Why Smart Investors Use CD Calculators

A Certificate of Deposit (CD) offers a predictable return, making it a safe and popular choice for growing savings. But understanding a CD's true potential involves more than just the Annual Percentage Yield (APY). That's where a CD calculator comes in. These tools help investors see the real impact of compounding interest.

Imagine depositing $10,000 into a CD. A simple interest calculation might not impress you. However, a CD calculator considers compounding, showing how your interest earns interest over time. This can significantly increase your final payout. Seeing this potential growth encourages saving and informed choices. Understanding how different compounding frequencies (daily, monthly, quarterly, annually) affect returns can reveal opportunities to maximize your earnings. It's important to note that "CD" in finance refers to Certificates of Deposit, not music CDs. CD rates can change based on factors like Federal Reserve decisions and the economy.

Unmasking the Power of Compounding

Compounding fuels CD growth, and a CD calculator shows you this in action. Enter different term lengths and APYs to model various scenarios. You'll see how even small adjustments can dramatically change your final balance. This clarity is crucial for smart financial decisions.

Comparing Apples to Apples

A CD calculator also helps you compare offers from different financial institutions. APYs can be misleading, especially with varying compounding frequencies. The calculator standardizes comparisons, ensuring you choose the CD that truly maximizes returns, not just the highest advertised rate.

Beyond the Basics: Advanced Insights

The best CD calculators go further than simple interest. They consider early withdrawal penalties, showing the real cost of accessing funds before maturity. This helps you make strategic decisions based on your situation and risk tolerance. Some calculators even provide insights into CD laddering, a strategy balancing liquidity and yield by staggering CD maturities. This transforms a basic calculator into a powerful financial planning tool.

The Features That Make a CD Calculator Worth Using

Not all CD calculators are created equal. Some offer basic interest calculations, while others provide more advanced features that can help you make informed decisions about your investments. Understanding these key features is crucial for maximizing your CD returns.

Essential Calculation Features

A truly useful CD calculator needs to go beyond simply calculating basic interest. Look for features like APY calculations, which accurately reflect the impact of compounding on your returns. This means the calculator should allow you to input the compounding frequency (daily, monthly, quarterly, annually) to see how it affects your final balance. For instance, a CD with a slightly lower APY but higher compounding frequency could actually result in greater earnings over time. The calculator should also clearly show the total interest earned over the CD's term.

Advanced Features for Informed Decisions

The best CD calculators offer advanced features that take your planning to the next level. The ability to factor in early withdrawal penalties is essential. Knowing the potential cost of accessing your funds before maturity is crucial. For example, if you need to withdraw $1,000 from a CD with a 3-month penalty, the calculator should show precisely how much you'll lose. This information allows you to carefully weigh the pros and cons of early access.

Being able to compare multiple scenarios simultaneously is another valuable feature. This allows you to input different deposit amounts, interest rates, and term lengths to easily compare potential returns. This side-by-side comparison simplifies the process of finding the best CD for your financial goals.

Some advanced calculators even offer insights into CD laddering strategies. CD laddering involves spreading your investment across multiple CDs with staggered maturity dates. This approach balances liquidity and yield, providing regular access to some funds while maximizing returns on others. A calculator that supports laddering can help you determine the optimal strategy for your specific needs.

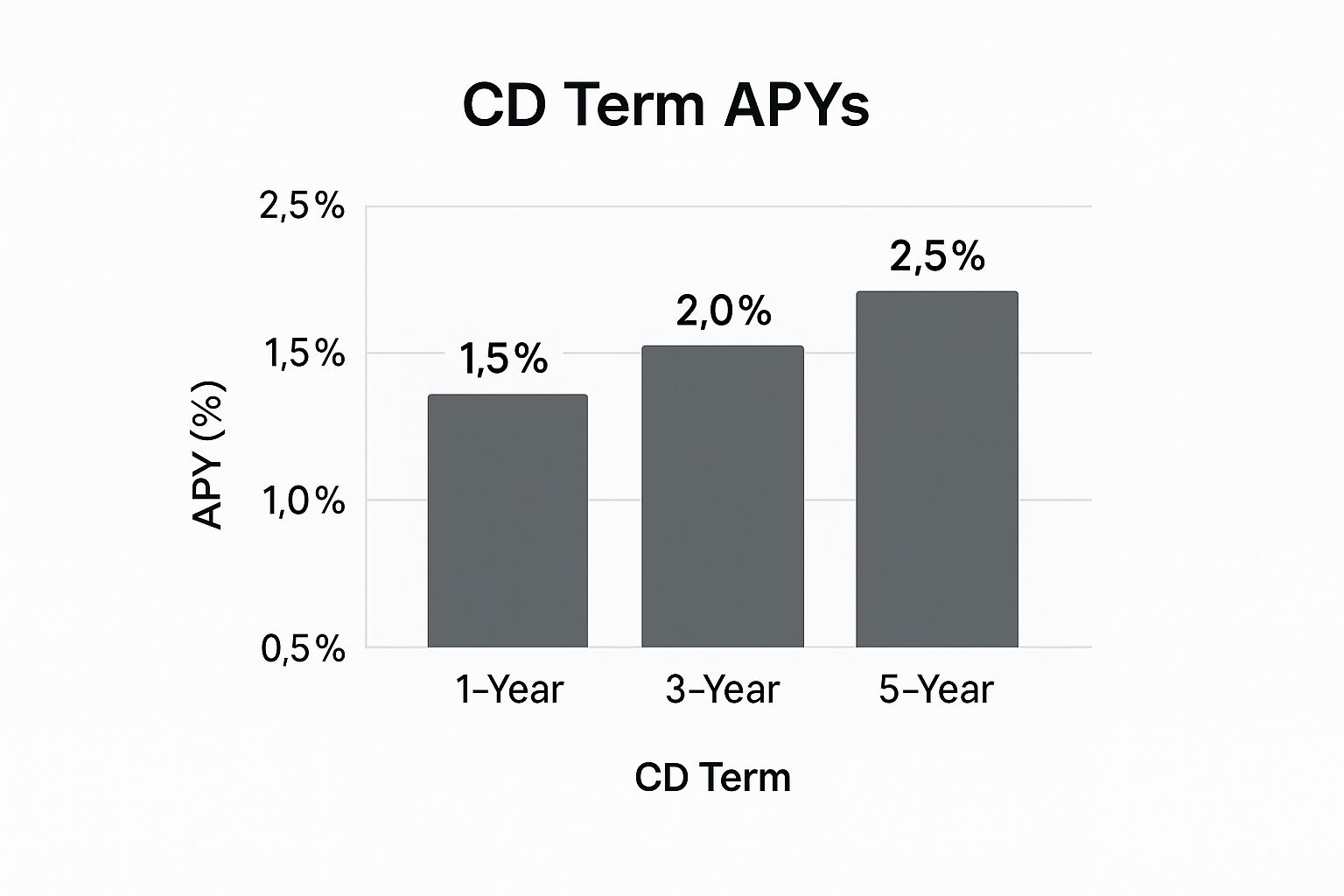

Visualizing Your CD Growth: The Power of Charts

Visualizing your CD growth can make a world of difference in understanding your potential returns. A helpful visualization tool, like a data chart, can clearly illustrate the growth of your investment under different scenarios. The following data chart compares total returns across various scenarios, highlighting the impact of compounding frequency, term length, and APY.

Let's consider three scenarios with a $5,000 initial deposit over five years:

- Scenario 1: 4% APY compounded annually

- Scenario 2: 3.9% APY compounded quarterly

- Scenario 3: 3.8% APY compounded daily

The data chart visually represents the final balance for each scenario. As you can see, even a slightly lower APY combined with more frequent compounding can yield better returns in the long run.

To further aid in selecting the right CD calculator, the table below outlines the essential and beneficial features to look for.

Essential Features in CD Calculators

| Feature | Importance | Benefit | Found In |

|---|---|---|---|

| APY Calculation | Must-have | Accurately reflects the impact of compounding | Most CD Calculators |

| Compounding Frequency Input | Must-have | Allows comparison of different compounding schedules | Most CD Calculators |

| Total Interest Earned Display | Must-have | Shows the overall return from the CD | Most CD Calculators |

| Early Withdrawal Penalty Calculation | Nice-to-have | Helps assess the cost of early access | Advanced CD Calculators |

| Multiple Scenario Comparison | Nice-to-have | Facilitates comparison of various CD options | Advanced CD Calculators |

| CD Laddering Support | Nice-to-have | Assists in developing a diversified CD strategy | Advanced CD Calculators |

This comparison highlights the importance of choosing a calculator that aligns with your specific needs. While basic features are essential for any CD calculation, the advanced features offered by some calculators can empower you to make more strategic decisions.

Mastering CD Calculators to Maximize Your Returns

A CD calculator is a valuable tool for projecting the future value of your Certificate of Deposit (CD) investments. Understanding how to use it strategically can significantly improve your returns. This involves more than simply inputting numbers; it requires grasping the various factors that influence CD growth.

Understanding Key Inputs

The first step to mastering a CD calculator is understanding the key inputs: initial deposit, APY (Annual Percentage Yield), term length, and compounding frequency. Each of these plays a crucial role in determining your final return. For example, a larger initial deposit results in a larger final balance, all else being equal. This is due to the power of compounding, where your interest earns interest.

The Power of Compounding

Compounding is the core driver of growth for CDs, and a CD calculator clearly illustrates this impact. The more frequently interest compounds (e.g., daily versus annually), the faster your money grows. Even small differences in APY and compounding frequency can significantly impact your final payout. Therefore, it’s important to use a calculator that allows you to adjust the compounding frequency and see the changes.

Simulating Different Scenarios

A key advantage of using a CD calculator is the ability to test various scenarios. By adjusting the term length, you can see how a longer CD term affects your overall return. You can also compare the results of different deposit amounts to determine the best initial investment for your financial goals. This empowers you to make data-driven decisions about your CD investments. Interestingly, while CDs are a reliable financial instrument, the physical CD market has declined. You can find more information on this trend here: https://www.statista.com/chart/12950/cd-sales-in-the-us/

Interpreting the Results

After inputting your information, it’s crucial to understand the results. Most CD calculators will show the future value of your investment, the total amount at maturity. They also typically display the total interest earned, the difference between your initial deposit and the future value. Some advanced calculators even provide an annual breakdown of interest earned, illustrating your investment’s growth.

Advanced Strategies: Laddering and Early Withdrawals

Beyond basic calculations, CD calculators can help you explore more complex strategies like CD laddering. This involves investing in multiple CDs with staggered maturity dates, balancing liquidity and return. A good calculator can help you model different laddering scenarios to optimize your overall yield. Furthermore, understanding early withdrawal penalties is essential. Many calculators let you simulate early withdrawals and see the penalty’s effect on your final payout. This helps avoid costly mistakes and enables informed decisions if you need access to your funds before maturity. Mastering these techniques makes a CD calculator a powerful financial planning tool.

The Best Calculator for CD Investments: Head-to-Head

Finding the perfect CD calculator can be tricky with so many options online. This section compares calculators from major banks like Wells Fargo, independent financial platforms, and specialized apps. We'll evaluate their accuracy, usability, and special features based on rigorous testing and user feedback. Understanding CD calculator returns often goes hand-in-hand with other financial calculations, such as understanding how to calculate holiday pay.

Evaluating Key Features and Functionality

Different calculators excel in different areas. Some handle simple interest projections, while others manage complex scenarios like CD laddering. We'll identify the best calculators for various needs, whether you're a seasoned investor or just starting. Some calculators excel at visualizing potential growth with interactive charts, while others offer detailed breakdowns of interest earned. This analysis helps you find a calculator that aligns with your investment goals.

We'll also examine how each calculator handles essential features like APY calculations, compounding frequency adjustments, and early withdrawal penalties. Accuracy is crucial, so we'll carefully examine the calculation methods to ensure reliable projections. This helps you avoid tools with potential discrepancies that could impact your returns.

Usability and Mobile Experience

A user-friendly interface is essential for any CD calculator. We'll assess each platform's user experience, including navigation, data input, and the clarity of results. Mobile responsiveness and ease of use on different devices are key factors. For instance, a clunky mobile interface can make comparing CD rates on the go difficult.

Uncovering Hidden Strengths and Weaknesses

We'll go beyond basic functionality to uncover hidden strengths and weaknesses that can influence your investment decisions. Some calculators provide unique insights like tax implications or inflation adjustments. Others might produce misleading results if used incorrectly. We'll highlight these potential pitfalls to help you avoid costly mistakes and choose calculators offering genuine value.

Head-to-Head Comparison: Top CD Calculator Tools

To help you choose the best tool, we've compiled a comparison table of leading CD calculators. It summarizes key features, user experience, special capabilities, and who each calculator is best suited for.

Top CD Calculator Tools Comparison: A detailed comparison of leading CD calculator tools available online, evaluating their features, accuracy, and usability.

| Calculator Name | Key Features | User Experience | Special Capabilities | Best For |

|---|---|---|---|---|

| Calculator.ninja CD Calculator | APY comparison, Compounding frequency adjustment, Laddering support, Early withdrawal penalty | Intuitive interface, Mobile-friendly design, Clear visualizations | Detailed interest breakdowns, Scenario comparison | All investors, from beginners to experts |

| Bank A CD Calculator | Basic APY calculation, Simple interest projection | Basic functionality, Limited mobile support | None | Beginner investors seeking simple projections |

| Financial Platform X CD Calculator | APY comparison, Compounding frequency adjustment | User-friendly interface, Robust mobile app | Inflation adjustment, Tax implications | Intermediate investors seeking more advanced features |

| Specialized App Y CD Calculator | CD laddering support, Early withdrawal penalty | Clean mobile interface, Advanced charting | Scenario planning, Portfolio integration | Advanced investors focused on CD laddering and portfolio management |

This comparison empowers you to choose the right CD calculator based on your individual needs and investment strategy. Understanding each tool's strengths and weaknesses allows you to make informed decisions and maximize your returns.

Strategic CD Calculator Techniques for Life Goals

A CD calculator is a powerful tool for achieving your financial objectives. It's more than just a simple interest calculator; it's a strategic instrument that can help you plan for major life events. Financial advisors frequently use these calculators to guide clients toward financial security, whether it's building an emergency fund or planning for a comfortable retirement. Let's explore some practical ways to use a CD calculator to reach your financial milestones.

Building an Emergency Fund

A vital use of a CD calculator is establishing an emergency fund. This fund acts as a safety net, protecting you from unexpected financial challenges. By inputting your target emergency fund amount, the calculator helps determine the initial deposit and CD term required. This provides a clear path and timeline for building your financial security.

You can also adjust the APY (Annual Percentage Yield) and compounding frequency. This allows you to see how different CD options affect your savings growth. You can then select the CD that best aligns with your emergency fund needs.

Creating Predictable Income Streams with CD Laddering

CD laddering is a strategy that delivers regular income while maximizing returns. It involves distributing your investment across multiple CDs with varying maturity dates. A CD laddering calculator helps you determine the optimal ladder structure for your income needs.

For instance, you could structure your CDs to mature every 3, 6, 9, and 12 months. This setup provides regular access to funds while still earning the higher yields offered by longer-term CDs. This steady income stream is especially helpful for retirees or anyone seeking predictable cash flow.

Integrating CDs into Retirement Planning

CDs can be a valuable part of a well-rounded retirement portfolio. A CD calculator can help determine how much to allocate to CDs to find the right balance between risk and return. By projecting the growth of your CD investments alongside other retirement assets, you can create a comprehensive retirement plan.

This balanced strategy provides stability while still aiming for long-term growth, helping you achieve your specific retirement goals.

Real-World Applications: Funding Education and Navigating Uncertainty

CD calculators have practical applications for various life goals. Parents, for example, can use a CD calculator to determine how much to save monthly for future education expenses. By entering the projected cost of education and the timeframe, the calculator can guide their savings plan.

CDs can also provide financial stability during uncertain economic times. While the physical compact disc market is declining, the principle of CDs as a financial instrument remains relevant. The global compact disc market was valued at approximately USD 1.6 billion in 2023 but is projected to decrease to USD 1.2 billion by 2032. Learn more about this market. During market volatility, the predictable return of a CD, calculated using a CD calculator, can offer peace of mind.

Adapting to Changing Economic Scenarios

Economic factors, such as shifting interest rates, can affect CD returns. A good CD calculator lets you adjust the APY to model different interest rate environments. This allows you to adapt your CD strategy as market conditions change.

This flexibility is essential for long-term financial success. By understanding these techniques, a CD calculator becomes an invaluable tool for achieving your financial goals and building a secure future.

Advanced CD Calculator Tactics for Serious Investors

For investors aiming to maximize their CD returns, a basic understanding of CD calculators isn't enough. This section delves into advanced techniques employed by seasoned investors to gain an edge in the CD market. This includes using calculators for in-depth analyses, incorporating them into overall investment strategies, and even creating custom models for specific scenarios.

Tax-Equivalent Yield and Inflation-Adjusted Returns

A key aspect of CD investing is understanding the effects of taxes and inflation. Tax-equivalent yield (TEY) calculations, often available in advanced calculators, help compare taxable investments with tax-advantaged CDs. This is especially important for investors in higher tax brackets. For example, a taxable investment yielding 6% might be equivalent to a tax-free CD yielding 4% depending on the investor's tax bracket. The TEY calculation clarifies the actual return after taxes.

Inflation-adjusted returns offer a realistic perspective on your investment’s growth. To make strategic decisions, long-term value is essential. A guide to Customer Lifetime Value (CLV) can be helpful. For instance, if your CD yields 5% but inflation is 3%, your real return is closer to 2%. Advanced calculators often include inflation adjustments for a more precise assessment of your investment’s true potential.

Opportunity Cost Comparisons and Spreadsheet Integration

Smart investment decisions involve understanding opportunity cost. This means comparing the potential return of a CD with other investment options. Advanced calculators can sometimes facilitate these comparisons, letting you evaluate CDs alongside stocks, bonds, or other investment vehicles. This helps ensure your capital is allocated effectively.

Integrating CD calculator outputs into comprehensive spreadsheet models improves portfolio management. This lets you track your CD holdings alongside other assets, analyze overall portfolio performance, and make informed decisions about rebalancing. This integration helps visualize the role of CDs within your broader investment strategy.

Advanced Laddering Strategies and Arbitrage Opportunities

CD laddering, a strategy involving staggered CD maturities, can be optimized with advanced calculator features. By modeling various laddering scenarios, you can create a steady income stream while maximizing returns as interest rates change. For example, during rising interest rate periods, a well-structured ladder can capture higher yields as CDs mature.

Savvy investors often use CD calculators to find arbitrage opportunities. This involves taking advantage of rate differences between financial institutions. By comparing CD rates across various banks and credit unions, investors can pinpoint the highest-yielding CDs for specific terms and deposit amounts. Even small rate differences can lead to significant gains, especially with larger deposits.

Building Custom CD Calculator Models

For investors with unique needs, some platforms allow creating custom calculation models. This might involve incorporating specific tax rules, adjusting for local inflation rates, or modeling complex scenarios not handled by standard calculators. This level of customization allows for more accurate and relevant projections.

By mastering these advanced techniques, you can go beyond basic CD calculations and unlock your investments' full potential. These strategies provide a foundation for informed decisions, maximizing returns, and achieving your financial goals. Ready to explore these techniques and boost your returns? Start maximizing your CD investments today with our comprehensive Certificate-of-Deposit Calculator!

Article created using Outrank