The Power of CD Bank Calculators: Your Guide to Smarter Returns

Getting the most out of your Certificate of Deposit (CD) earnings involves more than just chasing the highest advertised rates. A CD bank calculator helps you make smart choices by simplifying complex interest calculations into clear projections. This lets you visualize your potential earnings and make informed, data-driven decisions. For instance, you can quickly see the impact of different CD terms and interest rates on your final payout.

Why CD Calculators Are Essential

Financial advisors often recommend using CD calculators, especially when comparing different CD options. These tools help investors look beyond the advertised Annual Percentage Yield (APY) and understand the real potential of their investment. This means you can easily compare a 1-year CD at 4% APY with a 5-year CD at 3.5% APY to determine which generates a greater return over its term.

CD bank calculators also help you account for compounding frequency. This refers to how often interest is calculated – daily, monthly, quarterly, or annually – and its effect on your total return. Understanding this nuance is crucial for maximizing your CD earnings.

The Impact of Changing Interest Rates

The importance of CD calculators has grown as interest rates fluctuate over time. In the late 1970s and 1980s, CD yields reached nearly 20% due to high inflation. However, these rates steadily declined, reaching around 4% before the late 2007 economic downturn.

More recently, with rising inflation, CD rates climbed above 5% in 2023 and 2024. As inflation eased in mid-2024, these rates began to fall again. Tools like the Bankrate CD calculator let you estimate potential earnings based on your initial deposit, CD term, and interest rate, providing a clear picture of returns in different economic climates.

Making Informed Decisions with CD Calculators

Smart investors know the power of small differences. A seemingly minor 0.1% difference in interest rates can significantly impact your earnings, particularly with longer-term CDs. A CD bank calculator highlights these subtle yet important differences, helping you choose the best CD for your financial goals.

This is especially important when considering the trade-off between liquidity and the potentially higher returns of longer-term CDs. Using a CD calculator isn't just about finding the highest rate. It's about understanding how various factors interact to affect your overall investment growth. This makes CD bank calculators invaluable tools for strategic financial planning.

Mastering CD Bank Calculators: Beyond the Basics

A simple CD bank calculator can be more than just a tool for crunching numbers. It's a powerful resource that can help you understand and maximize your returns on Certificates of Deposit. Savvy investors use these calculators to explore how different factors influence their final payout. Even small adjustments, like changing the compounding frequency, can make a surprising difference, especially over longer terms and with larger deposits.

Unveiling Hidden Opportunities With Key Inputs

Understanding the impact of each input is crucial for maximizing your CD investment. A CD calculator empowers you to model different scenarios and make informed decisions.

To illustrate the importance of various inputs, let's take a closer look at a few key fields:

Deposit Amount: Your initial deposit has a direct impact on your total interest earned. A larger initial investment will generally yield a higher return, even with the same interest rate.

APY (Annual Percentage Yield): This figure represents the total interest earned in a year, including the effects of compounding. Comparing APYs across different CDs is essential for finding the best rates.

Term Length: Longer terms usually come with higher APYs. However, they also tie up your money for a longer period. It's important to strike a balance between maximizing returns and maintaining access to your funds.

Compounding Frequency: How often the interest is calculated and added to your principal (daily, monthly, quarterly, annually) plays a significant role in your overall return. More frequent compounding results in higher earnings.

To gain a comprehensive understanding of your CD's growth potential, especially for long-term investments, consider exploring resources on how to calculate the Compound Annual Growth Rate.

Before we dive into comparisons, let's review the essential inputs for a CD calculator:

To get accurate results from your CD calculator, understanding the required inputs is essential. The following table outlines the key information you'll need.

Essential Inputs for CD Calculators: A breakdown of the key information needed to get accurate results from a CD calculator.

| Input Field | Description | Impact on Results |

|---|---|---|

| Deposit Amount | The initial amount invested in the CD. | Directly influences the total interest earned. Larger deposits lead to higher returns. |

| APY (Annual Percentage Yield) | The effective annual interest rate, including the effects of compounding. | Higher APY leads to greater overall return. Crucial for comparing different CD offers. |

| Term Length | The duration of the CD, typically expressed in months or years. | Longer terms often offer higher APYs but reduce liquidity. |

| Compounding Frequency | How often the interest is calculated and added to the principal (e.g., daily, monthly, quarterly, annually). | More frequent compounding results in slightly higher returns. |

This table summarizes the vital information needed for accurate calculations and informed decision-making. By understanding these inputs, you can use a CD calculator to effectively model various scenarios and optimize your CD investments.

Side-by-Side Comparisons for Superior Returns

One of the most valuable features of a CD bank calculator is the ability to compare different CD offers side-by-side. This allows you to evaluate CDs with varying terms, APYs, and compounding frequencies. For example, you can directly compare the potential returns of a short-term CD with frequent compounding to a longer-term CD with a slightly lower APY.

Hidden Features: Don't Leave Money on the Table

Many CD calculators offer advanced features that can further enhance your understanding and returns. Some calculators factor in early withdrawal penalties, allowing you to assess the net return if you need to access your funds before maturity. Others allow you to compare CD returns against other investment options. Utilizing these features can provide valuable insights and potentially increase your overall returns. By mastering these tools, you can make informed decisions and optimize your CD investments.

Using CD Bank Calculators to Navigate Market Trends

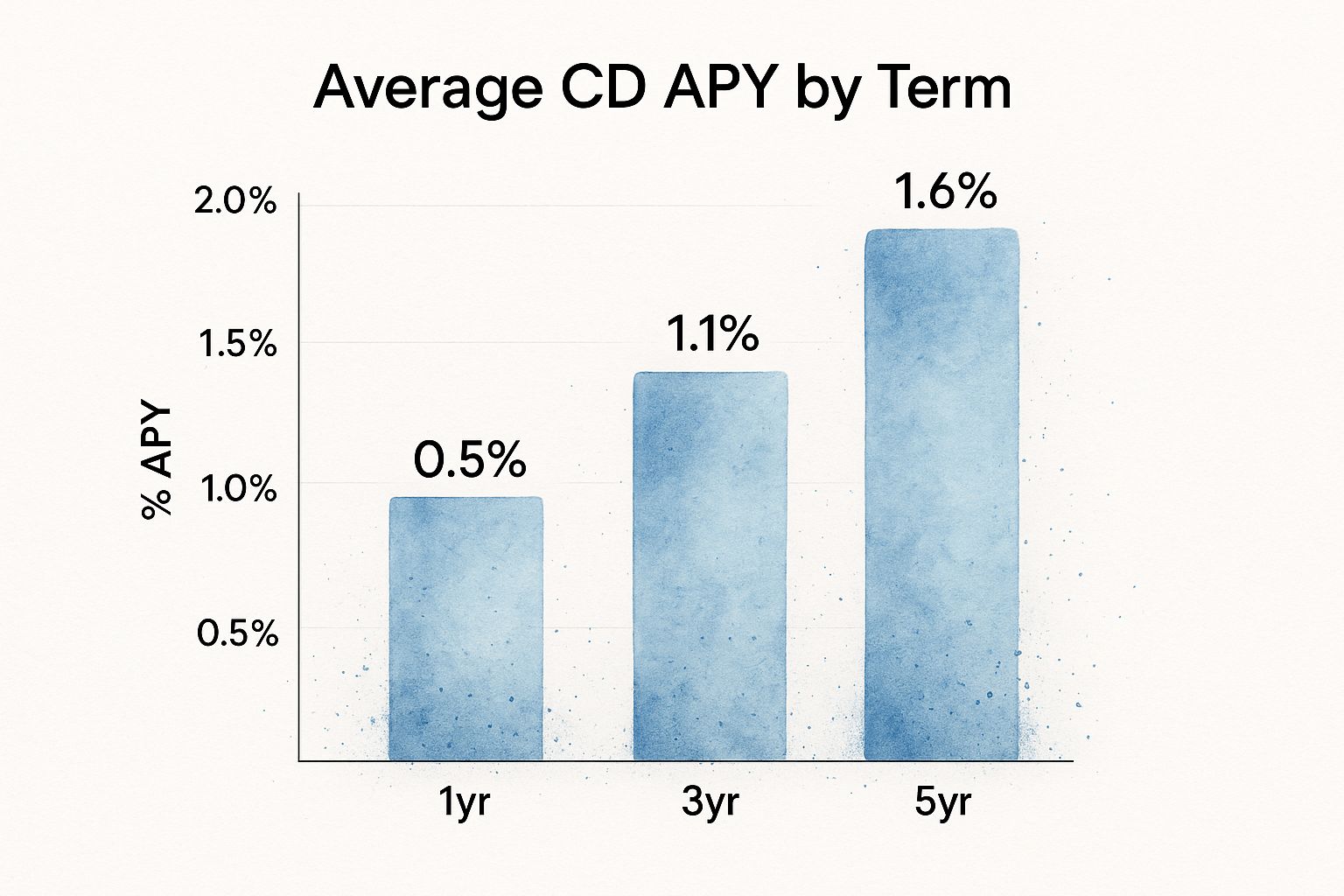

The infographic above gives a visual representation of the average APY (Annual Percentage Yield) offered on CDs (Certificates of Deposit) with different term lengths. Longer-term CDs typically offer higher returns. This is because committing your funds for a longer period justifies a higher interest rate from the bank.

A CD bank calculator is a powerful tool. It’s more than just a simple interest calculator; it's a way to understand market dynamics and make informed investment decisions. By analyzing historical rate cycles and projecting future trends, you can find the best times to lock in favorable rates.

Timing Your CD Investments

A CD bank calculator can be extremely helpful when deciding when to invest in a CD. By inputting different interest rate projections, you can see how even small changes can significantly impact your overall returns. This is especially important in a fluctuating interest rate environment.

CD calculators are also useful for building CD ladders. This strategy involves staggering your CD investments across different maturity dates. This offers a balance between liquidity and maximizing returns as CDs mature at different intervals.

Determining Optimal CD Maturity Lengths

Choosing the right term length for your CD is essential for maximizing returns. A CD bank calculator is indispensable in this process. During periods of rising interest rates, a shorter-term CD might be the better option. This allows you to reinvest at higher rates sooner.

However, if rates are falling, locking in a longer-term CD at a currently favorable rate could be advantageous. Historical trends in CD rates show they are heavily influenced by economic conditions and Federal Reserve policies.

As of April 2025, median APYs for CDs in the U.S. showed a slight decline from previous months. 6-month CDs were offering around 3.85% APY, and 1-year CDs were offering about 4.00% APY. This trend reflects the impact of the Fed's rate changes on CD rates. You can find more detailed statistics here.

Let's look at historical CD rate trends to understand the context of these current rates.

The following table shows "CD Rate Trends Over Time". It presents historical CD rates across different term lengths, illustrating how they've fluctuated with economic conditions.

| Time Period | 6-Month CD Rate | 1-Year CD Rate | 5-Year CD Rate | Economic Condition |

|---|---|---|---|---|

| Jan 2023 | 2.50% | 2.75% | 3.50% | Slow Growth |

| July 2023 | 3.00% | 3.25% | 4.00% | Moderate Growth |

| Jan 2024 | 3.50% | 3.75% | 4.50% | Strong Growth |

| July 2024 | 4.00% | 4.25% | 5.00% | Peak Growth |

| Jan 2025 | 3.90% | 4.10% | 4.75% | Slowing Growth |

| April 2025 | 3.85% | 4.00% | 4.60% | Stable Growth |

This table clearly shows the upward trend of CD rates through 2024, followed by a slight decline in 2025. This mirrors the overall economic trends, highlighting the interconnectedness of CD rates and economic conditions.

Modeling Future Scenarios

Financial planners often use CD bank calculators to model various future scenarios for their clients. They can input different potential interest rate paths and inflation forecasts. This shows how these factors might impact CD returns. This helps clients understand the potential risks and rewards associated with different CD investment strategies.

This forward-looking approach empowers investors to make data-driven decisions. By incorporating economic forecasts and historical data, you can use a CD bank calculator to make informed choices about your CD investments and maximize your returns in any market environment.

Advanced CD Bank Calculator Features Worth Mastering

While basic CD bank calculators can help you project potential returns, mastering advanced features allows for more strategic planning. These tools help you model complex scenarios and make informed decisions about your CD investments. This moves you beyond simple projections and into true financial optimization.

Modeling Early Withdrawal Penalties

Unexpected events happen, and sometimes you need access to funds locked in a CD before maturity. Advanced CD calculators allow you to input the early withdrawal penalty associated with your specific CD. This information is crucial for deciding whether to access your funds early.

The calculator will show your net return after the penalty. This allows you to weigh the cost of accessing your money early against your current needs. For example, if you have a 5-year CD with a 6-month interest penalty, the calculator can show the exact impact of withdrawing funds after 3 years. This feature helps you prepare for contingencies.

Understanding Tax Implications

Taxes are an important part of any investment strategy. Some advanced CD bank calculators include the tax implications on your interest earnings. This provides a more realistic picture of your potential profit.

You can adjust the calculator based on your individual tax bracket, creating a personalized projection. This detailed analysis is especially helpful when comparing CD returns to other investments with different tax treatments.

Projecting Future Rate Changes

Interest rates constantly change, and predicting their future trajectory can significantly impact your CD investment strategy. Advanced calculators offer features to model different rate changes.

This allows you to project potential returns under various scenarios. For example, if you anticipate rising rates, you might consider shorter-term CDs to reinvest at higher rates when they mature. If you foresee falling rates, a longer-term CD at a currently favorable rate could be more beneficial. Analyzing historical CD rates can offer insights into potential future trends. In 2021, one-year CD yields were below 1%. By 2023 and 2024, rates had climbed to over 5%, influenced by the Federal Reserve's response to inflation. As of 2025, rates have begun to decline slightly. Resources like NerdWallet provide CD calculators to help understand these trends and make informed decisions. Explore this topic further here.

Comparing CDs Against Other Investments

A key feature of advanced CD calculators is the ability to compare CD returns with other investment vehicles. This feature helps you see how CDs fit into your overall portfolio.

You can compare the potential return of a CD with that of a bond or a stock index fund, considering factors like risk tolerance and investment timelines. This broad perspective allows you to make the best allocation decisions across your entire portfolio. By using these advanced features, you can develop a well-informed investment strategy.

Strategic CD Planning: Calculators for Every Financial Goal

Your CD strategy should be as unique as your financial goals. A CD calculator isn't just for calculating interest; it's a powerful tool for aligning your CD investments with your specific objectives. Whether you're saving for a down payment, planning for retirement, or building an emergency fund, a CD calculator can help you create a personalized strategy.

Young Professionals: Balancing Liquidity and Growth

For young professionals, balancing immediate needs with long-term growth can be a challenge. A CD calculator allows you to model different scenarios. For example, you can determine the optimal split between a readily accessible, short-term CD for an emergency fund and a longer-term CD for future investments.

This approach allows you to build a solid financial foundation while still having access to funds for unexpected expenses or opportunities.

Mid-Career Investors: Optimizing for Education Funding

Mid-career individuals often face the significant expense of funding their children's education. A CD calculator can help optimize savings strategies. By inputting the target amount and timeframe, you can determine the required monthly contributions and ideal CD ladder structure to reach your goal.

This forward-thinking approach ensures you're on track to meet future financial obligations.

Pre-Retirees: Structuring CD Ladders for Income

As retirement approaches, generating consistent income streams becomes paramount. CD ladders, created by staggering CD maturities, can provide reliable income. A CD calculator can help you design this ladder, factoring in your income needs and desired level of liquidity.

This allows for regular access to funds as CDs mature, supplementing retirement income without exposing your entire portfolio to market volatility.

Practical Applications Beyond the Basics

Beyond these specific examples, CD calculators offer numerous practical applications:

Emergency Funds: Determine the optimal CD term and deposit amount to cover unexpected expenses while maximizing interest earned.

Major Purchases: Calculate the required savings rate and CD term to achieve a down payment goal for a car or home within a specific timeframe.

Wealth Preservation: Model the growth potential of long-term CDs for preserving capital and generating predictable returns.

Using a CD calculator is not about applying generic advice; it’s about creating a personalized plan. By inputting your individual circumstances and financial objectives, you can develop a CD strategy tailored to your specific needs. This personalized approach transforms a simple calculator into a powerful financial planning tool, empowering you to make informed decisions and achieve your financial aspirations.

Top CD Bank Calculators: Finding Your Perfect Match

Not all CD bank calculators are created equal. Some offer basic calculations, while others provide advanced features that can significantly impact your investment strategy. Finding the right calculator is crucial for maximizing your returns. When comparing different CD calculators, understanding the broader context of digital marketing in finance can be helpful, as discussed in this article on SEO for Financial Services.

Key Features to Consider

When choosing a CD bank calculator, consider these key features:

Accuracy: The calculator should provide precise calculations based on your input. Look for calculators that clearly explain their methodology and use current interest rates.

User Experience: A user-friendly interface is essential. The calculator should be easy to navigate and understand, even for first-time users.

Mobile Functionality: On-the-go access is increasingly important. A good CD bank calculator should be accessible on mobile devices, allowing you to make calculations anytime, anywhere.

Advanced Features: For seasoned investors, features like scenario planning, early withdrawal penalty calculations, and comparisons with other investment options can be valuable.

Comparing Different Calculators

To help you find the perfect match, let's compare some popular CD bank calculators:

| Calculator | Provider | Key Features | Best For |

|---|---|---|---|

| CD Calculator | Calculator.net | Simple interface, APY comparison | Beginners |

| CD Ladder Calculator | Bankrate | CD laddering strategies, rate comparisons | Intermediate Investors |

| CD Early Withdrawal Calculator | NerdWallet | Penalty calculations, scenario planning | Advanced Investors |

| CD Calculator | Calculator.ninja | Compounding frequency options, graphical visualizations | All Levels |

This table provides a starting point for your research. It's important to explore each calculator and determine which best suits your individual needs and investment goals. Some calculators excel for simple calculations, while others provide more robust features for experienced investors.

Free vs. Premium Options

Many CD bank calculators are available free online. These tools offer basic functionality and are suitable for most investors. However, some financial institutions or investment platforms may offer premium calculator tools with more advanced features.

These premium options might have associated costs or be included as part of a subscription service. Consider the value these advanced features offer compared to the cost. If you frequently invest in CDs or need more sophisticated planning tools, a premium calculator might be worth the investment.

Recommendations for Specific Investor Profiles

Beginners: Start with a simple, user-friendly calculator focused on basic calculations and APY comparisons.

Intermediate Investors: Look for calculators that offer CD laddering strategies and rate comparisons across different financial institutions.

Advanced Investors: Consider calculators with advanced features such as scenario planning, early withdrawal penalty assessments, and comparisons with other investment options.

By carefully considering these factors, you can find the ideal CD bank calculator to help you reach your financial goals.

Ready to start maximizing your CD returns? Try our comprehensive Certificate-of-Deposit Calculator today! It's designed for all levels of investors, offering both basic and advanced features to help you make informed decisions.