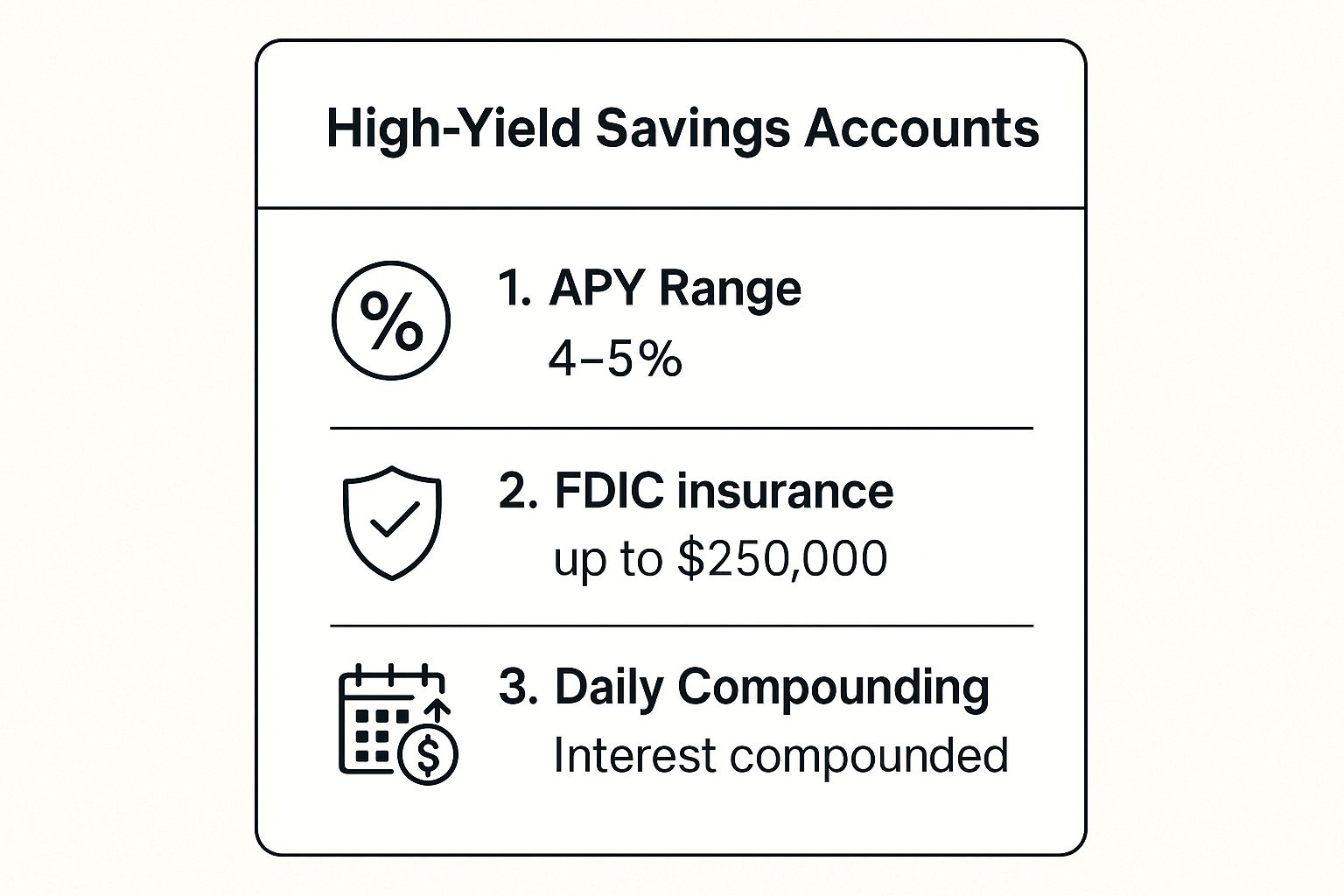

The following infographic highlights the core benefits that make HYSAs a standout option.

These three elements, competitive returns, robust insurance, and the power of compounding, work together to create a powerful, low-risk investment vehicle. This makes it a superior alternative to letting cash sit idle in a checking or low-yield savings account.

How to Implement This Strategy

Getting started with an HYSA is a straightforward process:

- Compare Top Providers: Begin by researching current APYs from reputable online banks. As of early 2024, institutions like Marcus by Goldman Sachs, Ally Bank, and Capital One 360 are consistent leaders.

- Check for Fees: Look for accounts with no monthly maintenance fees or minimum balance requirements to ensure your returns aren't eroded.

- Automate Your Savings: Once you open an account, set up recurring automatic transfers from your primary checking account. This "pay yourself first" approach ensures consistent progress toward your savings goals without requiring manual effort.

2. Money Market Accounts

For investors seeking a balance between the high yields of a savings account and the transactional flexibility of a checking account, a Money Market Account (MMA) is one of the best short term investments available. These deposit accounts typically offer interest rates competitive with HYSAs but add features like check-writing privileges and debit card access. This hybrid nature makes them exceptionally useful for funds you need to keep safe and growing, but might also need to access on short notice.

MMAs are offered by a wide range of financial institutions, from traditional brick-and-mortar banks to online banks and brokerage firms. Their rates, often variable and tied to prevailing market interest rates, can provide a significant boost over standard savings accounts. This makes them an excellent choice for large emergency funds, savings for a down payment, or a place to park cash while deciding on your next investment move.

Why It's a Top Short-Term Investment

The core value of an MMA is its unique blend of competitive yield, liquidity, and security. Like savings accounts, MMAs are federally insured by the FDIC (or NCUA for credit unions) up to $250,000 per depositor, per institution. This government guarantee removes the risk of losing your principal, which is non-negotiable for short-term financial goals.

Key Insight: An MMA serves as an ideal "operational" savings vehicle. It’s perfect for the money you don't need for daily spending but want to keep accessible for occasional large payments, like quarterly tax estimates or a home repair, without sacrificing growth potential.

The ability to write a limited number of checks or make debit transactions directly from the account provides a level of convenience that HYSAs typically lack. This functionality prevents the need to transfer funds to a checking account first, streamlining access to your cash when you need it most while it continues to earn a strong return.

How to Implement This Strategy

Setting up and using an MMA effectively is a simple process:

- Research Leading Providers: Compare APYs and features from different institutions. As of 2024, competitive options include the Discover Bank Money Market Account and CIT Bank Money Market Account. Brokerage-based accounts like the Vanguard Cash Plus Account also offer compelling features.

- Understand Account Terms: Pay close attention to minimum balance requirements, as falling below the threshold can trigger monthly fees that negate your interest earnings. Also, check for any limits on the number of monthly withdrawals or checks.

- Use as a Checking Alternative: Consider an MMA as a high-yield hub for your liquid cash. You can use it for significant, infrequent expenses while keeping the bulk of your day-to-day transactions in a standard checking account. If you're deciding between different savings products, you can explore detailed comparisons between money market accounts and CDs on bankdepositguide.com to see which fits your needs.

3. Certificates of Deposit (CDs)

For investors seeking predictable returns with zero market risk, Certificates of Deposit (CDs) are a classic and highly effective short-term investment. A CD is a time deposit offered by banks and credit unions where you agree to lock up your funds for a specific period, or term, ranging from three months to five years or more. In exchange, the financial institution pays you a fixed interest rate, which is often higher than that of a standard savings account.

This fixed-rate structure is the core appeal of a CD. It guarantees your return from day one, making it simple to calculate exactly how much your investment will be worth at the end of the term. This makes CDs an excellent choice for financial goals with a definite timeline, such as saving for a vacation in one year or a car payment in 18 months.

Why It's a Top Short-Term Investment

The power of a CD lies in its certainty and security. Like HYSAs, CDs are federally insured by the FDIC or NCUA up to $250,000, which means your principal is completely protected. Unlike HYSAs, however, the rate on a CD is locked in for the entire term. This protects you from interest rate drops, ensuring your earnings remain consistent regardless of economic shifts.

This predictability makes CDs one of the best short term investments for risk-averse individuals who need to know their exact return on a specific date. You trade liquidity for a higher, guaranteed APY, a worthwhile trade-off for funds you won't need to access immediately.

Key Insight: CDs remove all guesswork from your savings strategy. By locking in a competitive, fixed rate, you create a fire-and-forget investment that shields your money from both market volatility and potential interest rate declines.

This combination of a guaranteed return, government-backed insurance, and a fixed term makes CDs a powerful tool for conservative investors and anyone planning for a specific, time-bound financial goal.

How to Implement This Strategy

Effectively using CDs involves more than just picking the one with the highest rate. A strategic approach can maximize returns and flexibility.

- Shop for the Best Rates: Don't just settle for your primary bank's offer. Online banks and credit unions frequently provide much higher APYs. Also, consider brokered CDs available through investment firms like Fidelity or Schwab.

- Build a CD Ladder: To maintain access to your funds and manage interest rate risk, build a CD ladder. This involves splitting your investment across CDs with staggered maturity dates (e.g., 3-month, 6-month, 9-month, and 1-year terms). As each CD matures, you can either use the cash or reinvest it at the current top rate.

- Consider No-Penalty CDs: If you are concerned about needing access to your funds before the term ends, look into no-penalty (or liquid) CDs. These offer slightly lower rates but allow you to withdraw your money after an initial waiting period without incurring the typical early withdrawal penalty.

4. Treasury Bills (T-Bills)

For investors prioritizing absolute safety, Treasury Bills (T-Bills) represent the gold standard among the best short term investments. These are short-term debt securities issued by the U.S. Department of the Treasury with maturities ranging from a few weeks to 52 weeks. Backed by the full faith and credit of the U.S. government, they are considered one of the safest investments available, virtually eliminating the risk of default.

Unlike most investments that pay periodic interest, T-Bills are sold at a discount to their face value (par value). An investor buys the T-Bill for less than its stated value and, upon maturity, receives the full face value back. The difference between the purchase price and the maturity value constitutes the investor's return.

Why It's a Top Short-Term Investment

The unmatched security of T-Bills makes them an exceptional choice for short-term capital preservation. Because they are direct obligations of the U.S. government, they carry no credit risk, a feature that is invaluable during periods of economic uncertainty. This makes them a cornerstone for conservative investors and those who cannot afford to lose any principal.

Another significant advantage is their tax treatment. The interest earned on T-Bills is exempt from state and local income taxes, a benefit that can substantially boost the after-tax return for investors in high-tax states. While the income is subject to federal income tax, the state and local exemption often makes their effective yield higher than that of other taxable investments.

Key Insight: T-Bills offer a powerful combination of top-tier safety and tax efficiency. They are the ideal instrument for parking significant cash reserves, bridging investment gaps, or securing funds for a near-term liability where principal loss is not an option.

Their role in any robust financial plan extends beyond simple savings; T-Bills are a primary tool for capital preservation strategies.

How to Implement This Strategy

Purchasing T-Bills is accessible to individual investors and can be done without paying a commission:

- Use TreasuryDirect: The most cost-effective method is to buy T-Bills directly from the U.S. government through the TreasuryDirect.gov website. This platform allows you to purchase at auction with no fees.

- Build a T-Bill Ladder: To maintain liquidity while capturing yield, you can create a "T-Bill ladder." This involves buying T-Bills with staggered maturity dates, such as 4-week, 8-week, and 13-week bills. As each T-Bill matures, you can either use the cash or reinvest it into a new T-Bill, ensuring a steady stream of available funds.

- Consider a Brokerage Account: Alternatively, you can purchase T-Bills through a brokerage account. While this may offer more convenience, be mindful of any potential fees or markups that could reduce your overall return.

5. Money Market Funds

For investors looking for a highly liquid option that often provides yields competitive with HYSAs, Money Market Funds (MMFs) are a cornerstone of short-term cash management. These are mutual funds that invest exclusively in high-quality, short-term debt securities like Treasury bills, commercial paper, and certificates of deposit. Their primary goal is to maintain a stable net asset value (NAV) of $1 per share while generating modest, low-risk income.

MMFs are commonly held within brokerage or investment accounts, making them an excellent tool for parking cash that is waiting to be invested or held for upcoming expenses. They offer a seamless way to earn a return on idle funds without having to transfer money to a separate bank.

Why It's a Top Short-Term Investment

The core advantage of a Money Market Fund is its blend of high liquidity, competitive yields, and operational convenience, especially for those already active in the stock market. Unlike bank accounts, their yields react almost instantly to changes in federal interest rates, allowing investors to capitalize on a rising rate environment quickly. While not FDIC insured, they are regulated by the SEC and invest in extremely low-risk debt, providing a high degree of safety.

Key Insight: Money Market Funds serve as a strategic cash management hub within your investment portfolio. They provide a better return than standard brokerage sweep accounts while keeping your capital liquid and immediately deployable for market opportunities.

Leading fund providers like Vanguard, Fidelity, and Schwab offer a variety of MMFs, including government funds that invest solely in U.S. government securities for maximum safety, and prime funds that may offer slightly higher yields by including high-quality corporate debt.

How to Implement This Strategy

Integrating Money Market Funds into your short-term investment strategy is straightforward, especially if you have a brokerage account:

- Choose the Right Fund Type: Decide between government MMFs (like Vanguard Treasury Money Market Fund) for the highest safety or prime MMFs (like Fidelity Money Market Fund - SPRXX) for potentially higher yields. Your choice depends on your personal risk tolerance.

- Analyze Expense Ratios: While generally low, the expense ratio can impact your net return. Compare funds and select one with the lowest possible fee to maximize your earnings.

- Use as a Default Cash Position: Instead of letting cash sit in a low-yield sweep account, actively move uninvested funds into a chosen MMF. Many brokerage platforms allow you to set this as your default "core" position, automating the process.

6. Short-Term Bond Funds

For investors seeking a step up in yield from cash equivalents without taking on significant market risk, Short-Term Bond Funds represent a compelling middle ground. These investment vehicles, structured as either mutual funds or Exchange-Traded Funds (ETFs), pool investor capital to buy a diversified portfolio of bonds with short maturities, typically ranging from one to three years. This makes them one of the best short term investments for those with a slightly longer horizon.

Unlike individual bonds, which require you to hold them to maturity to receive your principal back, bond funds offer daily liquidity, allowing you to buy or sell shares on the open market. This structure provides a balance of higher potential returns than a money market fund while keeping interest rate sensitivity relatively low, making them suitable for goals that are 1-3 years away.

Why It's a Top Short-Term Investment

The core advantage of a short-term bond fund is its ability to deliver diversification and professional management at a low cost. Instead of researching and purchasing individual bonds, you gain instant exposure to a basket of debt instruments, which mitigates the risk of any single issuer defaulting. Their short duration also means they are less susceptible to price drops when interest rates rise compared to intermediate or long-term bond funds.

Key Insight: Short-term bond funds are a strategic tool for bridging the gap between ultra-safe cash and higher-risk equities. They allow you to earn a competitive yield while maintaining a stable principal value, making them ideal for goals like saving for a car or funding a near-term project.

This strategic positioning makes them a crucial component for investors looking to optimize returns on capital that will be needed in the foreseeable future but doesn't require immediate, next-day liquidity. Funds like the Vanguard Short-Term Treasury ETF (VGSH) or the iShares 1-3 Year Treasury Bond ETF (SHY) are popular examples that focus on government-backed debt for maximum safety.

How to Implement This Strategy

Integrating short-term bond funds into your portfolio is accessible through any standard brokerage account:

- Determine Your Risk Tolerance: Decide between funds holding ultra-safe U.S. Treasuries (like VGSH) or those holding corporate bonds, which offer slightly higher yields but carry more credit risk.

- Analyze the Expense Ratio: Fees directly impact your net return. Look for funds with low expense ratios, as these costs can add up over time. Many excellent ETFs offer expense ratios well below 0.10%.

- Consider Your Time Horizon: These funds are best suited for investment goals that are at least 12 months away. This buffer helps absorb any minor short-term price fluctuations and allows you to benefit from the income generated by the fund's bond holdings.

7. I Bonds (Series I Savings Bonds)

When inflation spikes, Series I Savings Bonds, or I Bonds, emerge as a powerful tool among the best short term investments. Issued directly by the U.S. Treasury, these bonds are designed to protect your money’s purchasing power from inflation. Their unique interest structure combines a fixed rate, which remains constant for the life of the bond, with a variable inflation rate that adjusts every six months. This composite rate ensures your returns keep pace with rising costs.

I Bonds became particularly popular during the high-inflation periods of 2022 and 2023, when their yields soared, offering a government-backed way to earn substantial returns. They are ideal for investors seeking to shield a portion of their portfolio from inflation's corrosive effects while accepting certain liquidity constraints. For example, the composite rate for I Bonds issued starting in May 2024 was 4.28%.

Why It's a Top Short-Term Investment

The core appeal of I Bonds is their direct, government-guaranteed protection against inflation. Unlike other investments that may lose real value when the Consumer Price Index (CPI) rises, an I Bond’s return is explicitly linked to it. This makes it an incredibly safe harbor for capital preservation during uncertain economic times. The interest earned is also exempt from state and local taxes, adding another layer of value.

Key Insight: I Bonds function as a direct hedge against inflation, making them one of the few assets where your principal is not only safe but also guaranteed to maintain its purchasing power. They are a strategic choice for funds you won't need for at least one year but want to protect for the medium term.

While your funds are locked for the first 12 months, this commitment is rewarded with a return that traditional savings vehicles often cannot match during inflationary periods. This unique structure provides a powerful balance of safety and inflation-adjusted growth.

How to Implement This Strategy

Purchasing and managing I Bonds is done directly through the U.S. Treasury, ensuring a secure process:

- Visit TreasuryDirect: All electronic I Bond purchases are made through the official TreasuryDirect.gov website. You will need to create an account to get started.

- Understand Purchase Limits: You can buy up to $10,000 in electronic I Bonds per person each calendar year. An additional $5,000 in paper bonds can be purchased using your federal tax refund.

- Plan for Liquidity Rules: Remember that you cannot cash in an I Bond for the first year. If you redeem it between years one and five, you will forfeit the previous three months of interest. This makes them suitable for goals that are at least 12 months away.

8. Corporate Bonds (Investment Grade, Short-Term)

For investors comfortable with a slight step up in risk for a corresponding increase in yield, investment-grade corporate bonds are among the best short term investments available. These are essentially loans made to large, financially stable corporations. In exchange for your capital, the company agrees to pay you periodic interest (coupons) and return your principal at a specified maturity date, typically within one to three years for short-term strategies.

Unlike government securities, corporate bonds carry credit risk, the risk that the issuing company could default on its debt. To mitigate this, investors focus on "investment-grade" bonds, which are those rated BBB- or higher by agencies like S&P or Moody's. This high rating signifies a strong capacity to meet financial commitments, making default a low-probability event.

Why It's a Top Short-Term Investment

The primary draw of short-term corporate bonds is their ability to offer a yield premium over safer government debt. This higher return compensates investors for taking on corporate credit risk. For those with a time horizon of 1 to 3 years, these bonds can provide predictable income streams and capital preservation, assuming you hold them to maturity and the issuer remains solvent.

Key Insight: Short-term corporate bonds strike a strategic balance, offering higher income than ultra-safe options like Treasury bills without the volatility of the stock market. They are an ideal tool for generating income from capital that you don't need immediately but want to keep relatively safe.

By focusing on bonds from established, blue-chip companies like Apple or Microsoft, you are lending to businesses with immense financial resources and a long history of meeting their obligations. This makes them a reliable component for a diversified short-term portfolio.

How to Implement This Strategy

Integrating corporate bonds into your strategy requires careful selection and diversification:

- Focus on High-Quality Issuers: Stick to bonds from companies with strong credit ratings, ideally A- or better. This minimizes your exposure to credit risk and ensures a higher likelihood of receiving your principal and interest payments on time.

- Diversify Your Holdings: Avoid concentrating all your funds in a single company's bonds. Spreading your investment across several corporations in different industries helps protect your portfolio if one company unexpectedly faces financial trouble.

- Consider Bond ETFs: For most individual investors, buying individual bonds can be complex and expensive. A more accessible route is through a short-term corporate bond ETF (Exchange-Traded Fund). These funds, such as the Vanguard Short-Term Corporate Bond ETF (VCSH), hold a diversified portfolio of hundreds of bonds, providing instant diversification and professional management for a low fee.

9. Dividend-Paying Stocks (Blue Chip)

While often associated with long-term investing, select blue-chip dividend-paying stocks can be considered one of the best short term investments for those with a higher risk tolerance. These are shares in large, financially stable companies known for their long history of distributing regular dividend payments to shareholders. This approach offers a dual-return potential: consistent income from dividends and the possibility of capital appreciation if the stock's price rises.

Blue-chip companies, such as consumer staples giant Procter & Gamble (PG) or utility leader NextEra Energy (NEE), operate in mature industries with predictable cash flows. This stability allows them to weather economic downturns better than smaller, growth-focused companies, making their stock prices generally less volatile and their dividend payments more reliable.

Why It's a Top Short-Term Investment

This strategy's appeal for a shorter horizon, typically 1 to 3 years, lies in its potential to generate income that can supplement or even outpace returns from cash-equivalent assets. While the principal is not insured and is subject to market risk, the regular dividend payments provide a tangible return, even if the stock's price remains flat or declines slightly. For an investor who can stomach some volatility, this can be a powerful way to put capital to work more aggressively than in a savings account.

Key Insight: For short-term goals, the focus on blue-chip dividend stocks shifts from long-term growth to income generation and relative stability. The dividend acts as a buffer, providing a predictable cash flow that reduces reliance solely on stock price appreciation over a limited timeframe.

The combination of income and potential growth, backed by corporate financial strength, makes this a compelling, albeit higher-risk, short-term option. It serves as a strategic step up from purely cash-based investments for those seeking enhanced returns.

How to Implement This Strategy

Successfully using dividend stocks for short-term goals requires careful selection and a clear understanding of the risks involved:

- Focus on Dividend Aristocrats: Prioritize companies in the S&P 500 Dividend Aristocrats index, which have increased their dividends for at least 25 consecutive years. This history demonstrates exceptional financial discipline and resilience.

- Analyze Payout Ratios: Ensure the company's dividend payout ratio (the percentage of earnings paid out as dividends) is sustainable, typically below 60-70%. A very high ratio could signal that the dividend is at risk of being cut.

- Diversify Your Holdings: Avoid concentrating your investment in a single stock or sector. Consider a dividend-focused ETF (Exchange-Traded Fund) for instant diversification across dozens of high-quality, dividend-paying companies.

For a deeper dive into this strategy, you can find valuable information here: Learn more about dividend-paying stocks on bankdepositguide.com.

10. Target-Date Short-Term Funds

For investors seeking a "set it and forget it" approach to their short-term goals, Target-Date Short-Term Funds offer a compelling solution. These are mutual funds or ETFs specifically engineered for goals with a defined time horizon, often within one to three years. They function by automatically shifting their investment mix, becoming progressively more conservative as the target date nears.

This built-in rebalancing, known as a "glide path," systematically reduces risk by decreasing exposure to volatile assets like stocks and increasing holdings in stable instruments like short-term bonds and cash equivalents. This makes them a great fit for goals such as saving for a car, funding a major home renovation, or accumulating capital for a business launch, where protecting the principal becomes more critical as the spending date approaches.

Why It's a Top Short-Term Investment

Target-date funds bring professional-grade portfolio management to everyday investors without the high fees. Their primary strength is automating the risk-reduction process, which can be difficult for individuals to manage effectively on their own. This ensures your investment strategy aligns perfectly with your timeline, minimizing the chance of a market downturn derailing your plans right before you need the funds.

Key Insight: Target-Date Short-Term Funds solve the problem of manual de-risking. They provide a disciplined, hands-off way to transition from growth to capital preservation, making them one of the best short term investments for goal-oriented savers who prefer not to actively manage their portfolio.

This automated adjustment makes them a standout option compared to static investments. While a bond fund offers stability, it doesn't automatically adapt its risk profile based on your specific timeline.

How to Implement This Strategy

Setting up this strategy involves selecting a fund that aligns with your specific financial objective and timeline.

- Match the Fund to Your Goal: Identify a fund with a target date that corresponds to when you'll need the money. Providers like Vanguard, Fidelity, and T. Rowe Price offer "Income" or near-date funds (e.g., Vanguard Target Retirement Income Fund) that serve this purpose well.

- Compare Expense Ratios: These are managed funds, so fees matter. Compare the expense ratios between different providers, as even a small difference can impact your net returns over time. Look for low-cost index-based options.

- Understand the Glide Path: Briefly review the fund's prospectus to understand its glide path-how and when it shifts its asset allocation. Ensure its level of conservatism near the target date matches your risk tolerance.

Top 10 Short-Term Investment Options Comparison

| Investment Type | Implementation Complexity 🔄 | Resource Requirements 🔄 | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐⚡ |

|---|---|---|---|---|---|

| High-Yield Savings Accounts | Low 🔄 | Low - no minimum period, easy online access | Moderate returns (4-5% APY) 📊 | Short-term savings, emergency funds | Guaranteed returns, FDIC insured, high liquidity ⚡⭐ |

| Money Market Accounts | Low to Moderate 🔄 | Moderate - higher minimum balances, check-writing | Moderate returns (~4.3% APY) 📊 | Short-term funds needing check access | FDIC insured, check & card access, better rates ⭐⚡ |

| Certificates of Deposit (CDs) | Moderate 🔄 | Moderate - locked deposits, fixed terms | Fixed, predictable returns (4.8-5.2% APY) 📊 | Medium-term savings with no liquidity need | Guaranteed fixed rates, FDIC insured, higher yields ⭐ |

| Treasury Bills (T-Bills) | Low 🔄 | Low - minimum $100, direct purchase possible | Safe, low risk returns (~4.7-5.2%) 📊 | Very short-term, capital preservation | Virtually risk-free, tax advantages, gov't-backed ⭐ |

| Money Market Funds | Moderate 🔄 | Moderate - brokerage account needed | Variable yields, higher than savings 📊 | Cash management inside investment accounts | Professional management, diversification ⭐ |

| Short-Term Bond Funds | Moderate 🔄 | Moderate - requires brokerage | Higher yield with some interest risk 📊 | 1-3 year investment horizons | Higher yields, diversification, daily liquidity ⭐ |

| I Bonds (Series I Savings Bonds) | Moderate 🔄 | Moderate - $10,000 annual limit | Inflation-protected returns 📊 | Long-term inflation protection | Inflation hedge, U.S. government backing ⭐ |

| Corporate Bonds (Short-Term) | Moderate to High 🔄 | Higher - requires research or funds | Higher yields, credit risk included 📊 | Income with moderate risk tolerance | Higher yields than gov't bonds, predictable income ⭐ |

| Dividend-Paying Stocks (Blue Chip) | High 🔄 | High - requires brokerage & market knowledge | Variable returns, dividends + appreciation 📊 | Income + growth seekers, moderate risk | Dividend income, potential capital growth ⭐⚡ |

| Target-Date Short-Term Funds | Moderate 🔄 | Moderate - brokerage, fund fees | Risk-adjusted returns over time 📊 | Hands-off investors with specific time goals | Automatic risk management, diversification ⭐ |

Choosing Your Path: Matching the Investment to Your Goal

Navigating the landscape of short-term investments can feel complex, but as we've explored, the core principle is simple: matching the right tool to the right financial job. The journey from identifying a financial goal to selecting the ideal investment vehicle is the most critical step you can take. We've detailed a diverse roster of options, from the bedrock security of High-Yield Savings Accounts and Treasury Bills to the slightly more dynamic potential of short-term bond funds and select dividend-paying stocks. The power lies not in choosing the single "best" option, but in understanding which one is the best for you, right now.

The key takeaway is that your timeline and risk tolerance are the two most important guideposts. Without a clear understanding of these factors, even the safest investment can become unsuitable. A three-month emergency fund has vastly different requirements than money you're setting aside for a home down payment in two years. The former demands immediate liquidity and absolute principal protection, making an HYSA or MMA the undisputed champion. The latter allows for slightly less liquidity and could benefit from the potentially higher, locked-in rates of a CD or the tax advantages of a Treasury Bill.

Synthesizing Your Strategy: From Knowledge to Action

The true value of mastering these concepts is moving beyond simply saving money and into the realm of strategic capital allocation. Instead of letting idle cash lose purchasing power to inflation, you are now equipped to make it work for you, even over brief periods. This proactive approach is what separates passive savers from active, successful investors. It’s about building a financial foundation so robust that your short-term goals are not just aspirations but near-certainties.

To put this knowledge into action, your next steps should be methodical and deliberate.

- 1. Define Your Goal and Timeline: Start with the "why." Are you saving for a vacation in 12 months? A car in 18 months? Or are you building a cash reserve for unexpected opportunities? Be specific with the amount and the exact timeframe. This single step will immediately narrow down your list of suitable investments.

- 2. Assess Your Risk Tolerance: Honestly evaluate how you would feel if your principal dipped, even slightly. For goals where you cannot afford any loss, like an emergency fund, your focus must be on capital preservation. This means sticking to FDIC-insured products like HYSAs, MMAs, and CDs, or government-backed securities like T-Bills.

- 3. Compare Current Rates and Terms: The financial environment is dynamic. The best CD rate today might be surpassed by another bank tomorrow. Use online comparison tools to survey the landscape for the highest APYs on savings accounts and CDs, and check the latest auction results for T-Bills on the TreasuryDirect website.

- 4. Consider the Tax Implications: Don't forget that investment earnings are often taxable. T-Bill interest is exempt from state and local taxes, a significant benefit for those in high-tax states. Qualified dividends from stocks are also taxed at a lower rate than ordinary income. Factoring in the after-tax return gives you a truer picture of your net earnings.

The Broader Impact: Building Financial Resilience

Ultimately, understanding the best short term investments is about more than just earning a few extra dollars in interest. It's about building financial resilience and control. When your short-term capital is deployed effectively, it creates a buffer that protects your long-term investment strategy from disruption. You won't be forced to sell stocks in a down market to cover an unexpected expense because you'll have a secure, liquid source of funds ready. This separation of short-term needs from long-term wealth creation is a cornerstone of sophisticated financial planning. By making intentional, informed choices with your cash, you are not just investing in an account; you are investing in your own peace of mind and future stability.

Are you considering a Certificate of Deposit to lock in a guaranteed return for your short-term goals? Use our free Certificate-of-Deposit Calculator to instantly compare how different rates, terms, and compounding frequencies will impact your total earnings. Make a data-driven decision by visiting the Certificate-of-Deposit Calculator today.