Unlocking the Power of Certificate of Deposit Calculators

A certificate of deposit (CD) offers a predictable return on your investment, but understanding how interest accrues can be tricky. This is where a CD calculator comes in. These tools help you project the growth of your savings accurately, making them indispensable for serious savers.

How CD Calculators Work

CD calculators eliminate the guesswork involved in projecting investment growth. You input key variables: your principal investment, the interest rate, the term length, and the compounding frequency. The calculator then provides precise insights, surpassing manual calculations. This allows you to make informed decisions about your CD investments. For instance, a calculator can quickly show the difference in returns between daily and annual compounding.

Why Use a CD Calculator?

CDs have been a popular savings vehicle, especially during times of economic uncertainty. In the 1980s, CD rates soared into the double digits, sometimes averaging over 11% APY due to the Federal Reserve’s response to inflation. This attractiveness has fluctuated with interest rate changes over time. Find more detailed statistics here

CD calculators also empower you to compare offers from different financial institutions. This side-by-side comparison helps you identify the best rates and terms, maximizing your potential return.

Understanding the Results

Understanding CD calculation terminology is essential for interpreting results. A CD calculator typically shows the future value of your investment (the total at maturity, including principal and interest) and the total interest earned. This information is crucial for aligning your CD investments with your financial goals.

Moreover, these calculators help you visualize the impact of different scenarios. Adjusting variables like term length or interest rate shows you how changes affect your final return. This interactive exploration lets you strategize and optimize your CD investments based on your financial situation.

Why Smart Investors Rely on CD Calculators

A certificate of deposit (CD) offers a secure way to grow your savings with a fixed interest rate over a specific period. But understanding the true potential of a CD requires more than simple interest calculations. That's where CD calculators become invaluable tools for smart investors. They provide a deeper understanding of how your money can grow, enabling informed decisions tailored to your financial goals.

Comparing Offers and Compounding Frequencies

One of the most significant advantages of a CD calculator is its ability to quickly compare offers from different financial institutions. Manually calculating potential returns for various CDs with varying rates and terms can be time-consuming and prone to errors. A CD calculator simplifies this process, allowing you to input the specifics of each CD and instantly compare potential yields side-by-side. This empowers you to identify the most competitive rates and terms, maximizing your returns.

CD calculators also clearly illustrate the impact of compounding frequency. The frequency, whether daily, monthly, quarterly, or annually, affects your final balance. A calculator lets you visualize these differences, helping you choose the best option for your growth objectives.

Planning CD Ladders and Aligning With Financial Goals

For those pursuing more sophisticated strategies like CD laddering, a CD calculator is essential. Laddering involves investing in multiple CDs with staggered maturity dates. A calculator helps you model various ladder structures by inputting different term lengths and interest rates. This allows you to fine-tune your ladder, balancing higher long-term rates with access to funds as needed.

Furthermore, CD calculators help align your investments with your financial goals. Whether it's a down payment, education expenses, or retirement, a calculator helps you determine the ideal term length to reach your target amount by your desired date.

To illustrate the advantages of using a CD calculator, let's look at a comparison:

CD Calculator Advantage: Before and After

See how certificate of deposit calculators transform financial decision-making compared to traditional methods

| Investment Decision | Without Calculator | With Calculator |

|---|---|---|

| Comparing CD Offers | Manual calculations, time-consuming and potentially inaccurate | Quick, side-by-side comparison of potential yields |

| Compounding Frequency Impact | Difficult to visualize the effect of different frequencies | Clear illustration of how compounding impacts growth |

| CD Ladder Planning | Complex and challenging to project various ladder structures | Easy modeling and optimization of ladder performance |

| Goal Alignment | Estimating maturity dates and amounts to reach goals | Precise determination of the required term length and investment |

This table highlights how CD calculators simplify complex calculations and provide valuable insights for informed decision-making.

Factoring in Inflation and Taxes

A key advantage of a CD calculator is its ability to incorporate real-world factors like inflation and taxes. By inputting estimated inflation rates, you can assess the real purchasing power of your investment at maturity. This ensures your gains keep pace with rising prices. Some advanced CD calculators even consider tax implications, providing a clearer picture of your net return.

Let's say you're comparing two CDs: one with a slightly lower interest rate but more frequent compounding, and another with a higher rate but less frequent compounding. Without a calculator, determining the better offer is challenging. A CD calculator instantly reveals the difference in final balances, considering the compounding effect and highlighting the superior option. This kind of clarity is invaluable for making smart investment decisions.

Through these practical applications, CD calculators transform abstract numbers into concrete financial strategies, empowering you to optimize your CD investments and build wealth over time. That's why they are an indispensable tool for any serious investor.

Mastering Certificate of Deposit Calculators: A Practical Guide

Now that we understand the advantages of using a certificate of deposit (CD) calculator, let's explore how to use these tools effectively. This guide will help you become proficient with CD calculators, allowing you to optimize your CD returns.

Inputting Information and Comparing Scenarios

The first step involves entering the correct information into the CD calculator. Begin by inputting your principal, which is the initial amount you'll invest. Next, enter the annual percentage yield (APY) offered by the financial institution. Remember, the APY differs from the simple interest rate. It reflects the total interest earned over a year, including the effects of compounding.

After entering the APY, input the term length, which is the duration of the CD. Finally, select the compounding frequency. This determines how often the earned interest is added back to the principal. With this information, the calculator will generate the future value of your investment (the total at maturity) and the total interest earned.

The true strength of CD calculators lies in their ability to compare different scenarios. By adjusting the term length, you can see how different terms impact your returns. This allows you to visualize how various CD terms fit into your long-term savings strategy. You can also experiment with different APYs from various banks to identify the most competitive rates.

Advanced Techniques for Maximizing Returns

Some CD calculators offer advanced features beyond basic calculations. These features can refine your CD strategy even further. One such feature is the ability to model multiple interest rate environments. This allows you to simulate different APY scenarios to understand how potential rate fluctuations could affect your returns.

Furthermore, you can use calculators to evaluate specialty CDs, like bump-up CDs or no-penalty CDs, against traditional CDs. Calculating the opportunity costs between different term structures is also possible. This helps you understand the potential trade-off between higher returns from longer-term CDs and the liquidity offered by shorter-term options.

Choosing the Right Calculator and Leveraging its Features

Numerous CD calculators are available, ranging from those offered by banks to independent financial platforms like Calculator.ninja. The right calculator for you depends on your specific needs. Basic calculators are sufficient for simple projections, while premium calculators offer advanced features such as tax impact modeling and inflation adjustments.

Look for calculators with user-friendly interfaces and mobile accessibility for convenient calculations on the go. Integration capabilities with other financial planning tools can also be beneficial. Some platforms offer supplementary educational resources, further enhancing your understanding of CD investments.

The statistical performance of CDs is closely tied to central bank policies, especially in major economies like the United States. Between 2022 and 2023, the Federal Reserve aggressively raised interest rates to combat inflation, which resulted in a surge in CD yields. At their peak, top nationwide CD rates reached over 6%, a level unseen for at least 16 years.

While these rates have started to decline following subsequent rate cuts in late 2024, they are still higher than in the previous decade. Learn more about the history of CD interest rates here. This highlights the importance of using a CD calculator to stay informed about current market conditions and adjust your strategy accordingly.

Through real-world examples, you can see how small changes in your inputs can significantly affect your potential earnings. For example, a mere 0.1% difference in APY can result in thousands of dollars difference over a longer term. By mastering CD calculators and understanding how different variables interact, you can confidently navigate the CD market and maximize your returns.

Reading Market Signals Through Your CD Calculator

Your certificate of deposit (CD) calculator isn't just for crunching numbers; it's a valuable tool for understanding economic trends and making smart investment choices. Savvy investors use these calculators to see how market conditions influence CD yields and adjust their savings strategies accordingly.

Decoding the Fed and CD Yields

Understanding the relationship between the Federal Reserve (Fed) and CD yields is key to using a CD calculator effectively. When the Fed raises interest rates, CD rates tend to rise as well. The opposite is also true: when the Fed cuts rates, CD yields typically decrease. A CD calculator lets you model different interest rate scenarios and project their impact on your potential returns, helping you prepare for changes in the interest rate environment.

Benchmarking Against Inflation

Nominal interest, the stated interest rate, doesn't tell the whole story. You also need to consider inflation to truly gauge your investment's performance. A CD calculator helps you benchmark potential CD returns against inflation, ensuring your investment maintains real purchasing power. For example, a CD offering a 4% APY with 3% inflation results in a real return of only 1%. This analysis is crucial for sound decision-making in varying market conditions.

Comparing Rates and Identifying Value

Systematically comparing CD rates across different financial institutions is essential for maximizing returns. Your CD calculator allows you to quickly input rates from various banks and directly compare potential yields. This helps you find the most competitive offers and spot valuable opportunities. For example, if rates have recently fallen, using a calculator to project returns at previously higher rates helps you understand potential lost gains and better assess the current market. The CD market has grown significantly, reaching an estimated value of USD 1 trillion in 2023, with projections nearing USD 1.5 trillion by the end of the decade. You can explore this growth further on Dataintelo. This expansion is driven by economic factors and investors seeking stable investment options.

Optimizing Your Strategy With Regular Recalculations

Because market conditions constantly change, regularly recalculating your potential CD returns with updated data is important. Your CD calculator becomes a dynamic tool for adjusting your strategy as economic conditions shift, ensuring your CD investments stay aligned with your financial goals.

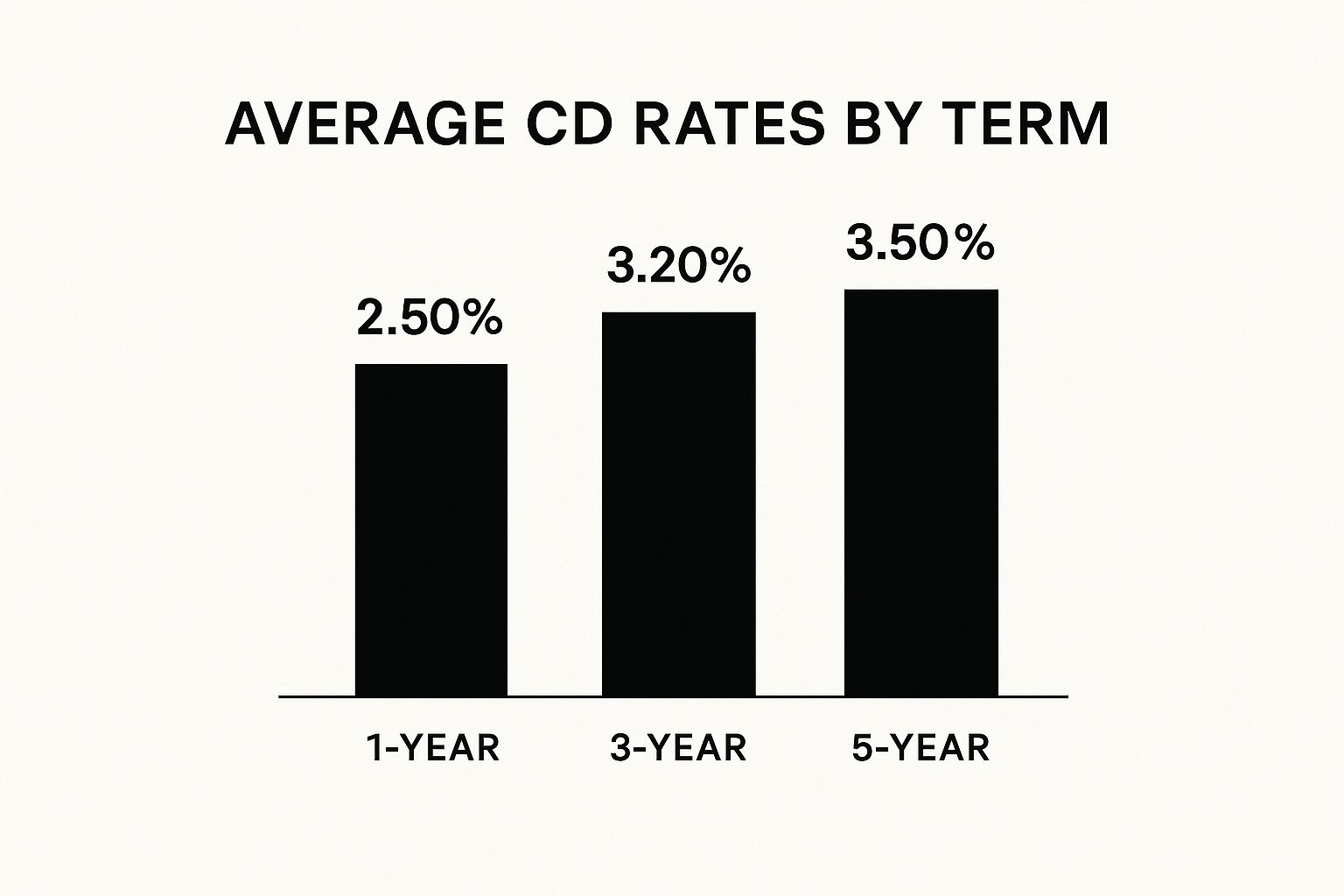

The following data chart shows the change in average CD rates over the last five years.

The chart highlights the substantial rise in average CD rates in 2023 followed by a slight decline in 2024, demonstrating how economic shifts directly affect CD yields. The 2023 peak underscores the importance of regularly monitoring rates and using your CD calculator.

To further illustrate how economic conditions can impact CD rates and inform your calculator usage, consider the following table:

CD Rate Evolution: Calculator Strategies Through Time

| Market Phase | Typical CD Rates | Economic Indicators | Calculator Strategy |

|---|---|---|---|

| Expansion | Rising | Low unemployment, increasing GDP | Use the calculator to project potential returns at higher rates and consider longer-term CDs. |

| Peak | High | Inflation concerns, potential rate cuts | Compare short-term and long-term CD rates using the calculator to balance yield and liquidity. |

| Contraction | Falling | Rising unemployment, slowing GDP | Use the calculator to evaluate current rates against historical yields and consider shorter-term CDs. |

| Trough | Low | Potential for rate increases | Use the calculator to model returns as rates begin to rise and consider laddering CDs. |

This table provides a framework for understanding how economic indicators can influence CD rates and inform the strategies you employ with your CD calculator.

Recognizing CD Allocation Opportunities

Professional money managers use CD calculators to determine the appropriate allocation for CDs within a diversified portfolio. When market volatility increases, the security and predictable returns of CDs become especially appealing. By using a calculator to model different portfolio allocations, you can visualize how including a higher percentage of CDs could impact your overall investment strategy. This analysis helps balance risk and reward in any economic climate.

Building the Perfect CD Ladder With Calculator Precision

CD laddering is a smart strategy for earning more interest while still being able to access your money. A certificate of deposit (CD) ladder spreads your investment across multiple CDs, each with a different maturity date. This creates a staggered flow of returns. Using a certificate of deposit CD calculator helps optimize your ladder's structure for maximum benefit.

Determining Ideal Spacing Between Rungs

Think of each CD in your ladder as a "rung." A CD calculator helps you figure out the best spacing between these rungs. Each rung represents a CD with a specific term length. For example, a five-rung ladder might have CDs maturing every 6, 12, 18, 24, and 30 months. The calculator lets you try different term lengths and interest rates. This helps you find the right balance between access to your money (liquidity) and higher returns.

Comparing Potential Returns Across Ladder Structures

Building a CD ladder isn't a one-size-fits-all process. Your financial goals and comfort level with risk will influence your ladder’s design. A certificate of deposit CD calculator lets you model different ladder structures. You can compare a standard ladder with evenly spaced rungs to a weighted ladder. A weighted ladder puts more money into longer-term CDs. Comparing potential returns helps you choose the ladder that best fits your objectives.

Visualizing Your Investment Timeline

One of the biggest advantages of using a CD calculator is seeing your investment timeline. The calculator shows you when each CD will mature and how much money you'll get back. This helps you plan for future expenses or reinvestment opportunities. Seeing this clear timeline simplifies CD laddering and gives you a roadmap for your investments. You can see exactly when you'll have money available for a down payment, for example, or to cover upcoming costs.

Balancing Long-Term Rates and Liquidity

The goal of laddering is to get higher long-term interest rates while still having access to some of your money regularly. Finding the right balance is key. A CD calculator helps you experiment with different ladder setups. This lets you find the best mix of term lengths. You can maximize your returns without giving up access to the cash you need. This becomes especially important when interest rates are changing. To further refine your strategy, consider using a Data Warehouse. A data warehouse can offer valuable market insights.

Dynamically Adjusting Your Ladder

Interest rates go up and down, so your CD ladder might need adjustments. A certificate of deposit CD calculator lets you see how your ladder would perform under different interest rate scenarios. This helps you anticipate potential gains or losses. You can then make informed decisions about changing your ladder’s structure. If rates rise, you might add new rungs at the higher rates. You could also reinvest maturing CDs into longer-term options. If rates fall, shorter-term CDs might be preferable to maintain flexibility. This dynamic approach helps maximize your returns, no matter what the market does.

Through careful planning and projections, a certificate of deposit CD calculator transforms CD laddering. It takes it from a simple concept to a sophisticated and optimized savings strategy. It helps you make smart decisions, balance your financial priorities, and build a more secure financial future.

Choosing the Right Certificate of Deposit Calculator

Not all CD calculators are created equal. Picking the right one can have a real impact on your investment decisions. Finding the best certificate of deposit (CD) calculator means looking at several key features to ensure accurate projections and help you make informed choices.

Essential Features for Accurate Projections

A reliable CD calculator needs to let you input the principal amount, interest rate (APY), and term length. These are the basics for calculating how a CD will grow. The compounding frequency is also important. This tells you how often the interest is calculated and added to the principal. A good calculator lets you choose between daily, monthly, quarterly, or annual compounding so you can see the effect on your returns.

- Principal: Your initial investment.

- APY: The Annual Percentage Yield, showing the total interest earned in a year, including the effects of compounding.

- Term Length: How long the CD will last (usually in months or years).

- Compounding Frequency: How often the interest is added to the principal.

Advanced Features for Enhanced Analysis

Beyond the basics, some CD calculators offer helpful extras that can really improve your analysis. Tax impact modeling shows your return after taxes are taken out, giving you a more realistic picture. Inflation adjustments help you understand your investment’s real growth after factoring in inflation’s impact on purchasing power. Scenario comparisons are useful too, letting you change inputs like interest rates and term lengths to compare different investment possibilities side-by-side.

- Tax Impact Modeling: Estimates your CD's return after taxes.

- Inflation Adjustments: Shows the impact of inflation on your investment.

- Scenario Comparisons: Lets you compare different CD scenarios.

User-Friendliness and Accessibility

A CD calculator is only useful if it's easy to use. A user-friendly interface makes it simple to enter information and understand the results. Mobile accessibility is also important, so you can make calculations and compare offers on the go. Some calculators even work with other financial planning tools, giving you a broader view of your investment strategy. Look for calculators with easily accessible customer support if you have questions.

Complementary Educational Resources

Some CD calculators offer more than just calculations. They might provide explanations of key CD terms, guides on CD laddering strategies, or details on how interest rates are set. These resources can deepen your CD knowledge and help you build a smarter investment strategy.

Finding the Right Fit for Your Needs

Different calculators are built for different levels of investing experience. Basic calculators, like the one offered by Calculator.ninja, are great for simple projections. More advanced calculators give you deeper analysis and special features. Bank calculators are handy, but they sometimes lack the features you'll find on independent financial platforms. Choose a CD calculator that matches your needs and financial goals to help you maximize your returns.

Turning Calculator Insights Into Profitable CD Decisions

A certificate of deposit (CD) calculator offers more than just numbers; it provides valuable insights for informed financial decisions. This section explains how to turn those calculations into actionable strategies for reaching your financial goals.

Balancing CD Security With Higher-Yield Alternatives

CDs offer security and predictable returns, making them appealing, especially during economic uncertainty. However, other investment options may offer higher potential returns. A CD calculator helps you weigh the security of a CD against the potential for greater gains elsewhere.

By comparing projected CD returns with other investments, you can assess the trade-offs and make choices that align with your risk tolerance. For example, you could compare a CD's fixed return with the potential, though less certain, return from investing in stocks.

Determining Optimal CD Allocation in Your Portfolio

Diversification is a cornerstone of sound financial planning. Figuring out the right percentage of your portfolio for CDs requires careful thought. A CD calculator helps you model different portfolio allocations, showing the potential impact of varying CD percentages on your overall returns.

This allows you to balance the stability of CDs with the growth potential of other investments. A conservative investor might allocate a larger portion to CDs, while a more aggressive investor might allocate a smaller portion.

Integrating CDs Into Retirement and Education Plans

CDs can play a strategic role in long-term financial plans, such as retirement or education funding. A CD calculator can project how CD investments will contribute to these goals.

By entering your target amount and desired timeframe, you can determine the necessary investment and ideal CD term lengths. This helps you effectively incorporate CDs into your broader financial roadmap.

Real-World Success Stories: Using Calculator Insights

Real-world examples show how investors have used CD calculators to make profitable decisions. Some investors use them to time the market, capitalizing on periods of high interest rates. Others leverage calculator insights to negotiate better rates with financial institutions. Selecting a secure platform is essential; resources like Protecting Your Credit Card From Scammers: Key Tips can be helpful. By analyzing potential returns under different scenarios, investors can avoid common pitfalls that reduce returns. For example, a calculator can show the impact of early withdrawal penalties, helping you avoid costly errors.

From Projections to Tangible Gains: A Decision-Making Process

Turning calculator projections into real financial gains requires a structured approach. First, define your financial goals and risk tolerance. Then, use a CD calculator to explore different scenarios and compare potential returns.

Finally, make informed decisions aligned with your objectives and regularly review your CD investments as market conditions change. This process helps you maximize your CD investments and achieve your financial aspirations.

Ready to start? Maximize your CD returns with our Certificate-of-Deposit Calculator today!

Article created using Outrank